The financial market has become more accessible due to the availability of technology, whereas retail trading has become profitable due to a wide range of trading strategies. Iceberg’s trading strategy is a unique approach to the marketplace that many professional investors follow.

However, it is a billionaire technique to approach, or investment firms follow this method for positive features of this method. When individuals want to follow, it requires understanding the concept and knowing the entire implementation process.

What is the Iceberg trading strategy?

It is usually splitting a single order into many smaller limit orders to conceal the actual size of your order. The term “iceberg” refers to a standard description that an iceberg hides a more prominent volume under the surface that is not visible.

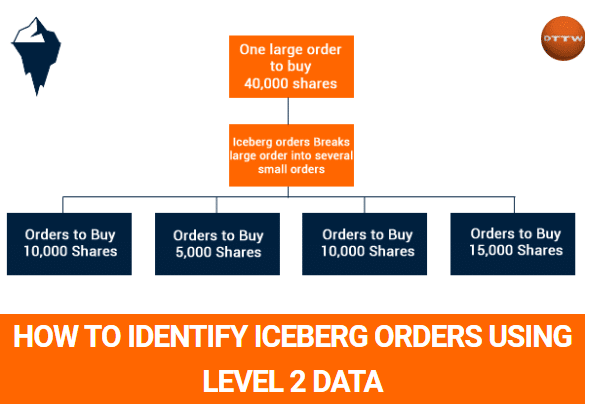

This strategy is similar to that concept as it involves many limit orders or reserve orders to conceal the actual volume. Investors split up a large order into many pieces.

The financial firms wish to execute orders to purchase or sell thousands of shares while a small portion is only visible. You can display only a portion of that order volume, while it does not display the total volume. This method reduces the risks of telegraphing the intent of the institutions by hiding as it can affect the price of the asset to move unfavorably.

How to identify iceberg orders?

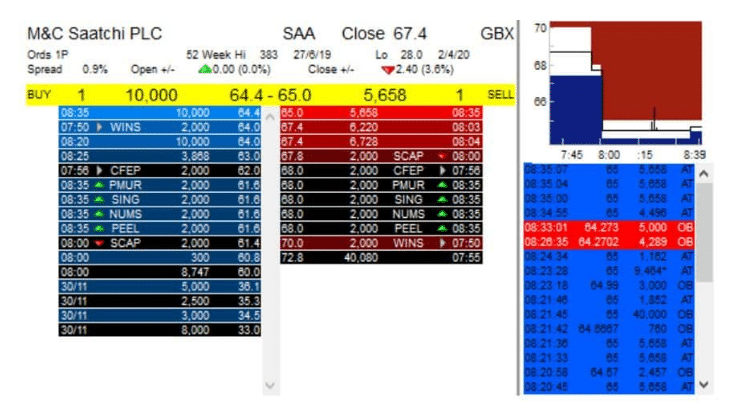

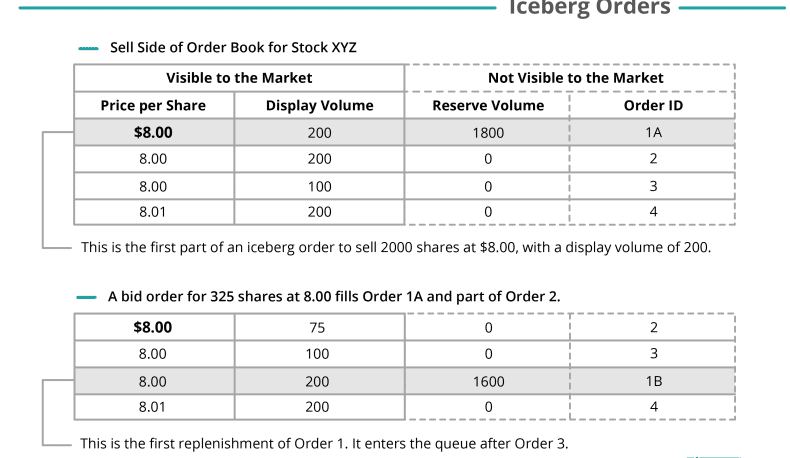

These orders usually contain a large volume while only a smaller portion is visible. So when any individual trader can determine iceberg order levels, it enables market participants to execute trades in the direction with large volume. It is usually an algorithmic approach in which one order executes, and the other will pop up from the queue.

Suppose you want to purchase 2000 shares. So you place an iceberg order limit at the price of $10.00 while it shows 100 shares. When the 100 share bid hits, another 100 shares will pop up, and the process will continue until purchasing a total of 2000 shares.

Meanwhile, the identification criteria are:

- Observe the traders column; if you see a repeated print, it signifies that there may be an iceberg order.

- Observe the bid/ask price; it indicates an iceberg order if you mark the same size and order printing.

- It is a potential iceberg order to spot trade executing and reloads.

However, it is nearly impossible for any individual trader to execute iceberg orders with a few thousand dollars in various financial assets. The only possible place individuals can practice this order type is in small stocks or penny stocks.

To trade with an iceberg trading strategy requires understanding the level 2 order book. Some brokers provide level 2 data that shows the trends as it gives detail of bid/ask prices. You may have 10-15bid ask prices to know the lowest price they offer and the highest bids.

A short-term strategy

In this technique, a large order mostly breaks into several orders to hide their actual position from other traders. It is mainly why hedge funds usually don’t have a single entry price on the trading instrument. Using level 2 data for executing trades is most common among traders.

In this way, you identify the bid/ask prices and incorporate that information to execute trades. You may spend some time looking at chart analysis. For instance, you can split your order into the same or different sizes. Check the level 2 info if several prints repeat or not, then place trades according to your estimate.

Bullish trade setup

Check the level 2 info where buy volume is increasing. Identify that increasing buy volume and place buy orders, place reasonable stop loss according to market context, then continue your buy order till the bullish momentum remains intact.

Bearish trade setup

Check the level 2 info and match sell volume is increasing. Then place sell orders according to your estimate. Place reasonable stop loss above the bearish momentum. The profit target will be till the bearish momentum remains intact.

A long-term strategy

Most major exchange platforms provide mechanisms to execute iceberg orders, such as the “max flow” parameter, which identifies the most significant order slice to display at a specific time. So any institute or firm can submit a “synthetic” order type.

In this way, trading platforms or brokers divide the main order into many small pieces and execute them all. This method is standard in implementing many trading platforms such as the CME group.

Bullish trade setup

Check the max flow parameter from the broker for your target asset. When you find the potential to make a buy order, place buy orders using the synthetic method, so your broker or platform will execute it using the iceberg method according to your desire. While placing buy orders, determine the stop loss and profit target levels.

Bearish trade setup

Place sell orders using the synthetic method when the max flow parameter suggests upcoming declining pressure on your target asset. Define stop loss, profit target levels for your sell orders, and place that while placing sell orders.

Pros and cons

| Pros | Cons |

| This method is suitable for institutional traders. | The Iceberg method is not suitable for individual traders. |

| It allows executing trades in the direction of volume. | It is not ideal for manual trading. |

| It is ideal for automatic trading. | It requires a certain level of understanding and trading capital. |

Final thought

The iceberg method is standard practice for institutional traders or hedge funds as they involve in trading with large capitals. Any individual trader with the knowledge of the iceberg info can execute more precious trades and seek this as a part of the research.

Meanwhile, individual traders who learn to identify the iceberg order levels can make enormous profits by placing trades in the direction of the iceberg orders.