Making money from crypto trading is more accessible than the traditional financial market, but many traders become confused while measuring the gain or loss. Moreover, trading cryptocurrencies involves a high rate of tax that often complicates the profit calculation. In that case, explicit knowledge about crypto gains and losses might save your money and effort.

In the following section, we will see an exact way to make money online from cryptocurrencies in a calculative way so that you can measure the gain and loss easily.

What are crypto gains and losses?

Crypto gain and loss is the exact amount an investor earns from investing in cryptocurrencies. The value of a crypto token is ever-changing, and its volatility often makes it hard to define the precise gain or loss. For example, the Bitcoin price can provide a 10% to 50% price change in a week, where finding the exact profit from the investment is hard.

Moreover, the recent surge in stablecoins made the profit calculation harder where investors use one cryptocurrency to buy another. Therefore, the primary intention to calculate the profit is from the crypto price change, which is related to the spot market. Later on, once investors convert their crypto to fiat, they can find the actual taxable gain or loss.

How to identify crypto gain and loss?

Finding the gain and loss from cryptocurrency trading is tricky. However, you need to follow some steps to find the raw and taxable gain/loss easily:

Crypto to crypto

If you buy a cryptocurrency using another crypto or stablecoin, it is subject to profit and loss. For example, if you have $5000 Bitcoin in your wallet and converted it to ADA. After five days, the value of your ADA reaches $5500, and you convert it back to BTC. The profit is only available once you return the asset to the primary crypto in this transaction.

Crypto to fiat

The actual profit for tax comes once you transfer the investment from crypto-fiat. For example, if you invest $1000 fiat and buy Bitcoin, there is no profit or loss as your asset is just converted from fiat to crypto.

If you hold the asset for a considerable time, the value of the crypto will change, and for example, let’s say, after five days, the value of the crypto reaches $1500. Theoretically, you have made a $500 profit from the beginning of the transaction, but it is subject to tax once you convert it back to fiat.

A short-term strategy

In the above section, we have seen the method to measure the profit, but in reality, you cannot make any profit until you acquire knowledge regarding buying and selling a crypto token. Buying and HODLing a crypto asset does not happen by guessing the price. There is deep knowledge about technical and fundamental analysis that helps traders define an asset’s future potentiality.

In the short–term trading method, we will see an intraday trading approach in cryptocurrency with a history of providing huge profits.

