The statement “Trend is always your friend” is somehow true for financial market traders. If you can identify the current trend of a trading instrument, you can make profitable trades with higher winning chances. Simply identifying trends will help you to make trading positions with less risk and increased profitability.

Novice traders often find it challenging to identify trends and make profits, as many won’t know or care about the proper ways to find them. However, using oscillator indicators, seeing the market trend became easy for traders.

Let’s check the top five oscillators to identify the trends and the guideline for using them.

Top five oscillator indicators

This part includes a description of the top five oscillator indicators to find the trend of price movement. These are prevalent indicators to identify trends and are easily applicable. All types of traders can analyze the price movement for the financial assets using these indicators.

RSI

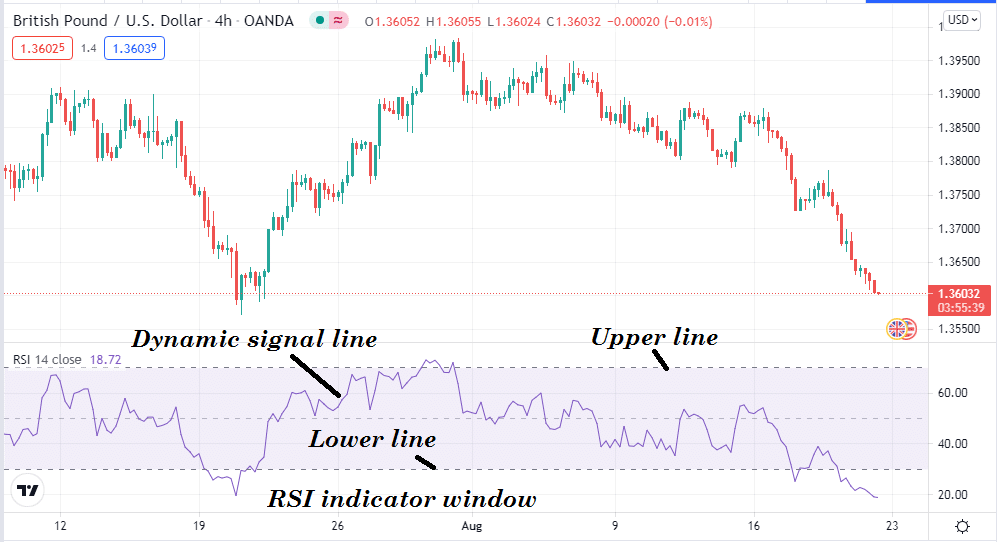

The short form of the Relative Strength Index is a standard technical indicator from the Oscillator class. A popular momentum indicator identifies the trend and the overall market context, such as overbought and oversold. This tool also shows both historical and current strengths and weaknesses for the asset price.

RSI is available for free on most trading platforms, and traders can see its reading in an independent window.

It has a dynamic line that adjusts the path with the movement. RSI has:

- A top line (70)

- A decreasing line (30)

However, it stays in the variety of 1-100. When the dynamic sign line touches or stays above the top (70) line, it suggests the price moved to the acute buyer’s area from which a bearish correction is incredibly possible.

Conversely, the signature line at or under the decrease (30) suggests an oversold condition, in which buyers wait to make trading positions.

Therefore, smart buyers integrate this tool with different signs and make trading choices based on how far it’s rebounding from the potential 30 or 70 levels.

Stochastic

It is another momentum indicator that shows the overbought/oversold condition, where the price may remain at 20 or 80. The difference might come with two dynamic signal lines:

- One is blue

- Another is red

When a positive force or buyers’ domination comes up at the market, the blue line in the indicator window should cross above the red signal line, and both dynamic signal lines start to move towards the upside. When both dynamic signal lines touch or stay above the upper (80) line, it indicates that the price is in an overbought condition.

On the other hand, the blue signal line below the red signal indicates sellers’ domination that may take the price towards the downside. Dynamic signal lines at or below the lower line indicate that the asset price is at oversold condition.

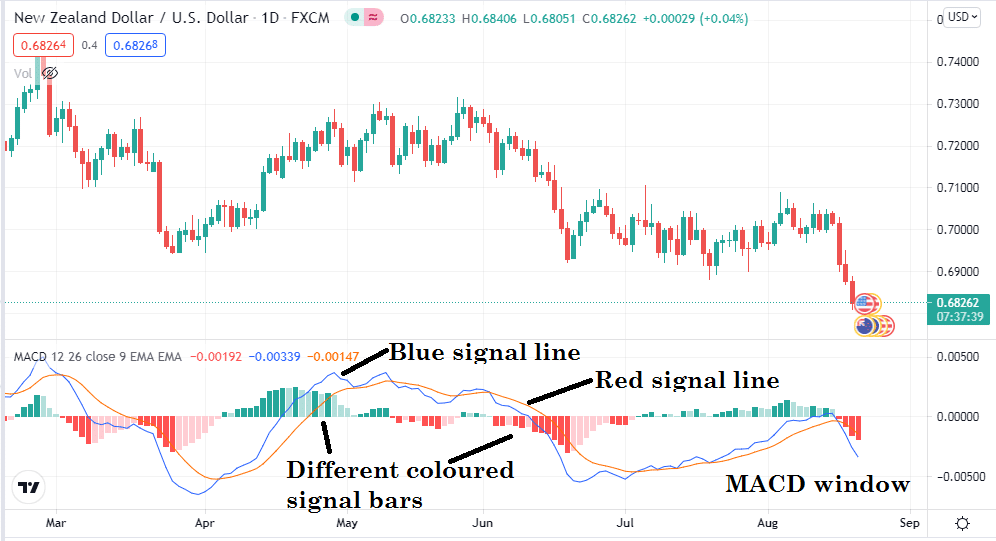

MACD

It is another standard trend-finding indicator, which is also popular among traders to identify trends. This tool shows reading in an independent window, including a middle (0.0) line, different color signal bars, and dynamic signal lines.

