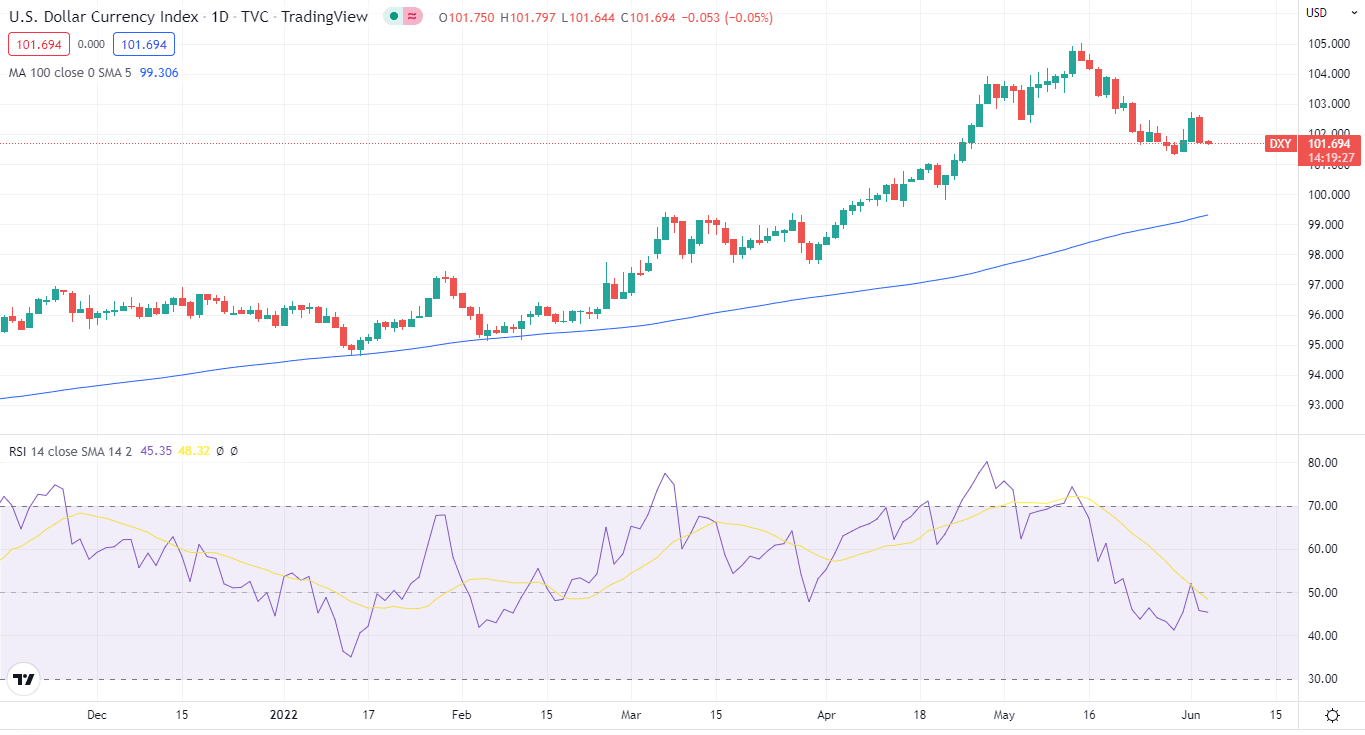

On Friday, June 3, DXY was down by 0.05% during the European session. The index is trading at 101.69 at the time of writing.

- After a good start to the week, DXY is traveling in a tight range for the second consecutive day.

- As investors eye employment data, US yields nudge higher.

- Investors are eyeing today’s NFP and unemployment rate for fresh impetus.

DXY fundamental forecast

The DXY remained steady at 101.76 during the Asian session and is slightly up on the week, halting a slide after two straight weekly losses of more than 1%.

Wobbling around

The first day of June brought gains for the DXY, but it has shed its gains since then. On Friday, the dollar stumbled toward its first solid week in three as investors turned to US employment data for signs of how far and fast the Federal Reserve would boost interest rates.

Markets have priced in two straight 50-basis-point Fed rate rises in June and July, but the greenback has been tossed about this week by concerns about what comes next.

US Yields nudge higher

The 10-year US Treasury yield climbed on Friday as investors await job data later in the session. The benchmark 10-year Treasury note rate rose 0.1 basis point to 2.9168%. The 30-year Treasury bond yield increased marginally to 3.0821%.

POTUS met Powell

On Tuesday, Joe Biden met with Federal Reserve Chair Jerome Powell to emphasize the need to contain the greatest inflation in 40 years and rein in surging gasoline, food, and consumer goods prices.

According to White House economic advisor Brian Deese, the discussion was constructive.

“The president underscored to Chair Powell in the meeting what he has underscored consistently, including today, that he respects the independence of the Federal Reserve,” Deese said afterward.

Key data releases from the US

Today, we have a busy day. Nonfarm Payrolls for May are coming later in the NA session, followed by the Unemployment Rate and the ISM Non-Manufacturing Index. Furthermore, the final Services PMI is due, followed by a speech by FOMC Governor L. Brainard.

What’s next?

The dollar has weakened again due to the growing impression that inflation may have peaked in April, supporting the assumption that the Fed may not need to be as active as market participants think when hiking Fed Funds rates. Meanwhile, the Fed’s stance, higher US rates, and the possibility of a hard landing in the US economy are all factors supporting a stronger dollar.

DXY technical analysis: traveling in a tight range

During the European session, DXY is hovering around the 101.70 level. So far, the index has lost 0.05%. The index is now trading at 101.69. The index is above its 100-day MA on the daily chart, and the RSI is near the 40-level.

A break above 102.94 would open the door to 103.32. If it can cross that level, we’ll see the index touching 103.91. On the flip side, the next support for the index lies around 101.29. If the index slips below this level, we can see a downward movement towards the 101.00 level.