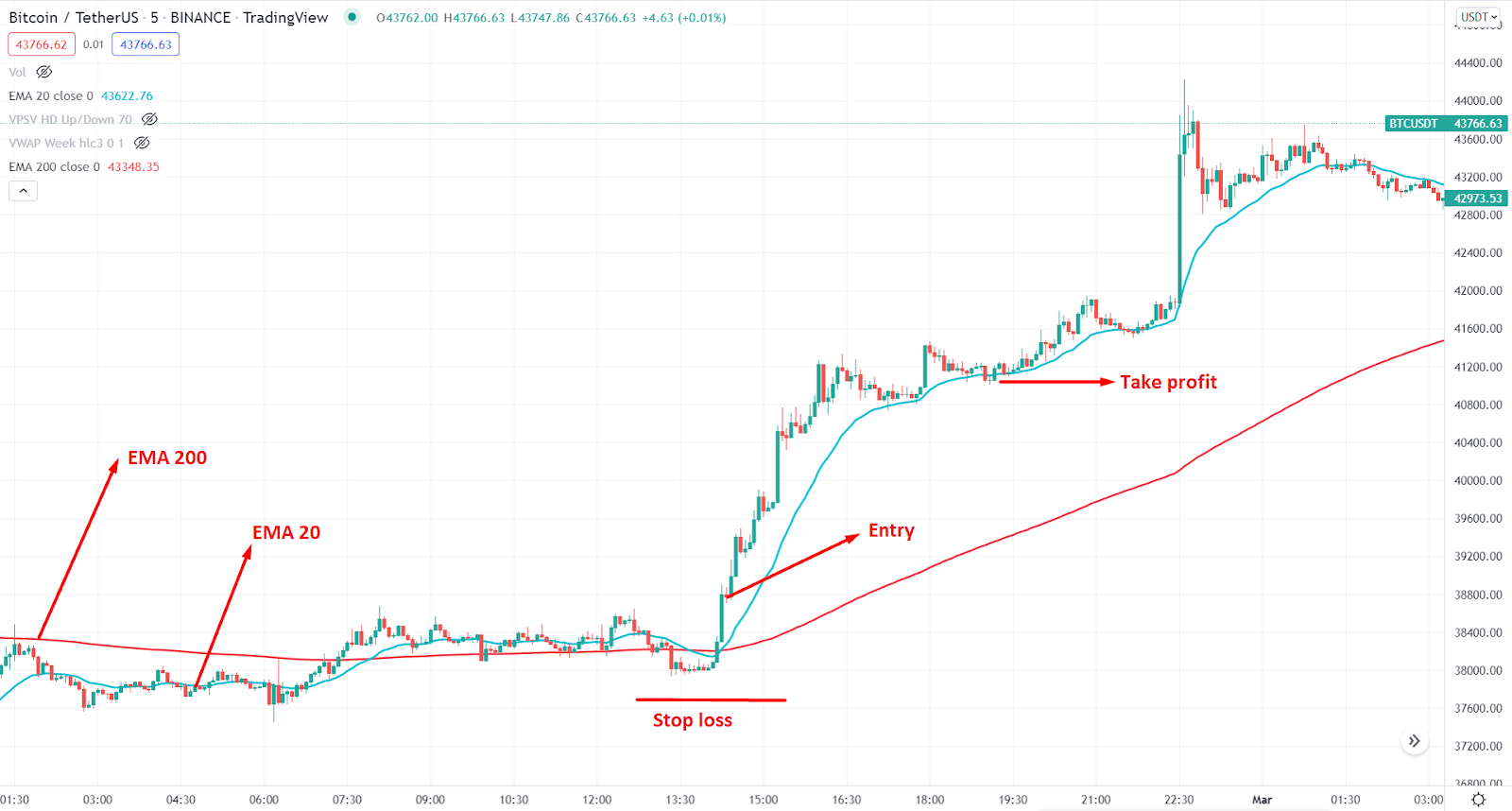

Bullish trade setup

In the bullish trade setup, we need to find the broader market context, and the buying opportunity is valid if the higher time frame trend is bullish. Later on, see the following condition in the chart before opening the buy trade:

- The higher time frame H4 or daily trend is bullish.

- In the 5 minutes chart, 20 EMA is above the 200 EMA.

- The price consolidated and moved above the 20 EMA with a solid bullish close.

- Open the buy trade from the candle above the 20 EMA.

- The stop loss is below the recent swing low with some buffer.

- Close the trade if the price struggles to move higher from the dynamic 20 EMA.