The signal bars alternate the size and look with the volatility of an FX pair. Dynamic signal traces cross or stay above the middle line suggests a bullish trend, and sign bars seem above the center (0.0) line. The blue line above the red line indicates a buyer’s domination and vice versa for bearish trends.

Signal bars seem beneath the middle line for a bearish trend, and the dynamic sign line crosses beneath it. It is helpful to pick out the market direction; however, buyers need to be aware of different trading tools to boost trading probability.

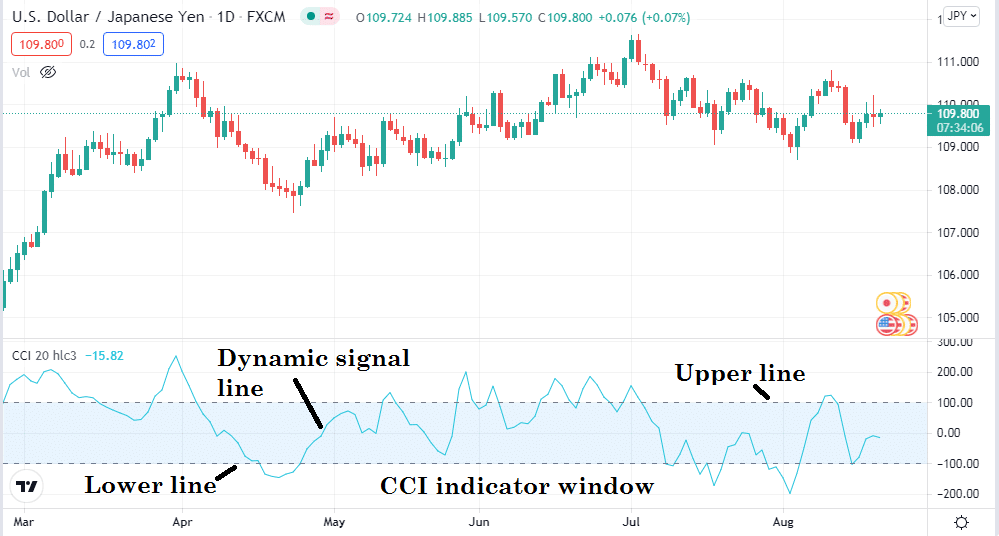

Commodity channel index

It is a standard indicator to identify the price direction of financial assets such as stocks, currencies, commodities, etc. It shows reading on an independent window which includes two straight lines and a dynamic signal line.

When buyers start to dominate the asset price, the dynamic signal line of the CCI window starts to move toward the upside. If that dynamic line touches, crosses, or remains above the upper line, indicating the asset price is on an uptrend. On the other hand, seller domination indicates when the signal line moves toward the lower line. It touches, crosses, or remains below the lower line for a downtrend.

Average true range

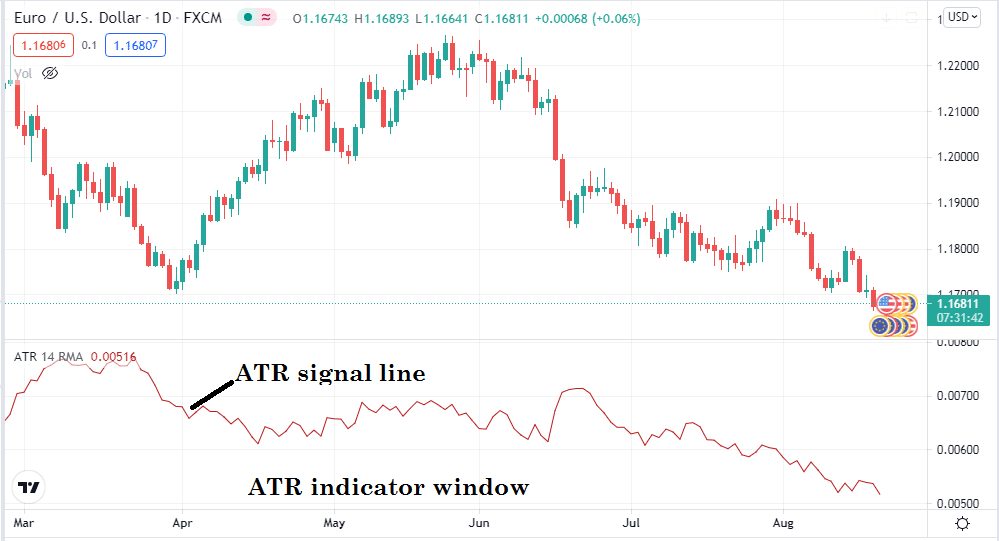

The last of the top five oscillator indicators in our list to identify trends is the ATR. This indicator is mainly a volatility tool, but you can also use it to identify trends. This tool includes a signal line on an independent window.

Like all other oscillator indicators above, the ATR signal line also changes direction with the price movement. This tool calculates the value after the period passes. For example, on a daily chart, it calculates every day and shows it on the chart.

You can use ATR to put trailing stops, stop loss calculations, continuous trend or reversal, etc. You minus X ATR value from the high when you are long on the asset; that will be your trailing stop point. On the other hand, you add the X ATR value from the low to get the trailing stop point on short orders.

Final thoughts

Finally, these are the top five oscillator indicators that financial traders frequently use to identify trends. Not just trends, these tools are helpful to show the market conditions from various angles. They were so valuable to traders for making trade decisions.