Since Friday, February 4, GBP/USD has lost some of its previous gains because of the stronger greenback.

- GBP/USD falls for the third day due to broad USD strength and Brexit concerns.

- USD gains as Treasury bond yields increase.

- Cable is trading in a narrow range as markets anticipate events later in the week.

GBP/USD fundamental forecast

Following a rise to the 1.3620s last week due to a falling US dollar and a hawkish BoE surprise, the pair retreated below 1.3550 in response to a much stronger-than-expected US job market data.

During the three-day slump, GBP/USD rallies off an intraday low to 1.3520 as the European trading day begins. The pair is now trading at 1.35243, down -0.09%.

Greenback strikes again

The benchmark 10-year US Treasury bond yield continued its march toward the crucial 2% level early Tuesday, assisting the dollar in maintaining its strength versus its major competitors.

The 10-year Treasury yield in the United States increased roughly three basis points (bps) to re-enter the two-year high of 1.95 percent, while the five-year counterpart rose four bps to re-enter the 18-month high of 1.8050 percent.

Hawkish fears about the US Federal Reserve’s (Fed) March meeting combine with geopolitical tensions regarding Russia-Ukraine and Sino-American trade squabbles to support US bond rates.

Brexit concerns

The latest escalation of Brexit anxieties is also serving as a negative factor. The Democratic Unionist Party will not allow Northern Ireland’s power-sharing government to be resurrected until the European Union drops its mandate for inspections on British products coming into the territory. The province’s agriculture minister said on Monday.

Boris in trouble

It’s worth mentioning that The Guardian’s report about additional hurdles for UK Prime Minister Boris Johnson as a result of difficulties for Labour Leader Keir Starmer weighs on GBP/USD pricing.

Key data releases from Britain

From the UK, we don’t have any significant news today. BoE Governor speaks on Thursday. In addition, the late-week Brexit discussions and the UK Q4 GDP will receive a lot of attention.

Key data releases from the US

From the US, we have CPI on Thursday. Later in the week, Fed officials will also speak.

What’s next?

Looking forward, the markets will focus on the US Consumer Price Index, which is scheduled for release on Thursday. Domestically, the UK GDP is seen as a possible stimulus for the pound.

However, GBP/USD traders may see additional weakening as the USD strengthens due to higher rates.

GBP/USD technical analysis: wobbling in a tight range

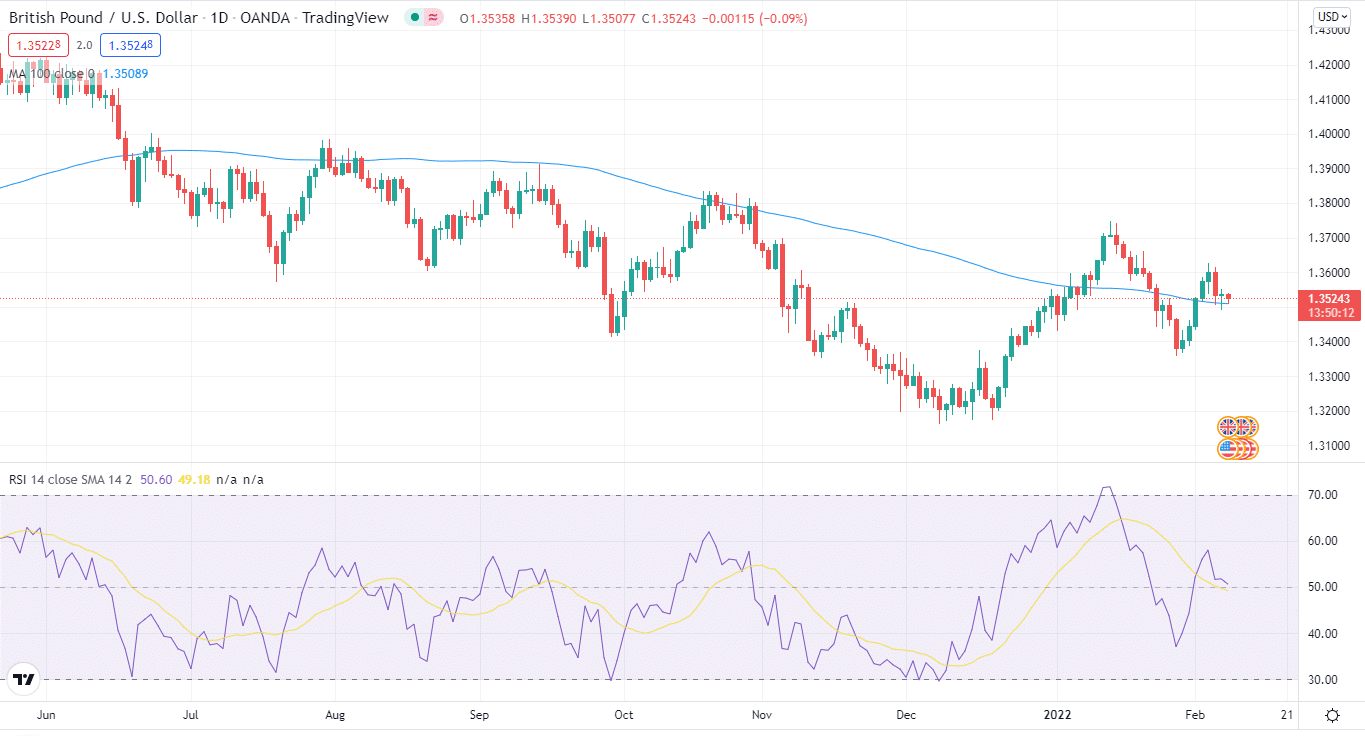

GBP/USD is traveling in a tight range between 1.3551 and 1.3507. So far, the pair has lost -0.09% since the start of the day. The pair is slightly above its 100-day moving average on the daily chart, and the RSI is neutral.

GBP/USD is now hitting the 1.3524 level. A below 1.3500 will bring GBP/USD towards the 1.3480 support level. If GBP/USD falls below this level again, it will challenge the next support level, at 1.3444.

On the upside, GBP/USD will go towards the next resistance level, around 1.3596. A break over the resistance level of 1.3660 will pave the door for a test of the following resistance level of 1.3706.