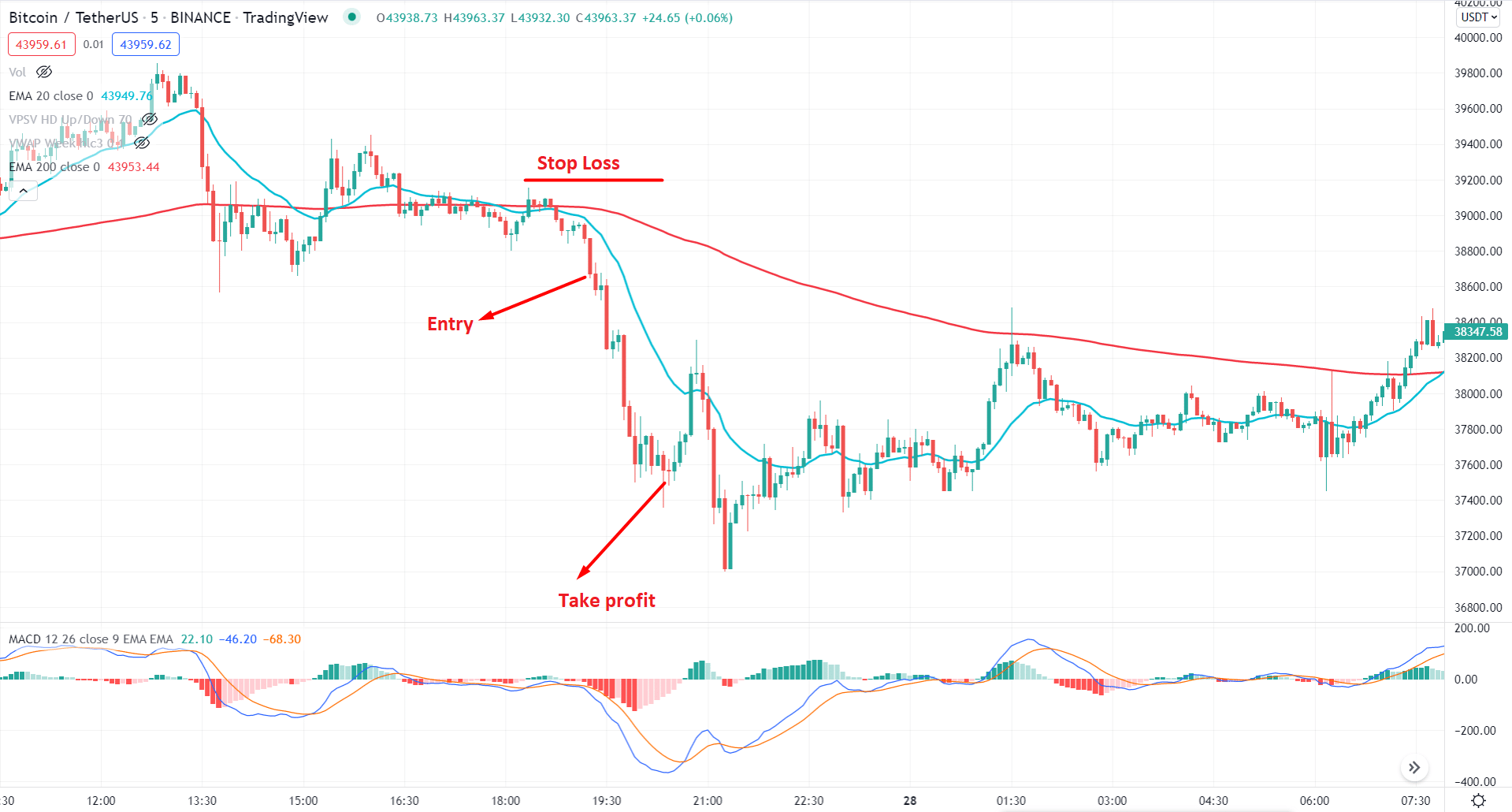

Bearish trade setup

Like the bullish trade, traders should find the higher time frame market context as bearish where the H4 or daily chart should show forming lower lows. Make sure that the bearish trade is applicable on crypto CFDs.

Make sure to find these conditions in the chart while opening the sell trade:

- The higher time frame H4 or daily trend is bearish.

- In the 5 minutes chart, 20 EMA is below the 200 EMA.

- The price consolidated and moved below the 20 EMA with a strong bearish close.

- Open the sell trade from the candle below the 20 EMA.

- The stop loss is above the recent swing high with some buffers.

- Close the trade if the price struggles to move lower from the dynamic 20 EMA.

