What is the pre-market trading strategy?

Pre-market trading is a process of making trades before the market opens. In particular, any trading activity before 9:30 AM Eastern time is considered as pre-market trading.

Many people wonder how a trader can open trade before the trading session starts. This trading approach is special and applicable for big investors only. However, retail traders like us also can take part in pre-market trading. The trading method in pre-market trading is not the same as active trading sessions.

Many brokers offer pre-market trading. However, the different brokers offer different parameters in pre-market trading. Therefore, finding a suitable broker with the maximum facilities is the primary target for a trader. Later on, investors should know how the pre-market works and what strategies will work here.

How to identify the pre-market trading strategy?

Finding the perfect trading method is the primary requirement for a trader. Therefore, you need to choose the most profitable and less risky pre-market trading method to maximize the market.

In pre-market strategies, most of the systems are based on pending orders. Therefore, you don’t need to see the price moving in front of you. You can anticipate what might happen after the market opens and open trades based on this.

However, make sure that there are some risks associated with the pre-market methods. Before the market opens, there are fewer trading volumes due to the absence of institutional traders. Therefore, you might experience a ranging market with less activity. Besides, having good knowledge about the running spread and trading costs are another important fact that a trader should consider in pre-market trading.

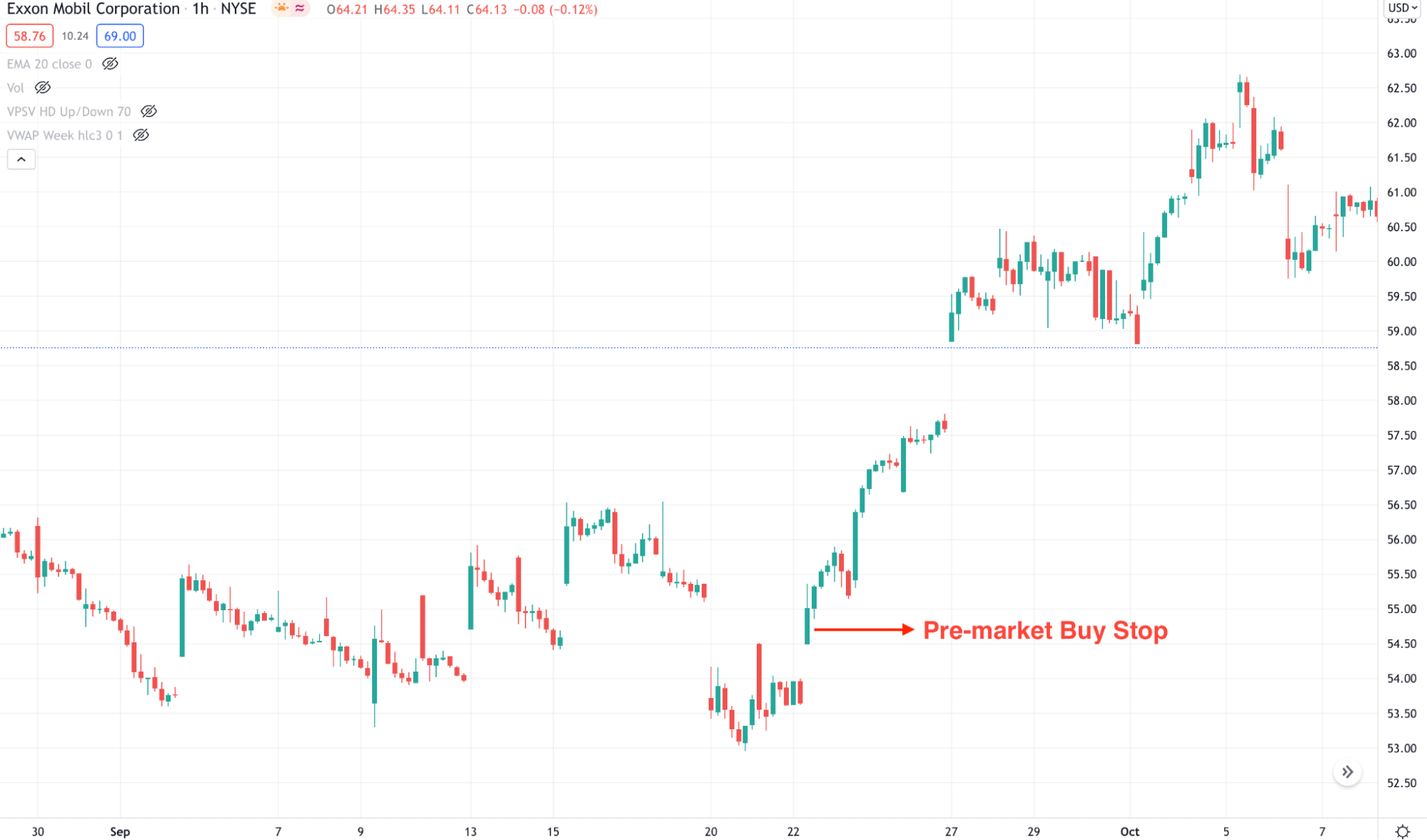

A short-term strategy

In this trading method, we will try to catch the impact of breaking news. Traders should closely monitor how the global news is coming. Any breaking news that can strongly impact the financial market can affect the price immediately after opening. So the news might have a bullish and bearish impact on stock or FX pairs. Based on this concept, we will open a pending order in the pre-market trading session and close the trade as soon as the market opens.

Bullish trade setup

Before taking a buy trade, make sure to find the following confirmations:

- Strong news appears that has a higher possibility of affecting market sentiment.

- Observe the trading cost and trading volume before the market opens and set a pending order.

- As we are focusing on bullish trade, open a buy stop order above the recent resistance level.

- Set the stop loss and take profit based on near-term areas so you can manually monitor those trades.

