The cryptocurrency market has become so attractive that investors and traders of other financial markets are coming to this field due to its excessive profitability. But if you are thinking of making a fortune by holding a crypto asset, you are at risk.

Do you know that one of the largest South African cryptocurrency exchanges vanished with $3.6 billion? Moreover, many ICOs and tokens vanished after acquiring people’s money. Therefore, this risk and uncertainty are common facts about financial trading, and there is no exception for the crypto market.

Many think these crypto coins are bubbles that may sink soon, while others believe in decentralized finance as a future. However, knowing that risk factors will help you to understand when and how you should invest. Let’s check out the top ten drawbacks of cryptocurrencies that every crypto trader should know.

Top ten main cons of cryptocurrency

In this part, we list the top ten disadvantages of using and trading cryptocurrencies. Knowing these facts will enable you to understand the cryptocurrency marketplace. It’s better to know all limitations when you want to take full advantage of any asset.

1. Scalability

One of the significant issues about cryptocurrency is scalability. Digital coins can’t compete with Visa or MasterCard as the transaction speed is a critical point besides the transaction process. Still, many transactions happen by giants like Visa, Mastercard, etc., rather than digital coins.

However, adoption and use are increasing rapidly day by day, but the infrastructure is still a challenge as the exchange of digital coins involves complexity, seamless, and difficulty.

Anyway, some organizations such as sharding, staking, and lightning networks already propose resolving solutions for this scalability issue of cryptocurrencies. It is positive news for crypto investors if they solve this issue of scalability.

2. Cybersecurity issues

Cryptocurrencies are a digital product in the financial market, so it involves risk of cyber security. Your confidential information can be in the hacker’s hands, and you can lose control of your account.

Meanwhile, if they can steal your money, there is no route to track them and stop the payment by altering the authentication. According to the Bitcoin rush, hackers got control over some ICO accounts this summer which caused investors to lose millions of dollars (approx. $474 million on an attack).

3. Volatility

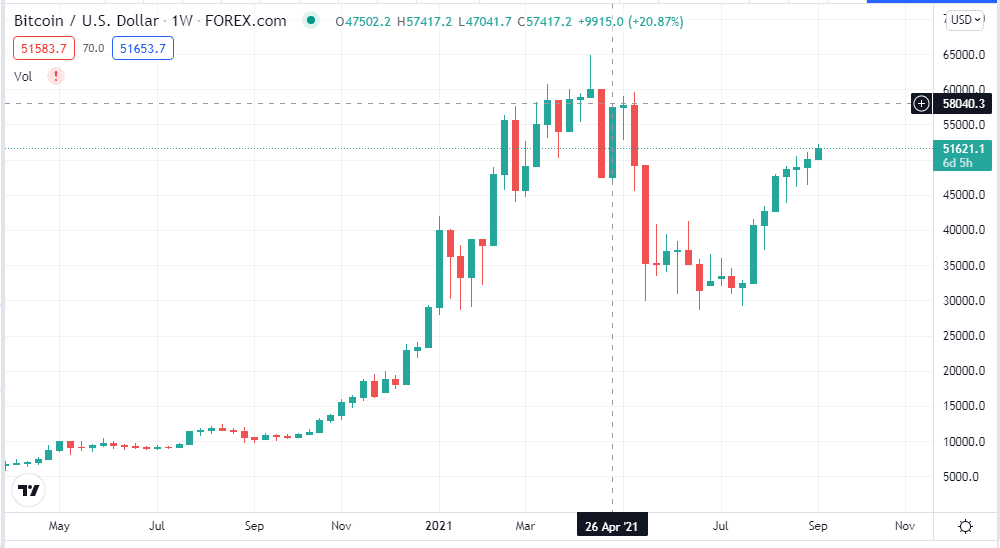

Volatility is another major concerning issue for cryptocurrencies. Lead investors such as Warren Buffett identified these assets as a bubble a few years back for this characteristic feature. This feature makes cryptocurrency a risky investment.

On the other hand, some investors, for example, the CEO of Tesla Elon Musk, see opportunities in the future of crypto. So recently, he made investments worth billions in crypto. Some propose linking these assets with intangible and tangible assets to overcome this issue of volatility.

That may decrease the volatility and increase the confidence of investors. We attach a figure of the weekly Bitcoin chart so you can see how fast the price of Bitcoin changes within a few months.

