On Tuesday, October 26, the cable is trading higher from its previous day, but the overall market remains neutral.

- GBP/USD struggles to find a clear direction and fails to build on Monday’s gains.

- London is buzzing with Brexit talks, second-tier US data is being sought to boost, and US Q3 GDP will be the deciding factor.

- Frost, the UK’s Brexit Minister, believes the EU’s Northern Ireland plan is insufficient and sets a December deadline for resolving the dispute.

GBP/USD fundamental forecast

GBP/USD is trading in a tight range around 1.3765 ahead of Tuesday’s London start. As a result, the cable pair’s previous day’s positive performance, the first in three days, fades amid a cautious atmosphere ahead of the UK’s crucial Brexit discussions.

Brexit chatters in London

On Monday, UK Brexit Minister David Frost expressed his displeasure with the recent Brexit discussions and the European Union’s (EU) new approach for resolving the Northern Ireland (NI) border concerns before a parliamentary committee.

Virus surge

Fears about speedier viral mutations in the UK and the recent increase in Covid-19 cases are weighing on the GBP/USD exchange rate. For the past four days, the UK has seen around 40,000 new cases every day.

As the country enters the winter season, the UK health minister has cautioned people not to loosen their guard since there might be 100,000 COVID cases each day.

DXY going strong

The disappointing US Treasury rates are being probed by upbeat sentiment, but the US Dollar Index (DXY) stays robust, extending the previous day’s comeback from the monthly low. The cause for the Fed taper tantrums might be tied to hawkish Fedspeak and anticipation of stronger US Q3 GDP data.

In the midst of these maneuvers, US 10-year Treasury rates hover around 1.64 percent following a two-day decline, while stock futures post modest gains to re-establish record highs.

Hawkish comments

Huw Pill, the Bank of England’s new chief economist, indicated last week that the MPC is “finely balanced” on raising rates in November. Still, his views were seen as hawkish because he also predicted that inflation in the UK might surge beyond 5% by early next year.

This has bolstered the Pound’s underlying strength while also increasing the risk of disappointment for bulls.

Key data releases from Britain

On the calendar front, GBP’s important data is the Annual budget release tomorrow.

Key data releases from the US

From the US, we have Advance GDP on Thursday and Treasury report on Friday.

What’s next?

Looking ahead, a delegation of EU officials is expected to arrive in London on Tuesday, heightening the importance of Brexit stories for GBP/USD traders.

Given the lower chance of a favorable conclusion, the cable pair may stay under pressure, with second-tier US data such as Consumer Confidence and housing reports providing new impetus.

GBP/USD technical analysis: upside remains limited

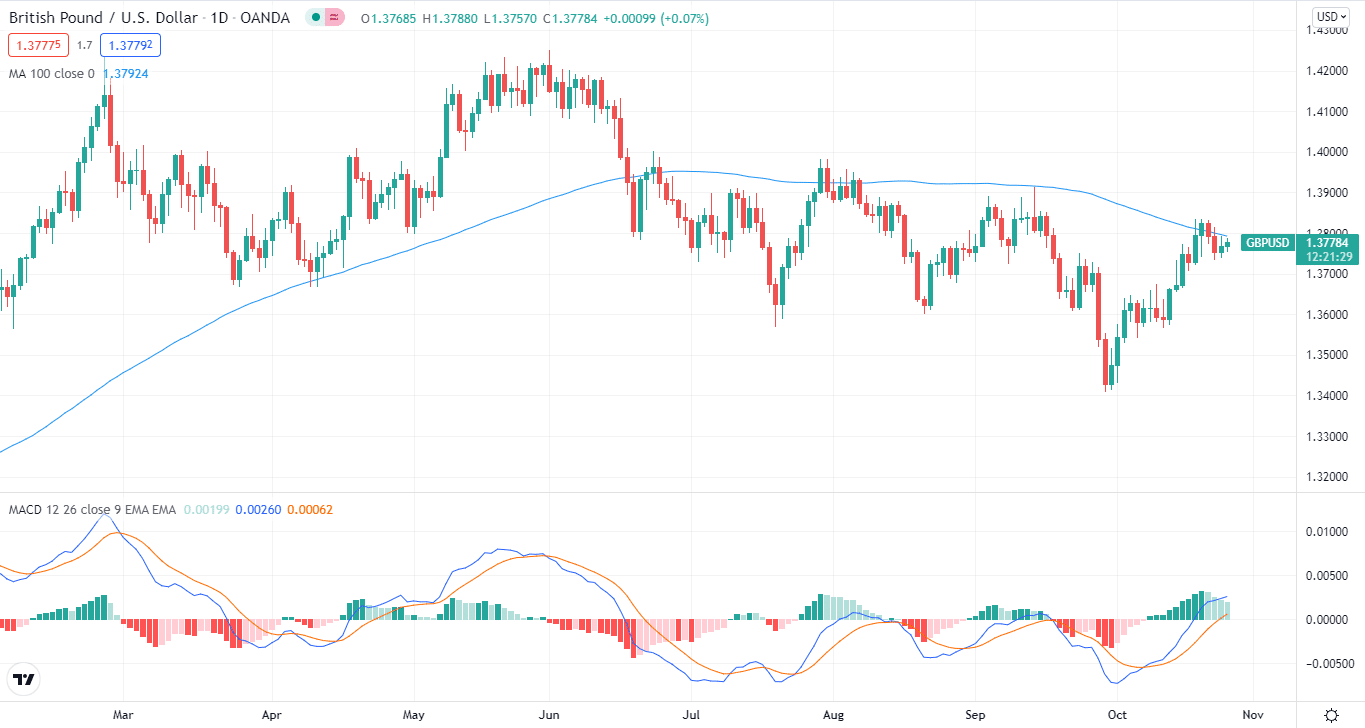

The pair is slightly below its 100-day moving average on the daily chart, and the MACD is pointing upwards.

GBP/USD is stable at around 1.3776, just below the 100-day moving average; we are worried that this will continue to contain the upside and are wary of a collapse here.

The support level is 1.3720, followed by 1.3569, the low from October 12. If it succeeds in crossing this level, the next one is around 1.3411.

Further gains to 1.3914 (mid-September high) could be possible if the 100-DMA is broken, and the cable must reclaim this barrier to maintain its upward momentum.