Supply-demand is a core concept of the economy, an effective tool in the financial market. Moreover, the whole financial market follows the rules of supply-demand, where there is no exception for the crypto market.

However, the cryptocurrency market is different where the decentralized nature makes investors think about its effectiveness on supply-demand. The good news is that any trading method based on supply-demand is readily applicable there. If you want to build a long-term portfolio in the crypto space, there is no way to ignore this tool. In the following section, we will see the nuts and bolts of supply-demand trading, including the exact way to take buy and sell trades to grab 40 pips every time.

What is the crypto supply-demand strategy?

The supply represents how much assets are available to investors in an economy, whereas the demand represents its worth. However, in the financial market, the selling pressure comes due to the increase in supply, while the buying pressure results from increased demand.

When the supply exceeds demand or demand exceeds supply, the trading becomes fruitful as it moves the market. Therefore, the core idea is to identify where the supply or demand exceeds one another.

The above image shows how the supply-demand formed in the price chart and makes the price move.

How to trade using supply-demand in trading strategy?

The first thing a trader to consider is supply-demand is where this area’s location is. Usually, the supply level remains at the top of the swing from where big investors open selling positions. Conversely, the demand level is the last bear’s pressure before taking the price up.

However, supply-demand trading needs further clarification based on price action and chart reading. Traders should know that the financial market is driven by whale investors who can make the price move with their buying/selling powers. However, the drawback is that big investors cannot complete their trading orders the first time. Therefore, the price revisits the supply-demand zone before showing the actual move, our main strength.

Therefore in supply-demand trading, we should follow these steps before opening a trade.

