Deceleration is a technical indicator to evaluate the navigation force of the market. It is one of the most delicate components of a trading strategy. The decelerator is a prominent indicator, and it changes direction beforehand of any changes in the navigation force that changes the direction of the price.

The indicator recognizes in the practice idea that price changes ahead of the direction changes in the last turn. The price will lower the current direction movement’s speed; hence, data on the price deceleration is needed, whether positive or negative. The indicator’s histogram turns around while the forces of the first slowdown. Price deceleration will be zero by the time of the turn.

The following section will see a deceleration indicator trading guide that includes exact buying and selling trading methods.

What is the deceleration indicator?

The indicator calculates the number of buyers and sellers there, the force’s navigator supporting the price movement. Hence, deceleration is also utilized for trend reversal trading or trend-following trading motives.

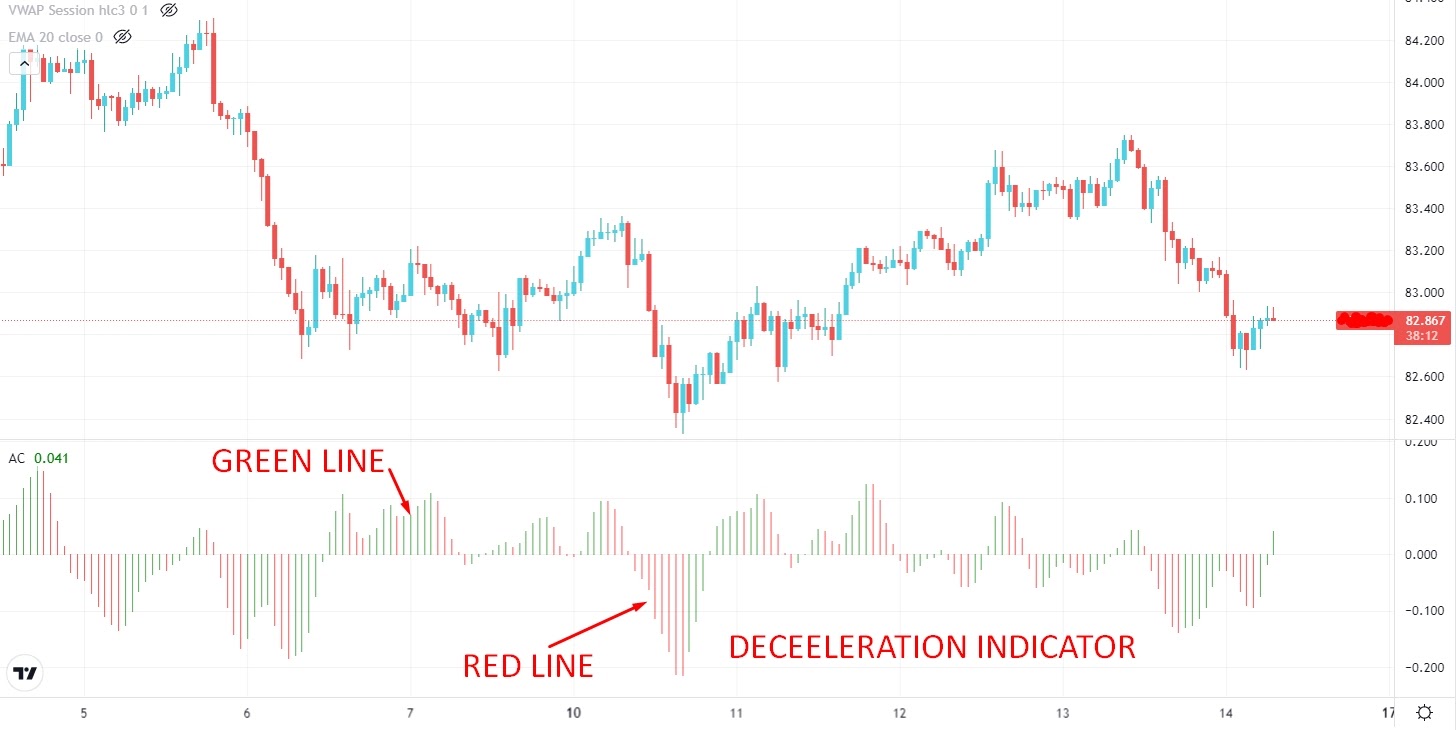

Essentially, when the price is going upwards, the deceleration bar turns green, indicating the number of buyers is higher than sellers. Mostly, a buy signal showed when the deceleration bar passed over zero. The price move is more vital when the green bar goes higher. Also, it shows that more buyers are there.

