Mutual funds are investments that tend to match the performance of other underlying assets rather than surpass. These are potential assets with several attractive features such as diversification, attractive return, lower cost, and low-risk insolvency.

Russell 2000 Index Mutual Fund is one of the best funds to invest in. Before making investments, it’s better to consider several unavoidable facts such as market opportunity, business types, location, etc. Knowing complete reviews can be an elegant solution as it includes details about the funds such as history, performances, volatility measurements, risk factors, etc.

This article contains a complete review of the VRTIX, which helps you understand and make investment decisions.

What is the Russell 2000 Index Mutual Fund?

The VRTIX seeks to track the performance of an index that measures the return from small-capitalization stocks in the United States. The advisor of this fund is the Vanguard Equity Index Group. This fund generally tracks the performance of the Russell 2000 index that includes the performance of 2000 smaller US companies.

FTSE Russell manages the fund Russell 2000, which is also a chieftain of the United States economy. It focuses on the smaller companies, which focus on the United States capital market. The Russel 3000 index includes these 2000 companies, which VRTIX follows.

This fund is in the small blend investment category, which is also available as an ETF. The asset class of this fund is domestic stocks that require an initial investment of $5 million, and the fund number is 1851. VRTIX offers a high potential investment growth, and this price rises and falls sharply compared to the holding bonds of this fund.

History of fund

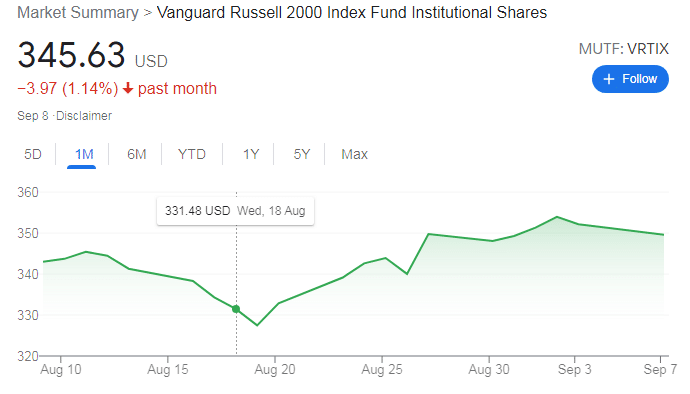

The launching year of the Russell 2000 Index Mutual Fund is 1984. The founder of this fund is the Frank Russell Company. Now FTSE Russell manages this fund, which is also supplementary to the LSE (London Stock Exchange) Group. So VRTIX has been operating well for a few decades. This fund is unique as it allows the ETF and many mutual funds to have ties to the Russell 2000 index. Now, this fund is trading at 345.63 as of writing.

Rankings

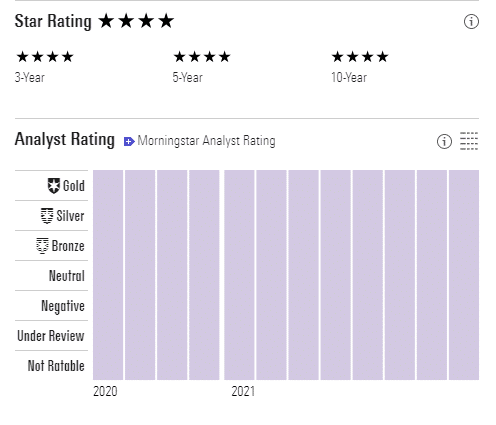

This fund is not currently under any ranking. We checked the evaluation list by the US news of 590 small blend funds. They make a list of top-rated fund lists for long-term investors; you can check on highlights. Morningstar’s rating is 4 out of 5 for this fund. Check the rating chart of VRTIX below.