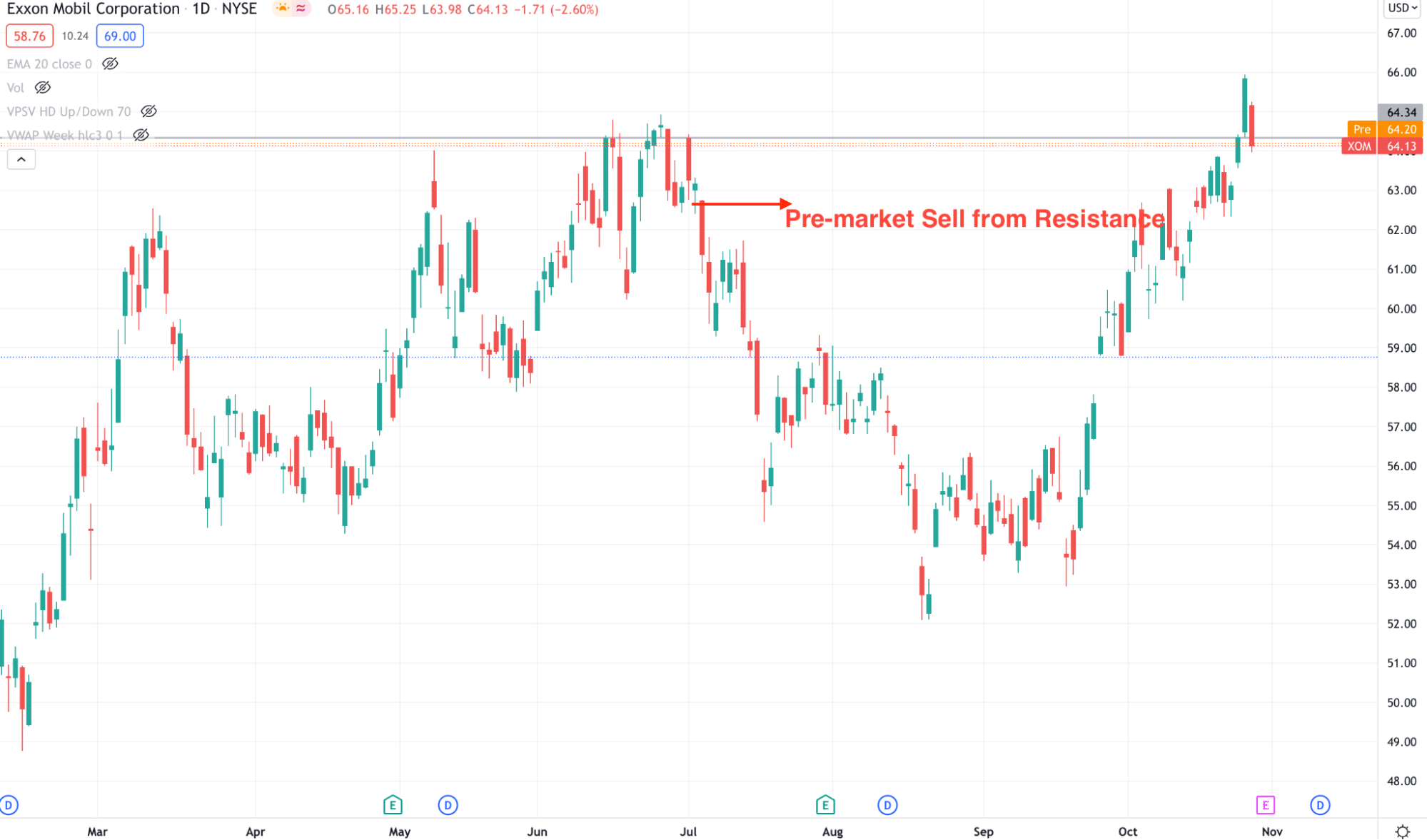

Bearish trade setup

The same theory applies to the bearish market, where you need to ensure that the news negatively affects the instrument. For example, a travel ban is bad for travel stocks; a tax increase is bad for indices, etc.

- Observe the trading cost and trading volume before the market opens and set a pending order.

- As we are focusing on bearish trade, open a sell stop order below the recent support level.

- Set the stop loss and take profit based on near-term areas so you can manually monitor those trades.