A long-term strategy

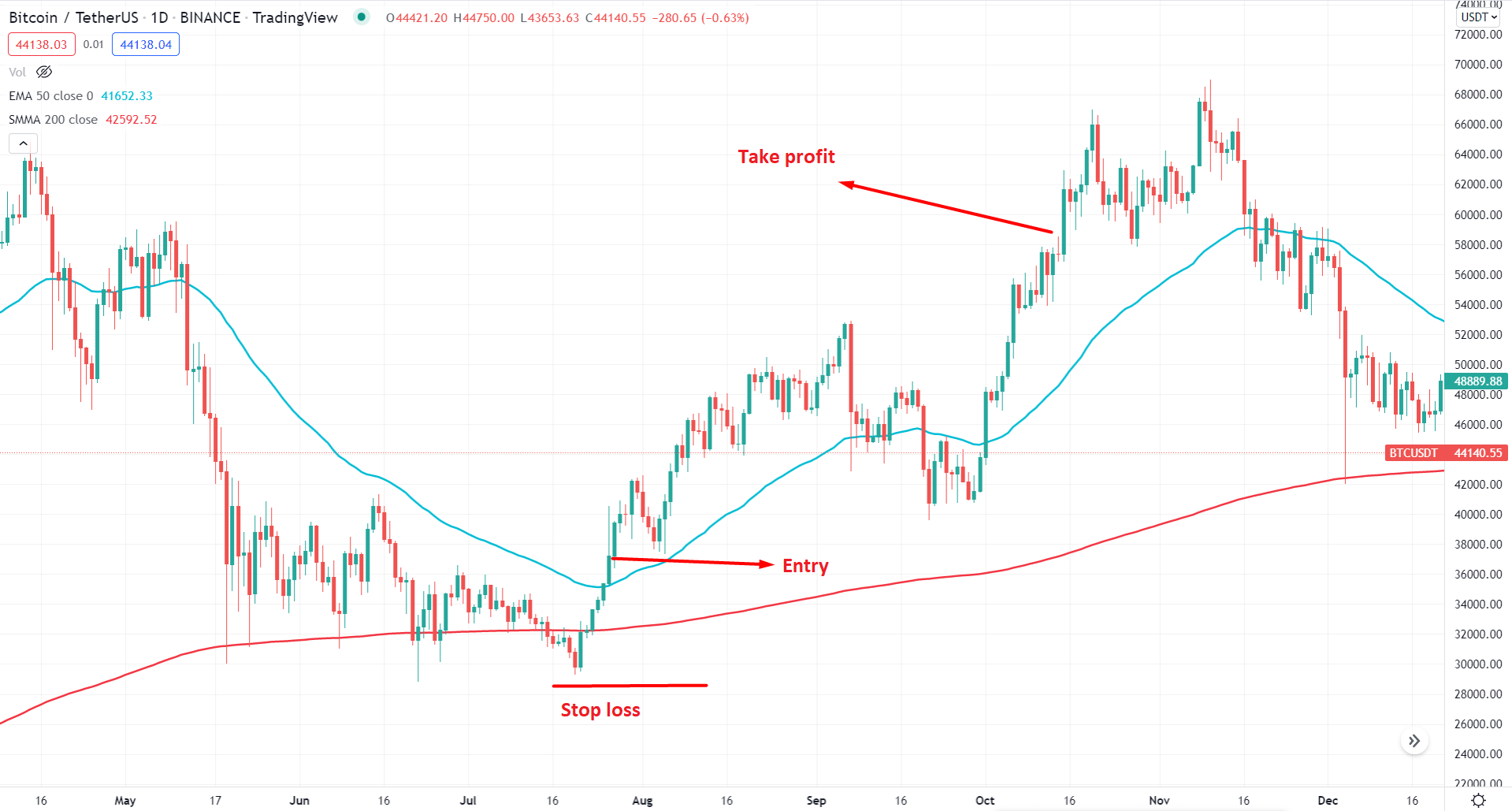

The long-term strategy is suitable for HODLers and investors who spare ready to hold the trade for a long time. There are many strategies for crypto long-term trading, and among them, we will focus on the golden cross strategy.

In the golden cross method, SMA 200 represents the longer-term trader’s sentiment, and EMA 50 represents short-term traders’ sentiment. When both sentiments move in one direction, we are ready to open a trade.

Bullish trade setup

In the long term bullish setup, make sure to find the following steps:

- The 50 EMA is above the 200 SMA, representing that short-term trader are more bullish than long-term traders.

- The overall activity happens in the daily or H4 chart where the price moved above the dynamic 50 EMA.

- The buy trade is valid once a bullish candle closes above the 50 EMA.

- The aggressive stop loss is below the bullish candle, while the conservative approach sets it below the 200 SMA.

- After taking the trade, you can close the 50% position after reaching the 1:1 risk vs. Reward ratio and hold it for further gain.

