On September 15, the Australian dollar fell against the US dollar after China’s year-on-year retail sales came in at 2.5%, lower than the 7.0% expected and the 8.5% seen the previous month.

- The AUD/USD pair adopts offers to retest a multi-day low, extending the week’s most significant daily loss.

- In August, China’s industrial production fell by 5.3%, while retail sales fell by 2.5% yearly.

- Despite lower US inflation, risk appetite is dwindling due to uncertainty over Fed tapering.

AUD/USD fundamental forecast

AUD/USD is trading at its lowest on Wednesday, dropping 0.15% in the Asian session.

Chinese PMI

After essential data from the most prominent client, China added to traders’ pessimism throughout early Wednesday, AUD/USD bears continued in charge, down 0.22 %while taking offers around 0.7300.

The Chinese Communist Party continues to implement its “shared prosperity” strategy, which has dragged on Chinese stock markets as many industries are forced to re-adjust to new rules.

Before today’s report, Chinese gaming stocks had already fallen due to additional announcements of increased scrutiny.

China’s industrial production growth fell to 5.3 %YoY, compared to an estimated 5.8 %and a previous reading of 6.4 percent. Retail Sales figures followed suit, falling to 2.5 %from 8.5 % in previous lessons, contrary to a market estimate of 7.0%.

Covid-19 concerns

The significant increase in Covid numbers in Australia is also posing a challenge to pair buyers. In addition, the number of coronavirus infections in Australia is steadily increasing.

US Treasury yields

Due to its risk barometer status, the AUD/USD values are impacted by the rise in US Treasury rates, which coincides with worries about the US Federal Reserve’s (Fed) future move.

However, on Tuesday, US 10-year Treasury rates fell to their lowest level in a month before rebounding to 1.29%.

Even when the US inflation data for August came in lower than expected, markets went risk-off on Tuesday. The US CPI fell to 0.3% monthly, the lowest level since January, versus 0.4% predicted and 0.5% before.

Key data releases from Australia

On the calendar front, on September 16, Australia’s employment change and the unemployment rate will be announced.

Key data releases from the US

From the US, we have US retail sales and unemployment claims. This can provide the pair with medium fluctuations.

What’s next?

The AUD/USD will be watching for additional signs to affirm the Fed’s tapering next week to get a boost ahead of tomorrow’s Australian employment data.

Thursday’s Retail Sales and Friday’s Michigan Consumer Confidence are both highlighted in the same way.

In addition, risk catalysts and August US Industrial Production, which is projected to decline from 0.9 to 0.5%, might provide intermediate movements today.

AUD/USD technical analysis: key levels in action

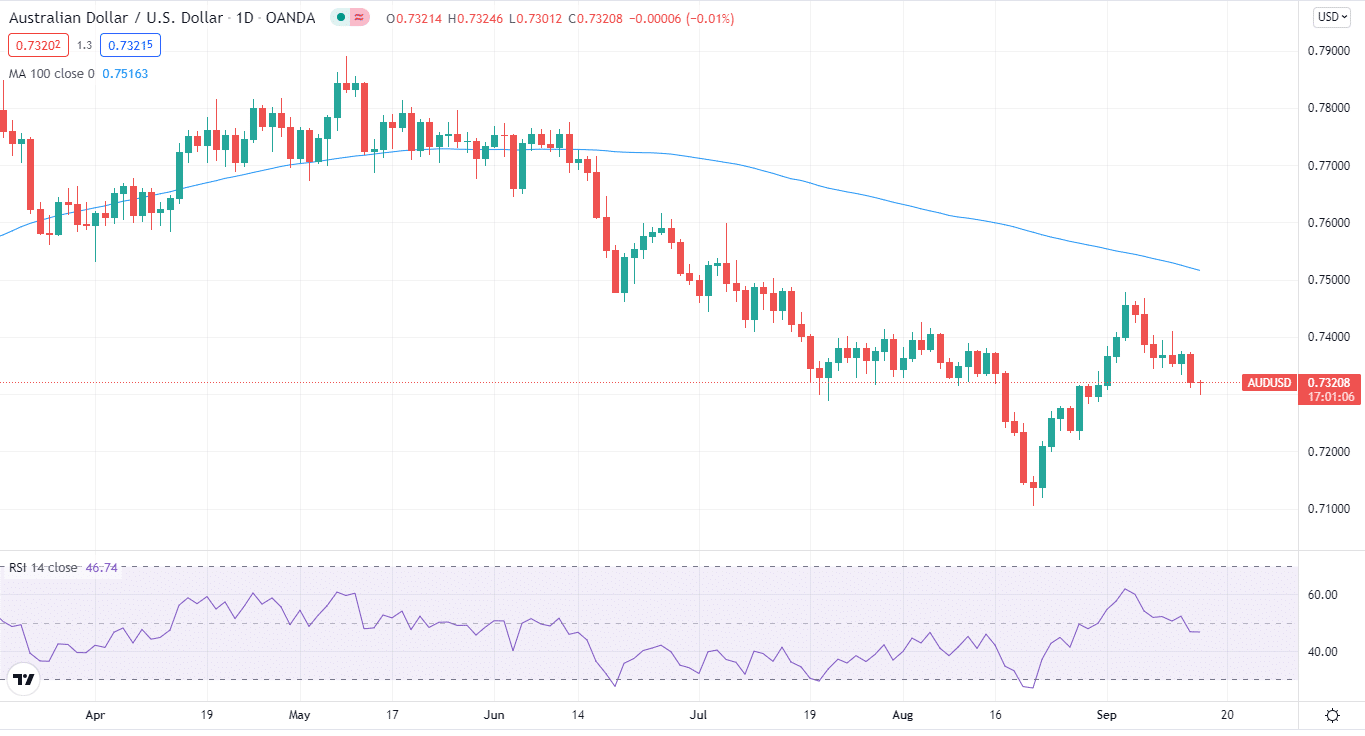

AUD/USD started the day dipping below 0.7310 and is currently trading at 0.7322.

AUD/USD is below the 100-day moving average on the daily chart, and the RSI is close to the neutral level.

A significant downward breach of the 50-day moving average at 0.7355 has AUD/USD sellers focused on the 0.7300 round figure before testing the crucial support of 0.7220.

The AUD/USD pair is now seeking to maintain its position around the 0.7311 support level. This point is a pivot point for the pair. If the pair goes below this level, it can go towards the next support at 0.7290.

On the upside, the pair’s resistance is at 0.7374, which was its previous day high. If the pair can break above this level, the next resistance lies at 0.7420.