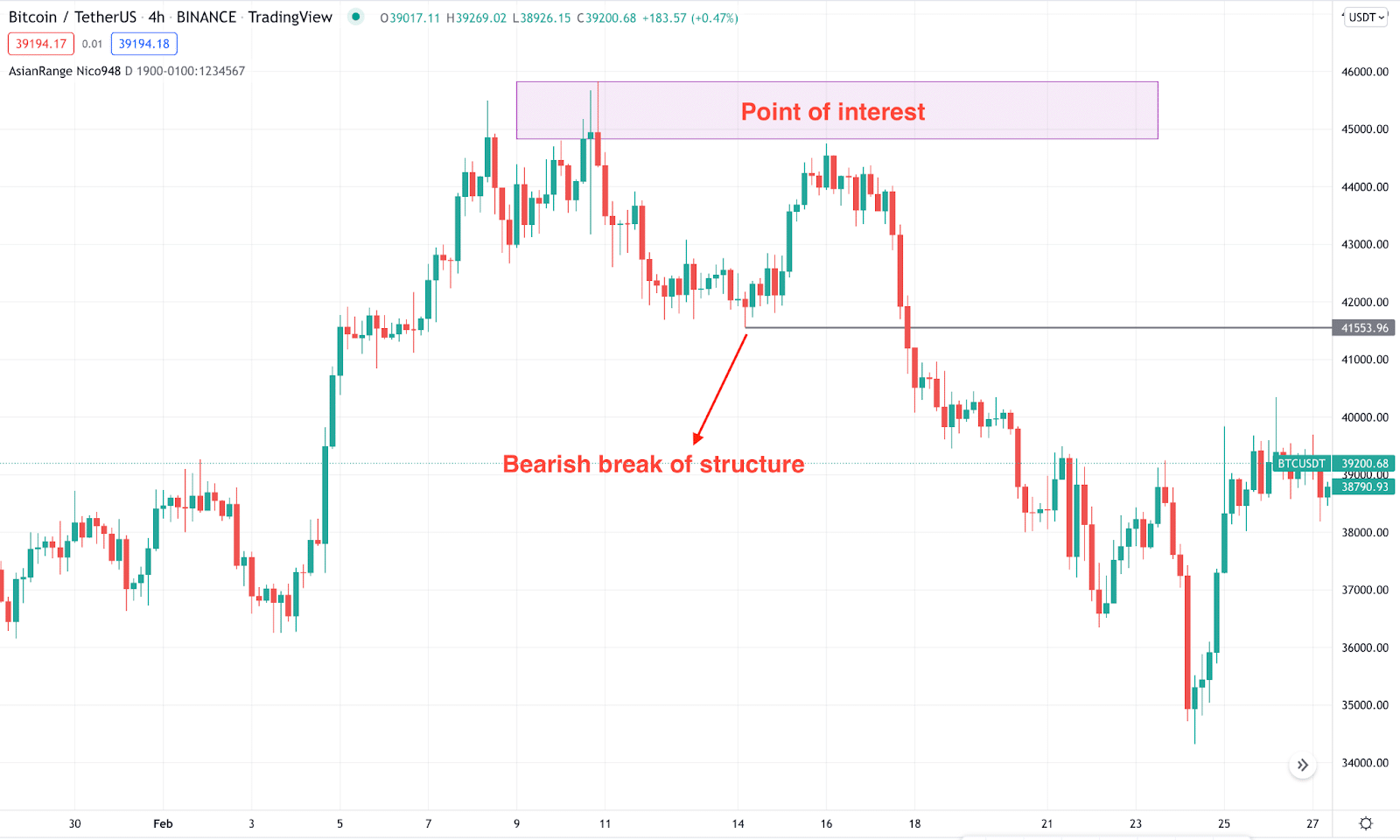

Identify the point of interest

It is the last opposite candle from where the price breaks any near-term swing. In supply-demand trading, we will take trades from the point of interest only.