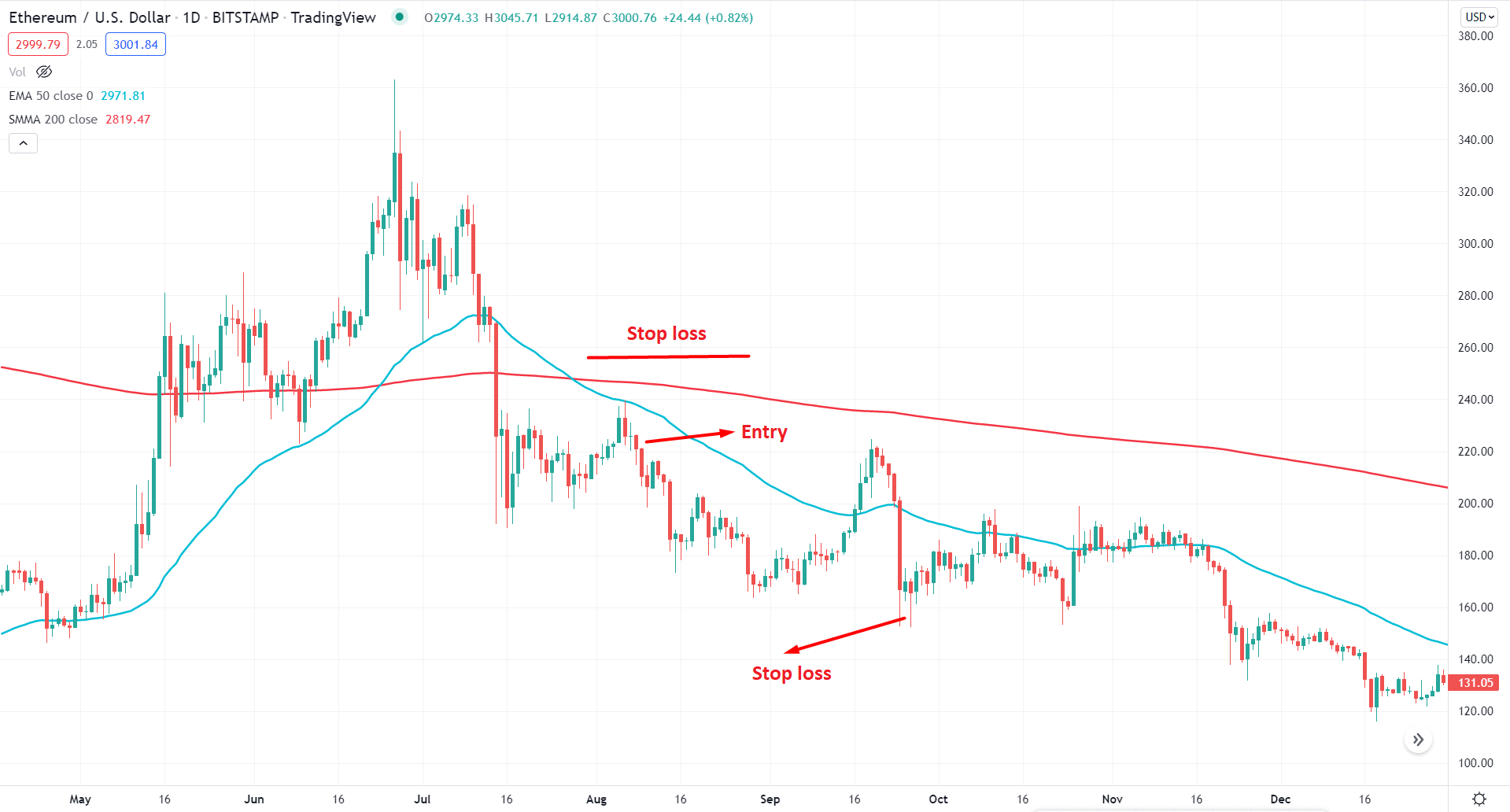

Bearish trade setup

In the long-term bearish setup, make sure to find the following steps:

- The 50 EMA is below the 200 SMA, representing that short-term trader are more bullish than long-term traders.

- Open the sell trade once a bearish rejection candle appears below the 50 EMA.

- The stop loss is above the rejection candle or 200 SMA.

- The first take profit is based on 1:1 RR, and you can hold it for further gains.

Pros & cons

| Pros | Cons |

| Cryptocurrency profits more than traditional financial markets due to its market volatility. | Cryptocurrency gains/ losses need a strong knowledge about technical and fundamental analysis. |

| Calculating gains and losses from cryptocurrency trading is straightforward. | In many countries, profit/loss from crypto investment is subject to tax. |

| Short-term and long-term profit-making opportunities are available in cryptocurrency trading. | Excessive volatility often makes trading conditions uncertain. |

Final thoughts

In the above section, we have seen how to make profits from cryptocurrency trading in both short-term and long-term manners. Although these strategies are profitable in the crypto market, investors should remain cautious about uncertainty.