On Friday, December 17, DXY was up by 0.06% at the start of the European session. The index has been dipping since December 15, despite hawkish comments from Fed. Reserve.

- DXY bulls slip even though Fed’s expect three rate hikes in 2022.

- The Federal Reserve announced it would accelerate its asset purchase program.

- Omicron uncertainty also lingers in on DXY bulls.

DXY fundamental forecast

The DXY travels between 95.90 and 96.07 as it recovers some of its previous losses. However, the greenback index has had a weak result, down 0.06%.

Fed hawkish stance

On Wednesday, Federal Reserve policymakers shifted into an inflation-fighting mode, saying they would reduce their pandemic-era stimulus more rapidly at a period of rising rates and a growing economy, capping off a difficult year with a policy shift that could usher in rising interest rates in 2022.

The central bank’s policy announcement paved the way for a more quick finish to the monthly bond-buying program that the Fed has used during the crisis to keep money churning through markets and boost the economy.

According to a new set of economic estimates presented on Wednesday, officials anticipate hiking interest rates, which are now near zero, three times next year.

The Fed is doing less to stimulate the economy each passing month by tapering down its asset purchases quicker, putting the program on course to stop fully in March.

Rising inflation

Inflation has been stronger and more widespread than policymakers projected, and it has persisted longer. Consumer prices rose 6.8% year on year in November, the fastest growth rate since 1982.

The Fed’s favored inflation gauge has increased at a slightly slower pace, but it has also increased dramatically.

Omicron threat

If the new Omicron version of the coronavirus affects supply chains and causes companies to shut down for extended periods, it may allow excessive inflation to persist.

Mr. Powell admitted on Wednesday that the virus’s spread was a concern that added to economic uncertainty.

However, it should be highlighted that Omicron worries have recently impacted the market’s mood, challenging risk barometers like the AUD/USD and gold prices on a light calendar day.

However, US 10-year Treasury rates print moderate advances of approximately 1.42% to maintain the weekly loss, which challenges market bulls and supports the DXY’s strength.

Key data releases from the US

On the calendar, today we have FOMC member Waller’s speech.

What’s next?

The inability of the US currency to welcome the Fed’s aggressive approach. Traders will wait for further cues before resuming their bullish positions.

On the other hand, the economic calendar indicates a calm conclusion to a busy week, so risk triggers will be key to monitoring new energy.

DXY technical analysis: key levels in action

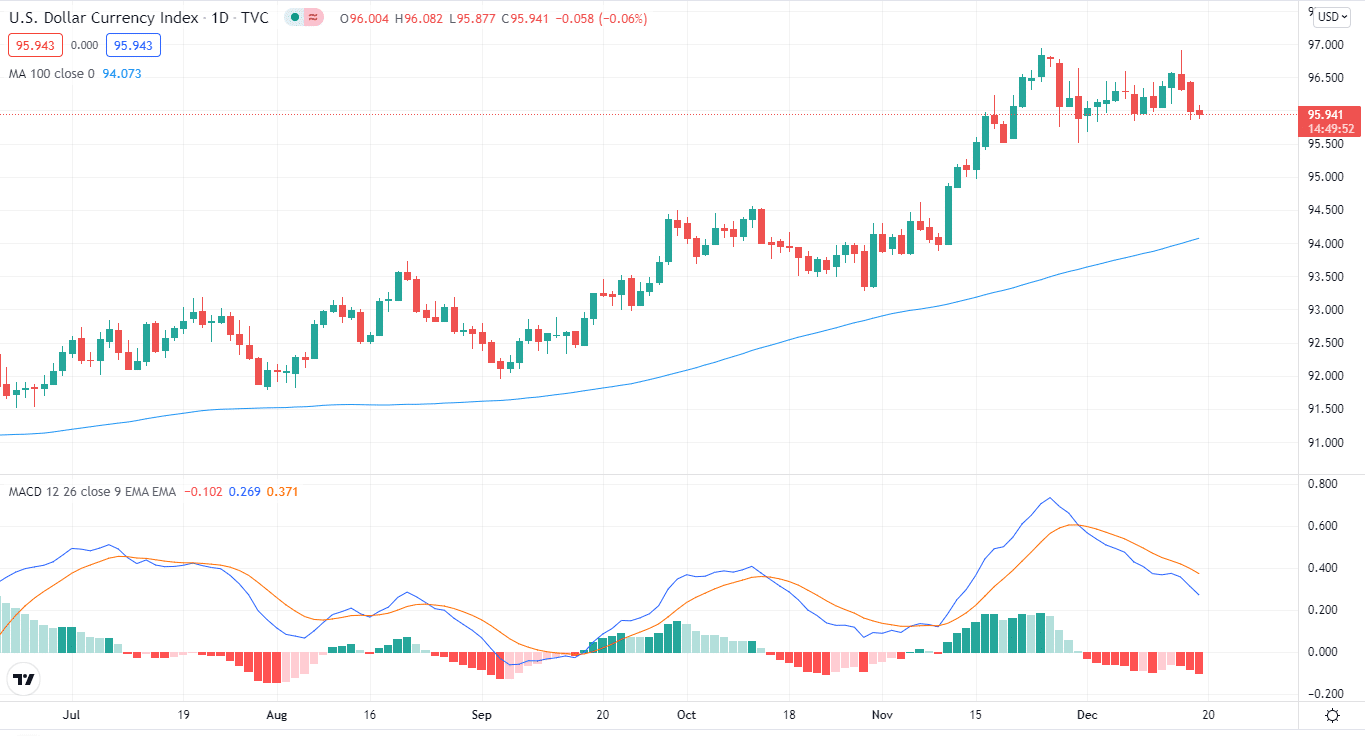

DXY is trying to stay between the 95.90 and 96.10 levels. The index is down by 0.11% since the start of the Asian session.

The index is above its 100-day MA on the daily chart, and the MACD is pointing downwards. This suggests a short-term bearish trend.

A break above 96.10 would open the door to 96.440. If it can cross that level, we’ll see the index touching 96.90, the level it achieved on December 15.

On the flip side, the next support for the index lies around 95.80. If the index slips below this level, we can see a downward movement towards the 95.50 level.