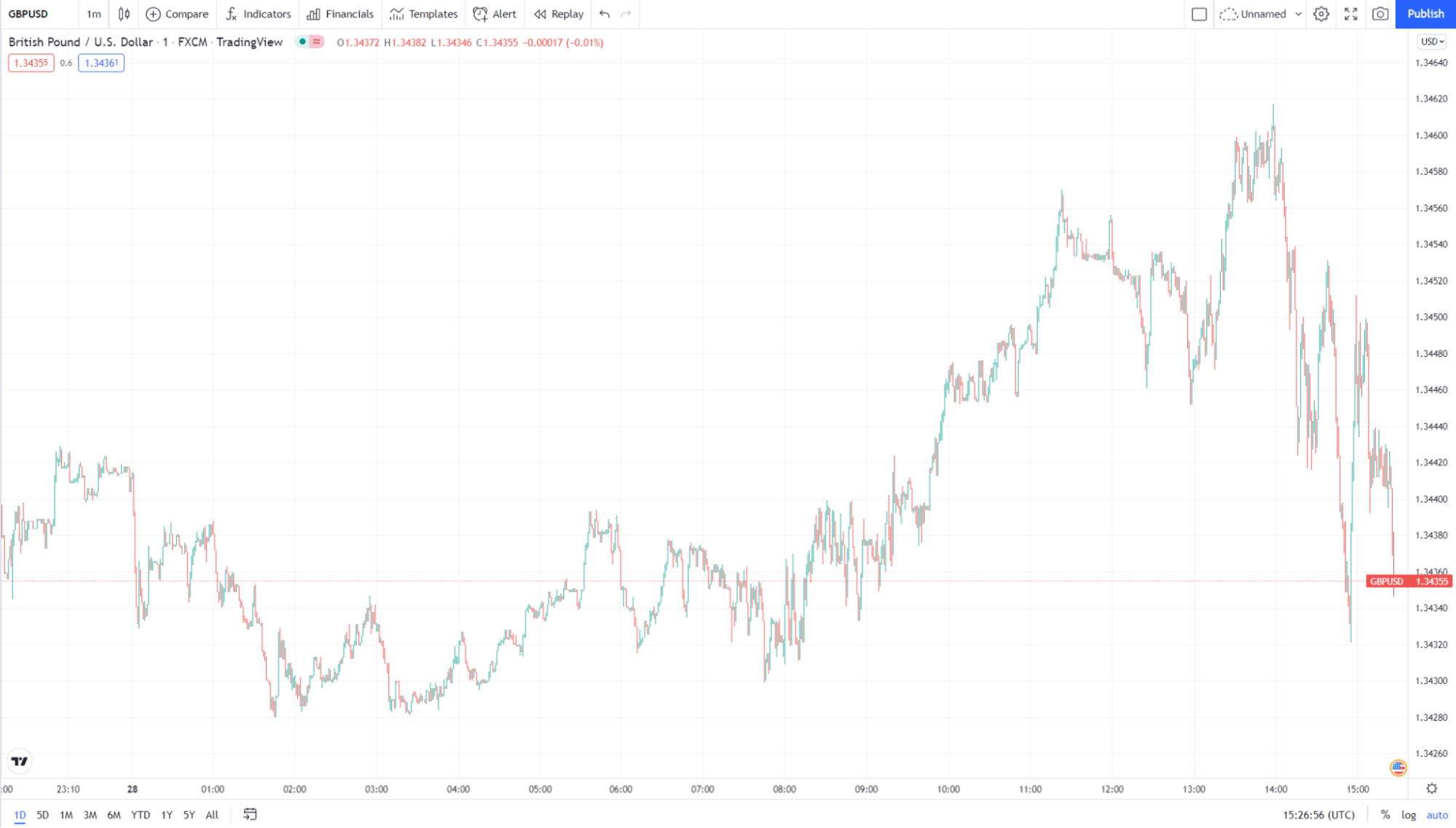

The GBP/USD pair remains positive around the mid-1.3400, consolidating gains near the 5-week tops as we are proceeding towards the year end.

- GBP/USD hovers around the highs through the New York session.

- Omicron-related optimism boosts risk sentiment as the restrictions are reduced.

- Further optimism boosts as the post-Brexit fisheries regulations diminish uncertainties and GBP 75 million funds have been announced for the UK ports and processing plants.

- Technically, the GBP/USD pair remains well bid above the key SMAs.

GBP/USD fundamental analysis: risk-on sentiment to help the bulls

Optimistic domestic headlines from the UK and improved risk sentiment help the pair sustain a bullish bias. However, the Christmas season and year-end keep the activity limited. The GBP/USD is strong in fundamental perspective for the following reasons:

Diminishing fear of Omicron

The health minister of the UK, Sajid Javed, shared his support for the Covid-19 restrictions. His statement triggered some positive momentum for the pound sterling. He also reiterated that the government would not impose any further restrictions. Moreover, the temporary restrictions will remain in action until the End of March.

On Monday, the Covid-19 cases numbered 98,515 while above 100,000 for many days. The receding number is creating a risk-on sentiment for the markets. Statistics have shown that the hospitalization rate in South Africa and the UK have erased the Omicron variant concerns.

Other positive developments

Another positive development in the market is US Vice President Kamala Haris, who said she would not refuse or rebuttal Joe Biden’s Build Back Better (BBB) plan. Moreover, the tension between Ukraine and Russia is likely to ease off, providing additional room for the pound bulls. News about Iran’s denuclearization deal also gives room to the GBP bids.

Post-Brexit fisheries concerns

After the Brexit, the UK-France clash over fisheries rights was a bee in the bonnet for the pound buyers. However, the recent negotiations have proved fruitful, and positive news flow is shedding off the post-Brexit fears.

As per recent regulations about fisheries, the 70% share of the fisheries, including crew and the fish, have to land on the ports of the UK. Furthermore, the UK government has announced a package of GBP 75 million to improve the fisheries ports and infrastructure for the development of the industry.

GBP/USD technical analysis: bulls consolidating ahead of continuation

The GBP/USD bearish candle formation can be seen around the top of 1.3450. This could be a potential pin bar or bearish engulfing candle that may trigger some profit-taking around the key level before continuing the uptrend. Furthermore, you may also observe the ascending triangle pattern, and the price remains guarded by the triangle’s boundaries.

However, any breakout will be considered decisive and may trigger a trend movement in either direction. To grab the trading opportunities, keep your eyes at 1.3450 and 1.3400 as these are the current most-ranging levels that refrain the price from going outside. Now, take a look at the support and resistance levels.

Support levels

- 1.3415

- 1.3330

- 1.3280

Resistance levels

- 1.3455

- 1.3510

1.3600