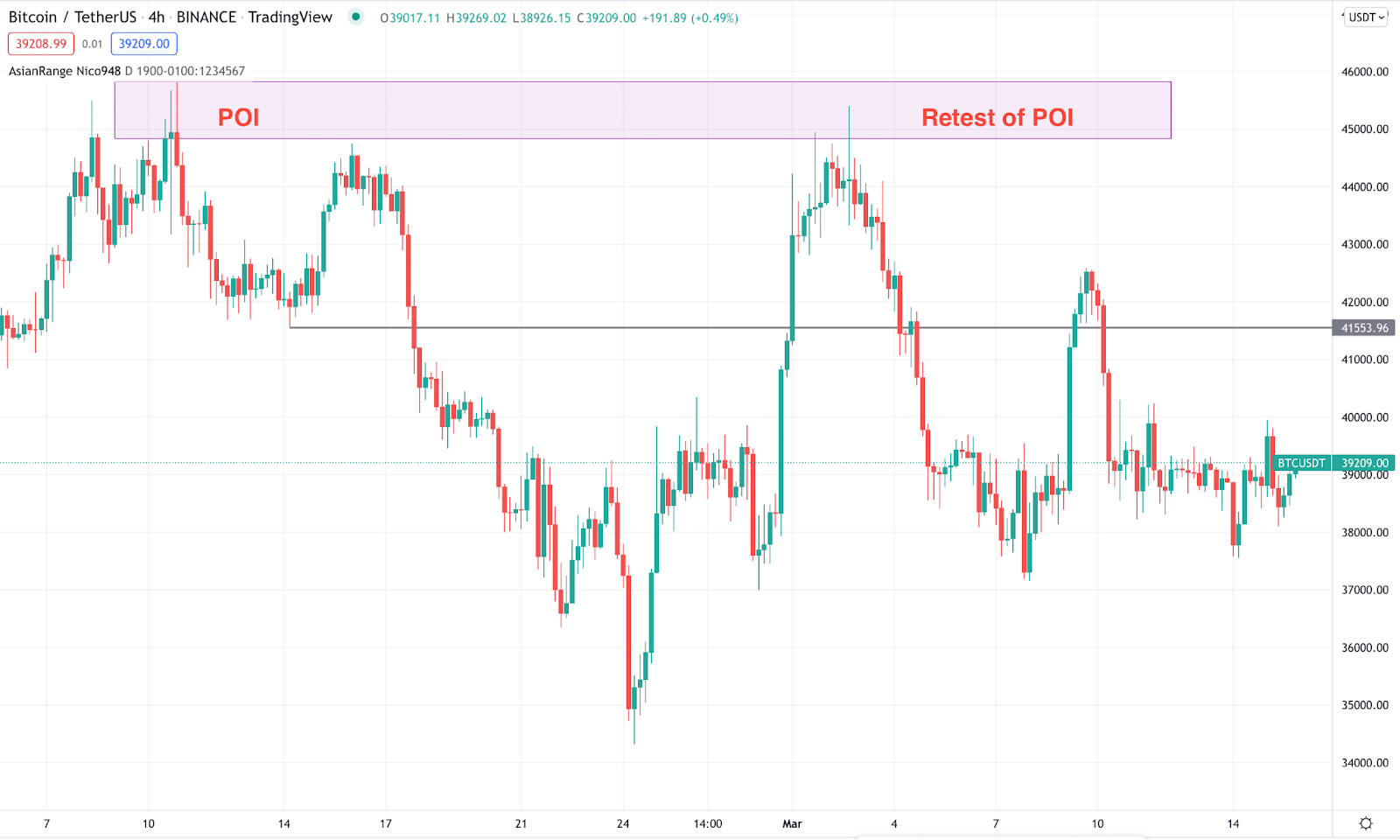

Wait for the retest

After the primary move, the price should again come to the point of interest before showing the actual move. Therefore, mark the zone and set an alert for the revisit.

Confirmation

When the price revisits the POI, investors should monitor the price action. The trade is valid once the price rejects the level with an appropriate candlestick formation.