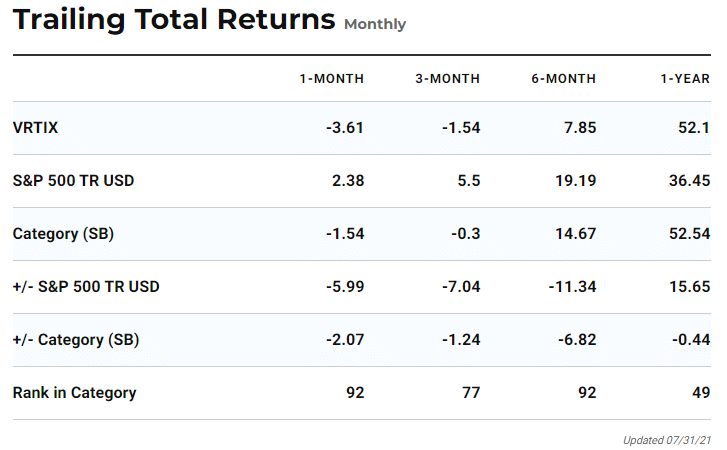

Trailing total returns

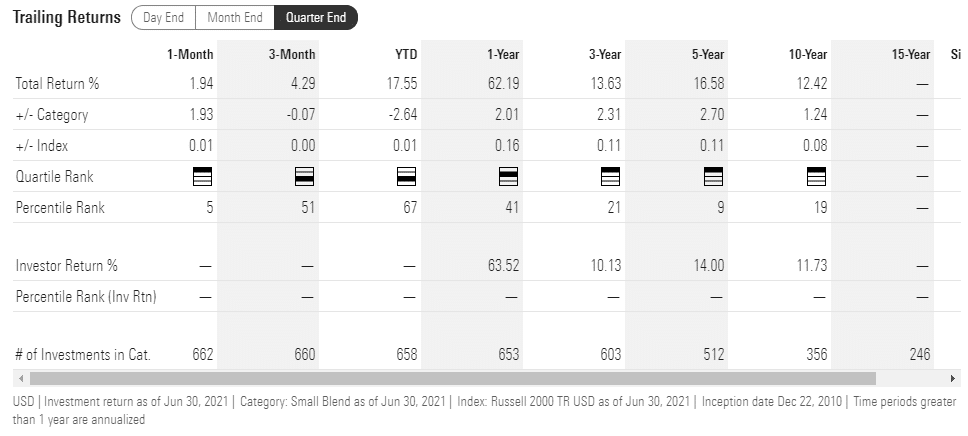

The return information is essential when you want to invest in any funds for a specific period. The return amount varies on the amount of investment and the duration of holding. We attach a trailing return chart below that includes return information for different periods and other data such as ranking on specific time performance, category, etc.

VRTIX had negative returns for a monthly and quarterly duration, which are -3.61% and -1.54%. The figure is far better for 6-months and yearly. This fund recently got a 7.85 percent return in six months, and the yearly was 52.1 percent. This return figure makes this fund an attractive investment asset for a longer period.

Performance

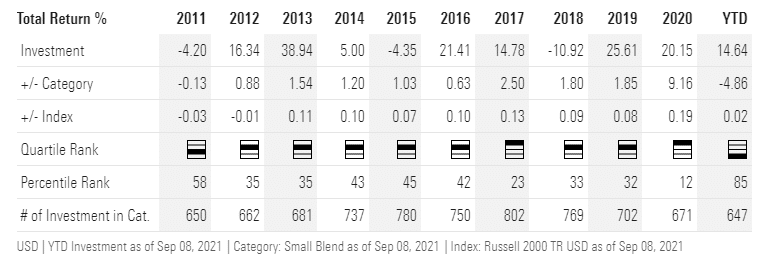

It is another essential factor when you are checking the potentiality of any mutual fund. Our observation for the past ten years historical data found that this fund has been upward for seven years and downward for three years.

This fund has given a return of 52.10 percent over the last year; over the past three years, the return was 11.60 percent. The VRTIX index got a 14.39 percent return and a 12.42 percent return over ten years in the last five years.