When it comes to the opposite direction, the deceleration bar functions similarly along with the red bars. Inside the trending markets, more precise signals are found, but the deceleration does not perform the same within ranges. However, the signals of buy and sell do not ensure profit; it only hints at the confirmation so that traders may take potential trades to profit from that. Also, the previous performance is not related to the future trading results, and there is always a considerable risk of loss.

How to identify trade using the deceleration indicator?

The deceleration oscillator’s concept is coherent and user-friendly. The indicator comprises two lines indicating deceleration of the current navigation force of the market.

- If the indicator’s value goes higher than the zero line, it depicts the uptrend in the market.

- On the contrary, the continuation of the downtrend in the market showed in the case of the value dips under 0 line.

However, the deceleration oscillator gives a buy signal when the bar becomes green one after another; the indicator is over the zero line. On the other hand, if the bar becomes red, the deceleration indicator is under the zero line; thus, it hints at the sell signal.

Furthermore, it is significant to monitor the value and the indicator bars’ colors for efficient trading. The rules are pretty simple here: if traders notice a red bar, they should avoid buying. Conversely, if the bar is green, they should stay away from selling. In this way, the deceleration oscillator helps out in the elimination of wrong entries.

The momentum opposes the trade while traders buy if the indicator is under 0. It demands an additional confirmation of three green bars in a row for a long position entry while the values are negative. Additionally, traders may buy if they notice a minimum of two back-to-back green bars higher than zero. A similar process is for selling or short positions as well.

Traders may go for sell only if the deceleration oscillator shapes a minimum of two back-to-back red bars. If the red bars appear on top of the zero line, then traders require a minimum of three red bars in a row.

Short-term trading strategy

Here we will look at only M5, M15, and H1 time frames to identify trades. Moreover, we will add another indicator called the dynamic level of 20 EMA to determine the proper entry points.

Bullish trade setup

Entry

Enter a buy trade when the price has an impulsive bullish candle close above the dynamic level of 20 EMA, and the deceleration line is green above the 0.00 level.

Stop loss

Place your SL order below the support level or the last swing level with a 5-10 pips buffer.

Take profit

Place the take profit order by calculating a 1:3 risk/reward ratio.

Bearish trade setup

Entry

Enter a sell trade when the price has an impulsive bearish candle close below the dynamic level of 20 EMA, and the deceleration line in red below the 0.00 level.

Stop loss

Place your SL order above the resistance level or the last swing level with a 5-10 pips buffer.

Take profit

Place the take profit order by calculating a 1:3 risk/reward ratio.

Long-term trading strategy

In this strategy, we will use H4, D1, W1 time frames to identify entries. Furthermore, we will add the MACD indicator to increase our accuracy.

Bullish trade setup

Entry

Open a buy trade when the price had an impulsive bullish candle close after bouncing from the support level, and the deceleration indicator’s line is green above the 0.00 level. Also, look at the MACD line’s bullish crossover above the 0.00 level.

Stop loss

Place an SL order below the support level with a 10-15 pips buffer.

Take profit

Take the profit when the trade achieves at least a 1:3 risk/reward ratio.

Bearish trade setup

Entry

Open a sell trade when the price had an impulsive bearish candle close after rejecting resistance level, and the deceleration indicator’s line is red below the 0.00 level. Also, look at the MACD line’s bearish crossover below the 0.00 level.

Stop loss

Place an SL order above the resistance level with a 10-15 pips buffer.

Take profit

Take the profit when the trade achieves at a 1:3 risk/reward ratio.

Pros & cons

| Pros | Cons |

| Best works on the higher time frames. | Not suitable for short-term trading. |

| It can provide a good risk/reward-based trades. | It needs to add another indicator for confirmation. |

| Best works on the trending markets. | Can give false signals. |

Final thoughts

Finally, the deceleration indicator is in the first place to produce trading signals. Still, it should be utilized as an extra filter. The complex algorithm of the indicator gives smooth price attempts. Notwithstanding, the signals from the deceleration indicator deem to be dependable regarding the medium-term transactions on time frames from H1 and higher.