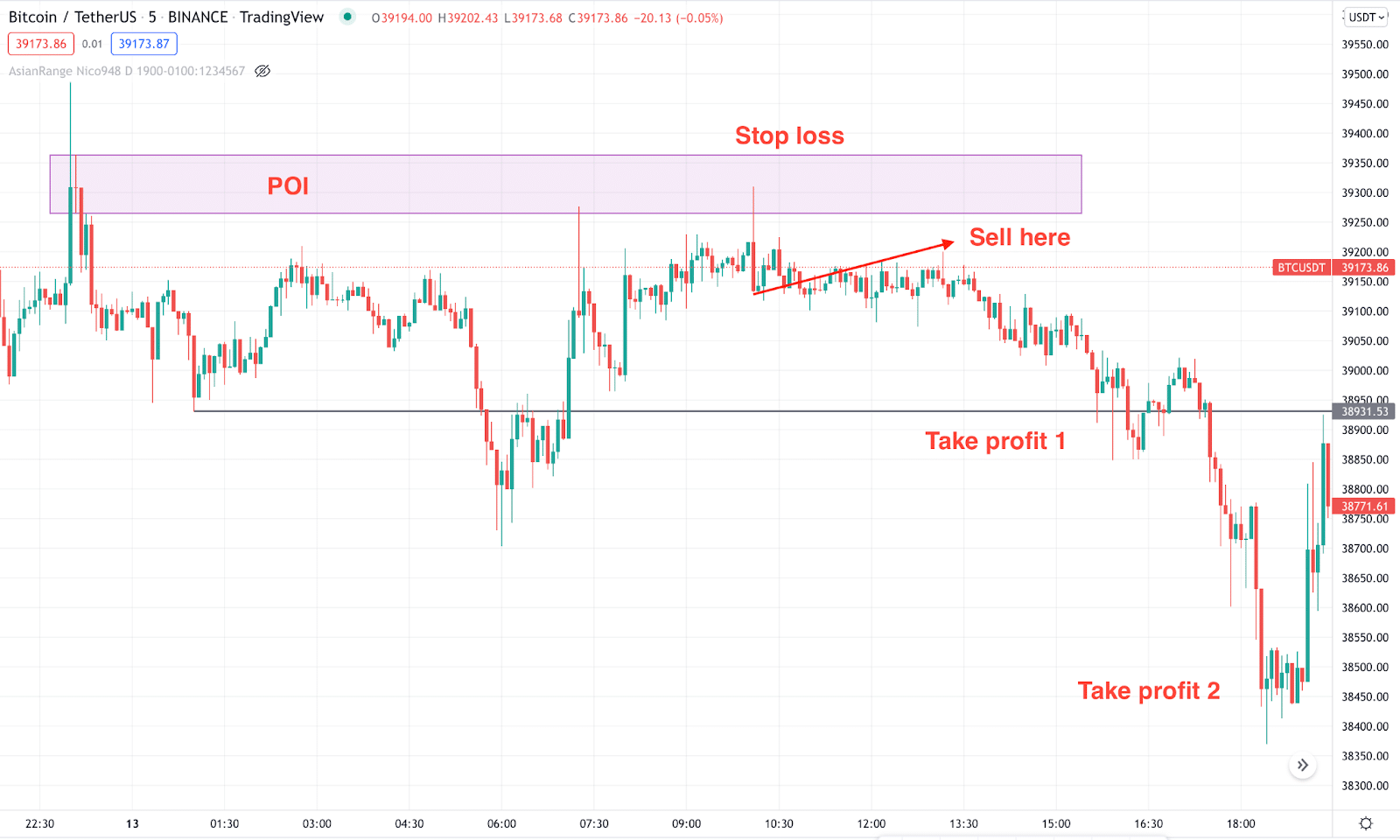

A short-term trading strategy

We will see a crypto coin’s buying and selling idea in the one-minute or five-minute chart in the short-term method. As it is a lower time frame trading, investors should ensure that the broader market context of the current price matches the trade’s direction.

Bullish trade scenario

Before opening a buying position, make sure to follow these steps:

- The higher time frame trend is bullish, and the price is within a bullish impulsive trend after a correction.

- The lower time frame price formed a bullish break of structure, and the point of interest is identified.

- The price revisited the POI and formed a bullish rejection candle. The buying trade is valid once the bullish rejection candle closes.

The above image shows how the price shows a bullish rejection candle at the 5M point of interest where the stop loss is below the recent swing low with some buffer. The first take profit should be at the break of the structure level but traders can extend it based on the price action.

Bearish trade scenario

You can take a sell trade on crypto CFDs once you find these conditions in the price chart:

- The higher time frame trend is bearish, and the price is within a bearish impulsive trend after a correction.

- The lower time frame price formed a bearish break of structure and identified the point of interest.

- The price revisited the POI and formed a bearish rejection candle. The bearish trade is valid once the bearish rejection candle closes.

The above image shows how the price retested the point of interest before making another swing low. The first take profit is at the near-term swing low but the massive selling pressure created further bearish pressure towards the TP2.

A long-term trading strategy

It is suitable for investors and HOLDers who want to find a reliable price before buying any crypto asset. In the long-term method, investors should see a buy trade after a prolonged selling pressure and a sell trade after a prolonged buying pressure. In that case, investors would find enough space to move the price with a tighter stop loss.

