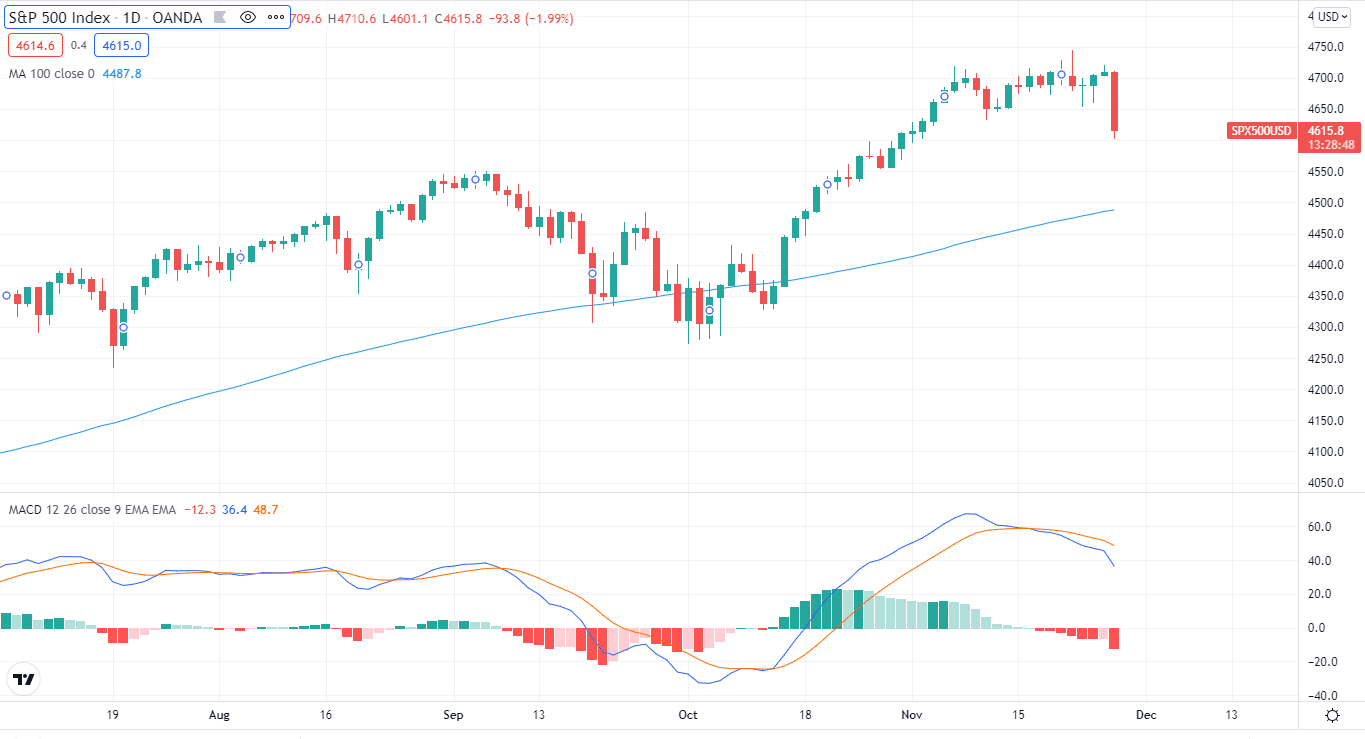

On Friday, S&P 500 dropped -1.99%, slipping to 4615, the level it witnessed on November 1.

- Ten-year Treasury rates in the United States have continued to fall from their monthly highs set on Wednesday.

- Virus problems worsen amid worries of a new strain that spreads quickly and is resistant to vaccinations.

- To close the week, traders may be entertained by Fed rate rise fears, China stories, and Covid developments on a short-trading day.

S&P 500 fundamental forecast

Following a day of sluggish trading on Thanksgiving Day, market mood deteriorates early Friday, sending US Treasury yields and stock futures down.

Drop in treasury yields

The 10-year Treasury rates in the United States have fallen 5.5 basis points (bps) to 1.589 percent, extending Wednesday’s retreat from the monthly high. The downbeat readings of the S&P 500 -1.99 percent intraday and Asia-Pacific markets also reflect risk aversion.

Mixed data

While Treasury rates are fading the Fed-led lift to the monthly high, they appear to be fearful of the recent Covid-19 stories, which are driving the market’s rush to risk safety.

In addition, a lack of directions following Wednesday’s mixed US data and weaker PMIs might also be a factor weighing on yields.

Sino-American tussle

Aside from the Covid-19 issues and worries that the Fed may raise the benchmark rate at the wrong moment, the market mood is weighed down by Sino-American squabbles on a light calendar day.

Following the virtual meeting between US President Joe Biden and his Chinese counterpart Xi Jinping, tensions between the two countries have gradually risen.

While China’s failure to meet the terms of the phase one agreement aroused initial worries of a new round of US-China spats, recent difficulties involving Vietnam and Taiwan have added gasoline to the fire.

The United States invites Taiwan to one of its home events and maintains a presence in the treacherous waters surrounding the Asian island, implying political tensions with Beijing.

Furthermore, China’s faltering companies, such as Evergrande and Kaisa, are putting the risk appetite to the test.

Key data releases from the US

On the calendar front, we have the US Treasury currency report today. Other than that, the markets will close earlier today.

What’s next?

Today’s lack of important data/events may prompt traders to continue the current risk-off mindset amidst virus worries. The news about US-China ties and Fed actions are also crucial. The US markets will close early on Friday, which is worth noting.

S&P 500 technical analysis: key levels in action

S&P 500 dropped at the start of the Asian session and is now further dipping in the earlier European session.

The index is above its 100-day MA on the daily chart, and the MACD is pointing downwards. It suggests a mild bearish trend.

So far, the index has lost -1.99% since the start of the day. A break below 4500 would open the door to 4568. It is October 29 low. If it can cross that level, we’ll see the index touching 4532.

On the flip side, the next resistance for the index lies around 4710, today’s high. If the index manages to go above this level, it can go towards 4744.