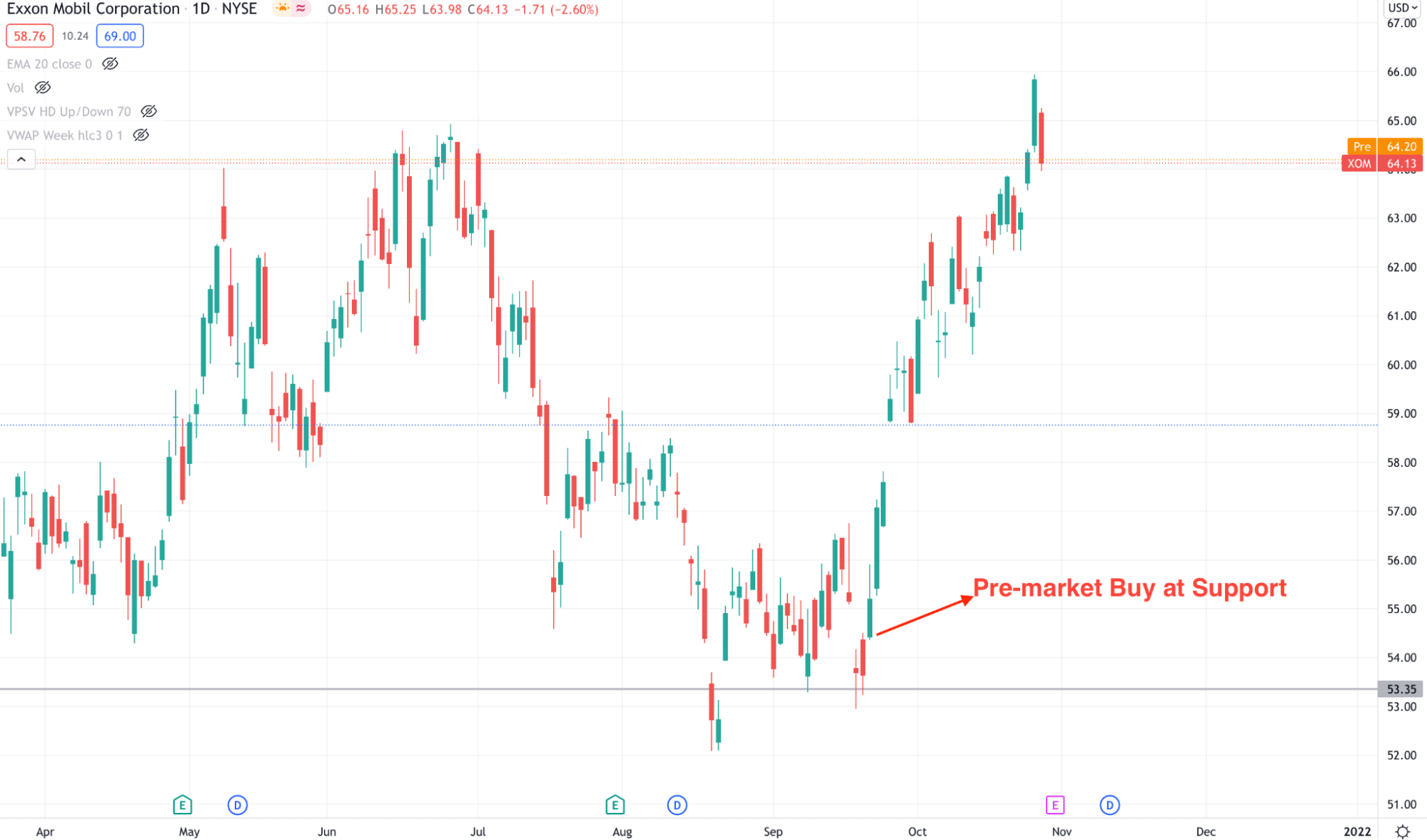

A long-term strategy

It is a simple range trading system where traders should know the market trend. Later on, follow the trend using simple price action tools like support resistance and candlestick. In that case, the daily close of the previous day is important.

Bullish trade setup

Before opening a buy trade, make sure to find the following confirmations:

- The market is trending higher in the daily chart.

- The last day’s daily candle closes above any important support level with a bullish rejection.

- Open a buy order at the pre-market time.

- The price is likely to follow the momentum, so set the stop loss and take profit manually after market opening.

Bearish trade setup

Before opening a sell trade, make sure to find the following confirmations:

- The market is trending lower in the daily chart.

- The last day’s daily candle closes below any important resistance level with a bearish rejection.

- Open a sell order at the pre-market time.

- The price is likely to follow the momentum, so set the stop loss and take profit manually after market opening.

Pros & cons

| Pros | Cons |

| This simple trading method is suitable for any trader. | Low liquidity and higher spread may affect the trading result. |

| The strategy allows getting immediate profit without a long holding time. | All brokers do not support pre-market trading. |

| It does not need to understand fundamental analysis. | It needs additional attention to external news. |

Final thoughts

Finally, we have seen how pre-market trading works in the financial market with a complete trading strategy. This method is different from traditional technical and fundamental analysis, and it is applicable in any financial market.

However, there are some risks that you cannot ignore while trading this strategy. The global financial market consists of some unavoidable risks where unexpected price behavior is prevalent. Therefore, the ultimate success in pre-market trading depends on utilizing your funds with proper risk management.