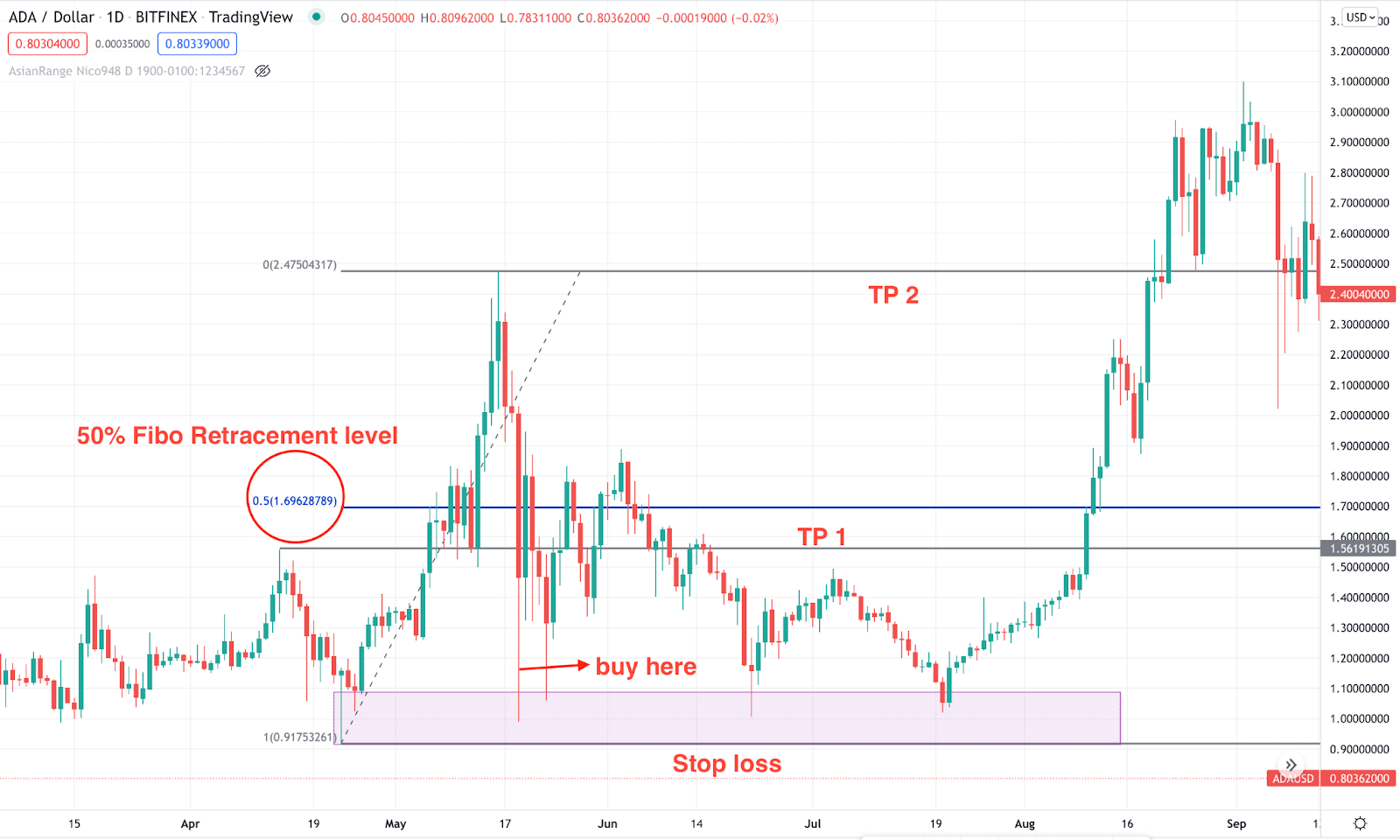

Bullish trade scenario

Before buying a trade, investors should see a coin that is trading at a discounted level. In that case, you can draw a Fibonacci line from swing high to swing low; if the price trades below the 50% of the Fibonacci retracement level, you can consider it at a discount level for bulls.

After that, find the following condition in the chart:

- The price moved above the near-term swing high where the last bearish candle of the swing low is the point of interest.

- The price revisits the POI with a corrective momentum.

- A bullish rejection candle appears in the POI that makes the trade valid.

- The stop loss is below the POI with some buffer, and the first take profit is at the latest swing high.