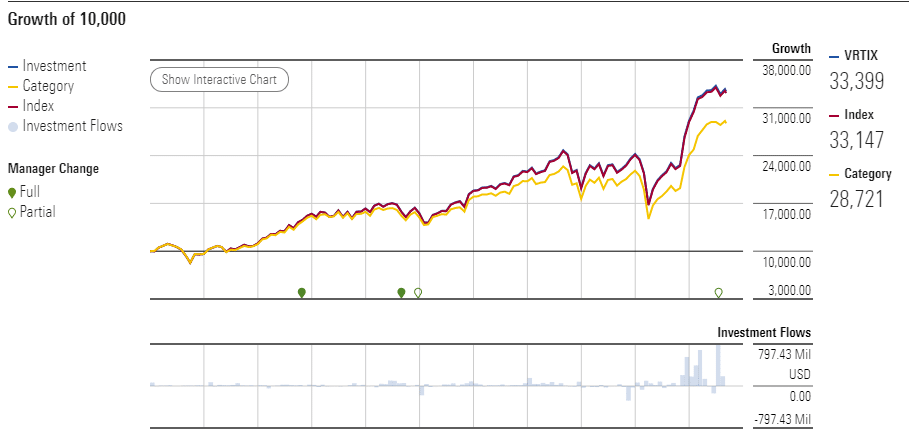

The figure above is a growth chart of $10,000 investment in this fund for understanding the performance better. A smooth upward growth chart it is. Now we attach the total return chart for the past ten years of VRTIX below.

For better understanding, we are attaching the quarter-end chart for VRTIX.

Fees

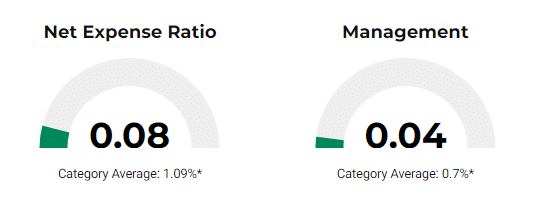

Fees and costs are other unavoidable factors to check on before investing. The Russell 2000 index has a low expense rate in comparison to other mutual funds in the same category. Expenses in several factors, which includes transaction costs, marketing, distribution fees, etc. The expense ratio for VRTIX is 0.08%.

Risks and holdings

It is prevalent that financial assets involve risk factors. The growth of this fund is dependable or relates to the performance of small companies that VRTIX is holding.

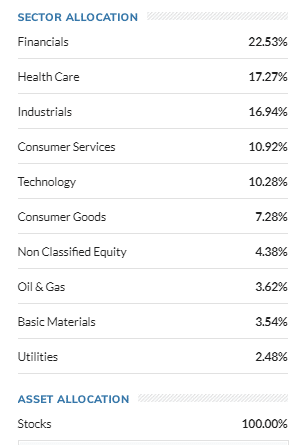

The figure above shows the holding percentage of VRTIX in several sectors. Growth and depreciation in these sectors depend on several factors. So declining holdings will cause VRTIX to decline. Moreover, Morningstar says this fund has an “above average” risk among other mutual funds in the same category.

Volatility measurements

You will get the idea about uncertainty in price movement by checking on the volatility measurement data. The standard deviation for Russell 2000 is 25.721. Meanwhile, the mean value is 1.194, alongside the Sharpe ratio is 0.511 for VRTIX.

Russell 2000 Index Mutual Fund 2022 forecast

We examine this fund by observing several angles, such as volatility measurement, cost, fees, return amount, history, etc., and summarize everything in this article. According to our research, we find this fund as a potential investment in the following year. If no uncertainty happens, the will may increase in 2022, as it’s been doing in recent years. It has a turnover of 19%, which is good enough.

Final thought

Finally, now you know all the basics about the Russell 2000. Although this is not a very popular option for the retailers, this fund has potential for long-term investment. It will help if you also consider some factors before investing, such as the investment duration, the return amount that suits your expectations, etc. We suggest doing some additional research besides this article before investing in VRTIX.