As the coronavirus continues to favor safe havens, market sentiment remains sluggish on Friday, Aug 20.

At the time of publication, however, S&P 500 futures declined 0.24% to 4405, while the yield on the 10-year US Treasury fell two basis points (bps) to 1.24%.

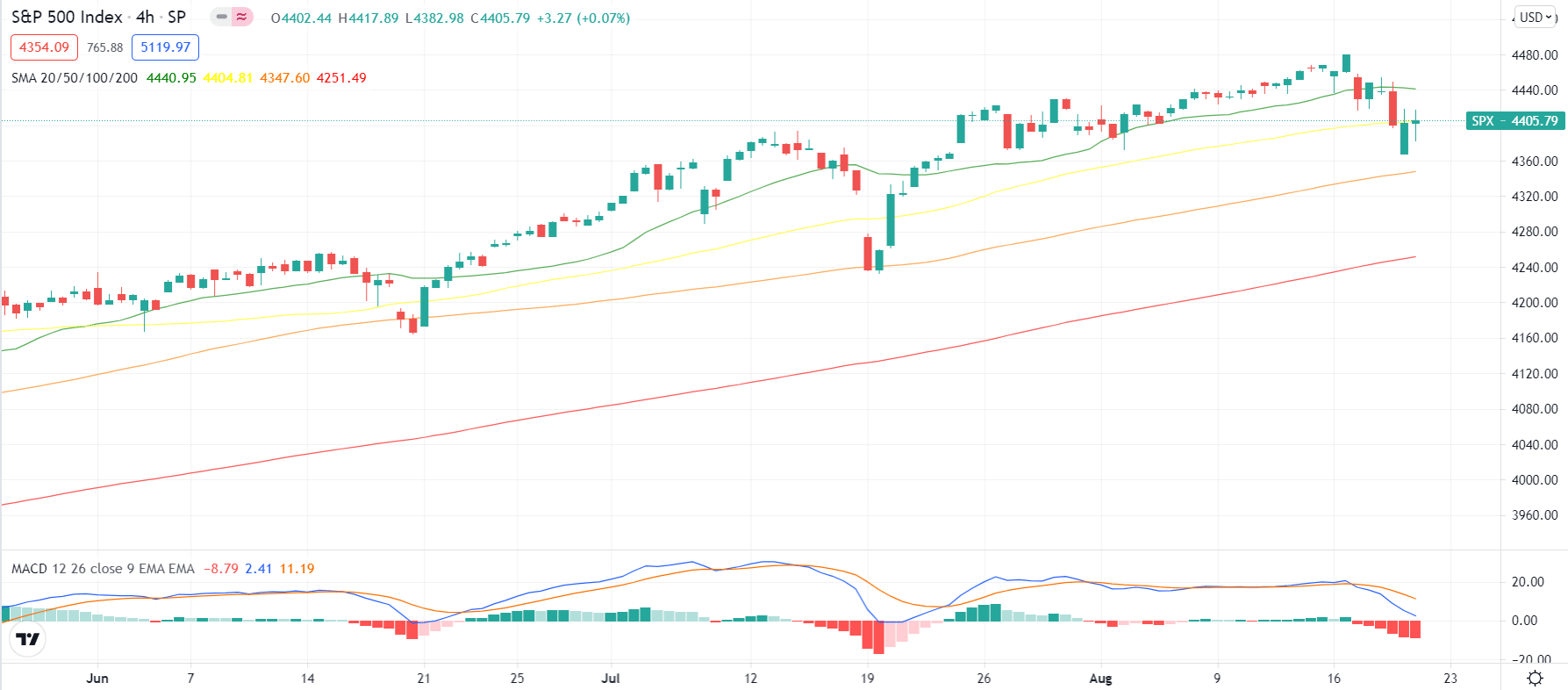

- S&P 500 continues to remain negative after finding the top at 4480.

- The US dollar manages to rise above the 9-month highs as risk mode remains deteriorated.

- Stocks and indices are in negative zones as bonds rise amid sour risk sentiment.

- The Delta variant remains a big concern for the markets that are not cooling off at the moment.

S&P 500 fundamental forecast: risk-off mode tumbling stocks and oil

A check on the US dollar index (DXY) shows that it is increasing its nine-month highs but remains steady near 93.50 as of the latest update.

Stocks down, bonds up

Early Friday morning, stocks were in negative territory after S&P 500 futures ended marginally in positive territory during the regular trading session.

Futures on the Dow Jones Industrial Average declined 105 points. Additionally, futures for the Nasdaq 100 and the S&P 500 were on the downside.

During Thursday’s regular trading session on Aug 19, the S&P 500 ended the day on a two-day losing streak, while the Dow ended the day with a third straight loss.

A volatile trading session resulted in a 0.1% increase for the S&P 500. There was a 0.1% gain in the Nasdaq Composite Index. As opposed to the trend, the Dow fell by 66.57 points.

In this week’s stock market, all three major indexes have declined. Since June, the S&P 500 and Dow have been performing poorly, while the Nasdaq has been struggling since May.

Oil slump

With crude oil prices continuing to decline, the energy index loses more than 3% among the S&P 500 significant sectors. US Treasury yields dropped nearly 2% daily, with the financial index down by 1%. Tech is the top index, growing at 1.1%.

Delta variant

On Thursday, after the number of daily infections in Australia reached 758, they dropped to almost 700. There were, however, two daily infections reported in Wellington early Friday morning, representing 11 daily cases in New Zealand now. The UK says multi-day death tolls, and the US is also experiencing significant numbers. Furthermore, China reported a decline in cases from 46 to 33 on Thursday.

Meanwhile, the UK and the US are moving towards re-vaccinating 12- to 17-year-olds and to offer vaccines to sick Asia-Pacific countries, reflecting an optimistic view of vaccines and a willingness to take risks.

S&P 500 technical forecast: 100-SMA to lend support

The S&P 500 index found a top at 4480 and is declining since then. However, the index found a temporary bottom near 4360. The index is still below the 20-period SMA, which keeps the bearish pressure intact. However, the rise in the index remains capped by the 50-period moving average on the 4-hour chart.

The MACD crossover is another indicator that tells about the bearish pressure. The MACD histogram lies below the zero line. However, the index remains supported by the 100-period SMA on the 4-hour chart.