4. Regulation fact

Cryptocurrencies are digital assets, and no one is controlling this marketplace. On the other hand, Central banks and governments back fiat currencies such as the dollars, euro, pounds, etc., are supplied so that the interest and inflation rates may remain stable. Moreover, there is no regulatory authority for cryptocurrencies.

Taking this digital asset under regulation must involve a change in protocols that will be lengthy and interrupt the normal process or operation. Cryptocurrencies share some features such as decentralization, transparency, and flexibility with other fiat currencies. It is still a matter of discussion if blockchain technology can fulfill the conditions of being under regulations.

5. Correlation fact

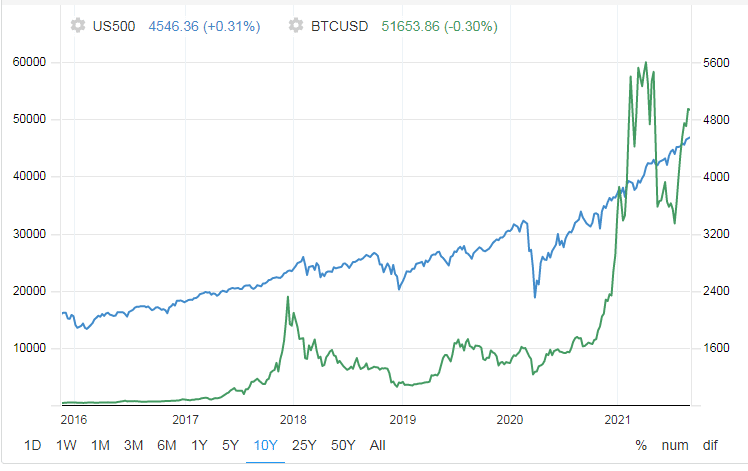

Financial assets such as currencies, commodities, stocks, etc., show positive and negative correlations depending on several factors. For example, the U.S dollar and gold chart show a negative or inverse correlation with each other.

Again The Canadian dollar and oil price shows a positive correlation with each other. We check the correlation between the popular crypto Bitcoin price and the S&P 500 index, another popular financial asset. Let’s match the figure below.

The figure above shows both positive and negative types of correlations back in 5 years. From 2010 to 2021, the bitcoin price rose seventeen times, and the S&P index fell seventeen times. Also, the Bitcoin price declines four times while the S&P index suffers a decline.

There is a positive correlation between S&P and Bitcoin index, which is stronger than the correlation between S&P 500 and the gold price. So it is an indication that Bitcoin cannot provide diversification benefits which is an essential factor for financial assets.

6. Difficult to understand

Cryptocurrencies are comparatively new assets in the financial market. So commonly, it isn’t easy to understand other financial assets such as fiat currencies and commodities. Moreover, fiat currencies and commodities have indicators to predict the future price movement, while cryptocurrencies have none. Blockchain technology is a new technology. So it isn’t easy to understand these digital assets.

7. Scam vulnerability

Cryptocurrencies are digital assets, so there is also scam vulnerability involved. Scammers are all across the internet and using platforms such as Facebook, Twitter, Instagram, etc., to reach their targets. So you can be a target, and they can rob you. Awareness about scammers and using the internet may reduce the risk.

8. No physical form

Cryptocurrencies have no physical forms like other financial assets such as currencies or commodities. Unless there is a proposal and implementation of a universal system, there will be no such thing as Bitcoin cards or physical coins. Cryptocurrencies store the information on the crypto wallets, which is a term of a computer program.

9. No valuation guarantee

There is no central authority to govern cryptocurrencies. So no one can make promises or guarantee the value of cryptocurrencies. For example, suppose many merchants leave the system of these digital assets by thinking it will dump, then the price will decline, which can cause the loss of other investors. So the decentralization of the cryptocurrency marketplace is a blessing and risky in both ways.

10. No buyer protection

There is no buyer protection in the transactions of cryptocurrencies. If the buyer sends payment with cryptocurrency and the seller doesn’t send the product or service, no one will complain or resolve the situation. That will make cryptocurrencies similar to traditional currencies. Involving a third party as ClearCoin can solve the problem, but then escrow services have to play the role of banks.

Final thoughts

Finally, these are the main drawbacks of cryptocurrencies. Meanwhile, cryptocurrency has many advantages: low international transaction cost, peer-to-peer service, mobile payments, no incurring banking cost, etc. These characteristics make the cryptocurrency marketplace so attractive to investors across the globe.