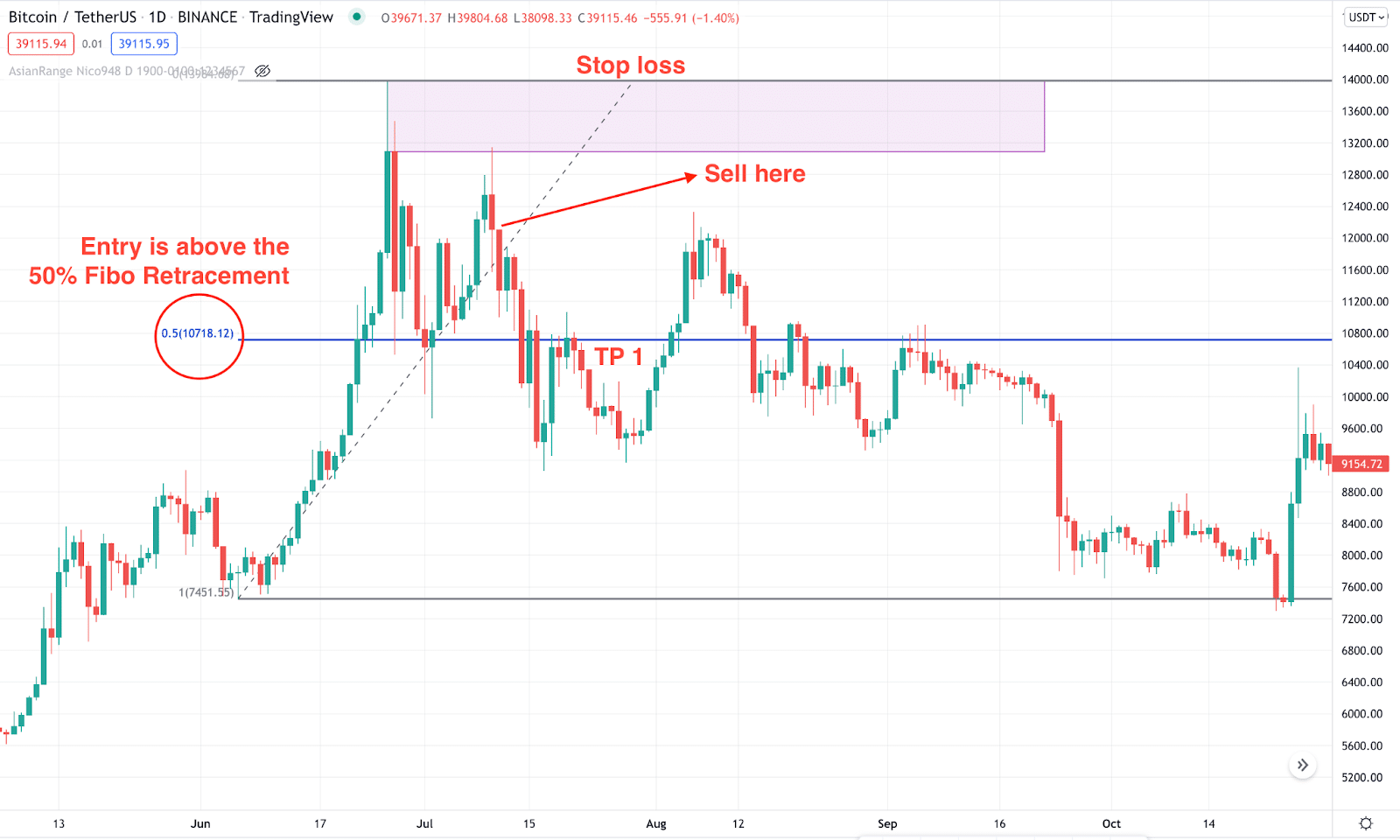

Bearish trade scenario

Like the bullish trading scenario, the bearish trade is valid once the price shows the following condition:

- The price stays above the 50% Fibonacci level and the bullish trend becomes weaker.

- A bearish pressure came with the break of structure and went after the point of interest.

- The price revisits the POI with a corrective momentum.

- A bearish rejection candle appears in the POI that makes the trade valid.

- The stop loss is above the POI with some buffer, and the first take profit is at the latest swing low.

Pros & cons

| Pros | Cons |

| The supply-demand trading helps traders to find highly accurate trades. | A sound risk management system is needed for this strategy. |

| The risk vs. reward ratio in supply-demand trading is extreme. | This method might provide wrong signals during the economic turmoil. |

| It is easy to manage any trades using this method. | The considerable volatility and price crash might make supply demand trading difficult. |

Final thoughts

If you are interested in making 40 pips every time you take a trade, the short-term method based on supply-demand will suit you. The higher volatility of crypto CFDs helps traders grab 50-60 pips per day while getting 2-5% gain per trade is very common in spot trading. However, if you are interested in holding your asset, you can pick the long-term method to get the full juice.