In this article, we will be discussing different aspects of auto and manual trading to help you decide the best fit for your business. While both have their benefits, each lags at specific points, so let’s have a thorough analysis.

What is manual trading?

It is the trading process that requires human decision-making. In manual trading, the participant chooses when to enter/exit trades instead of depending on a computerized algorithm.

An excellent manual trader is a seasoned investor who has spent considerable time in the market and understands all the combinations of currency pairs and the relevant technical indicators involved.

In plain words, the investor is in charge. He decides every move statistically and has the freedom to shift techniques based on market movements.

Pros of manual trading

Following are the benefits of opting for the manual approach:

- Helps in gaining experience

This is one of the most significant advantages of the human-oriented system. You get to deal with all the problems first hand and devise solutions that best cater to your needs.

You will be exposed to real-time situations and will learn to make strategically correct decisions. Moreover, you will get a deeper insight into the FX business, have a better understanding of the tools used, and will be able to conduct technical and fundamental analysis.

All of this will help you later in life if you plan to switch towards the automated system.

- You will be in greater control

Forex is a panic-inducing business. The worst thing one can feel is not being in control. Imagine you have a large sum of your balance invested, and you do not even have a say in how things work out. Not the ideal situation, right?

This is where the manual approach takes the lead. In the manual system, you have complete control over what you are doing. You are the captain of the ship who takes all the decisions.

- You can improvise and improve

The forex market is pretty unpredictable. Unexpected events take place that makes the charts go up and down in no time. In such scenarios, improvisation is inevitable. Humans can re-strategize to tackle the current market state, and something robots are not capable of

In manual trading, investors can recognize signals that the algorithm might miss out on. Investors can evaluate what is working out for them and what isn’t. So this helps in improving the overall technique.

Cons of manual trading

Following are the drawbacks of using this approach:

- It is time-consuming

In a quick business-like FX, the quote “time is money” holds practically true.

Manual trading demands research and experience, both of which are very time-consuming. When you are analyzing and assessing each trade separately, taking up time is inevitable.

- Emotions can dominate

As mentioned before, FX is a panic-inducing business. Most traders tend to get carried away in emotions and start panic buying/selling, which results in losses.

Discipline is a hard skill to master. Traders usually take a gamble out of pressure which increases the drawdowns and lowers the winning probability. Therefore, it is imperative to stick by the risk management rules to protect your capital.

- Not taking responsibility

Being a mastermind is not an easy job. While you are accredited for all your wins, you are solely responsible for your losses as well.

The majority of the investors struggle with taking responsibility and blaming external factors such as the trading plan, indicators, brokers, etc.

What is automated trading?

A trading algorithm decides trading moves based on the instructions that have already been written in the code. It does provide considerable freedom to the investor since they do not have to be on constant watch.

However, it depends on the previously mentioned method because only an expert manual trader who knows all the market secrets will devise an efficient code.

Once the instructions have been fed, the robot will automatically open or close trades when certain situations or rules occur. Automated trading may seem like a one-time effort, but that is not the case.

Investors need to keep optimizing their trading strategies for better results.

Pros of automated trading

Following are the advantages of choosing automated trading:

- No emotions involved

We deduced that a significant reason for losing is an emotional approach. Machine trading eliminates this factor.

All the decisions are based on statistical data without any intrusion of instinct. Once the emotions are boxed aside, the actual trading plan can be implemented with greater precision.

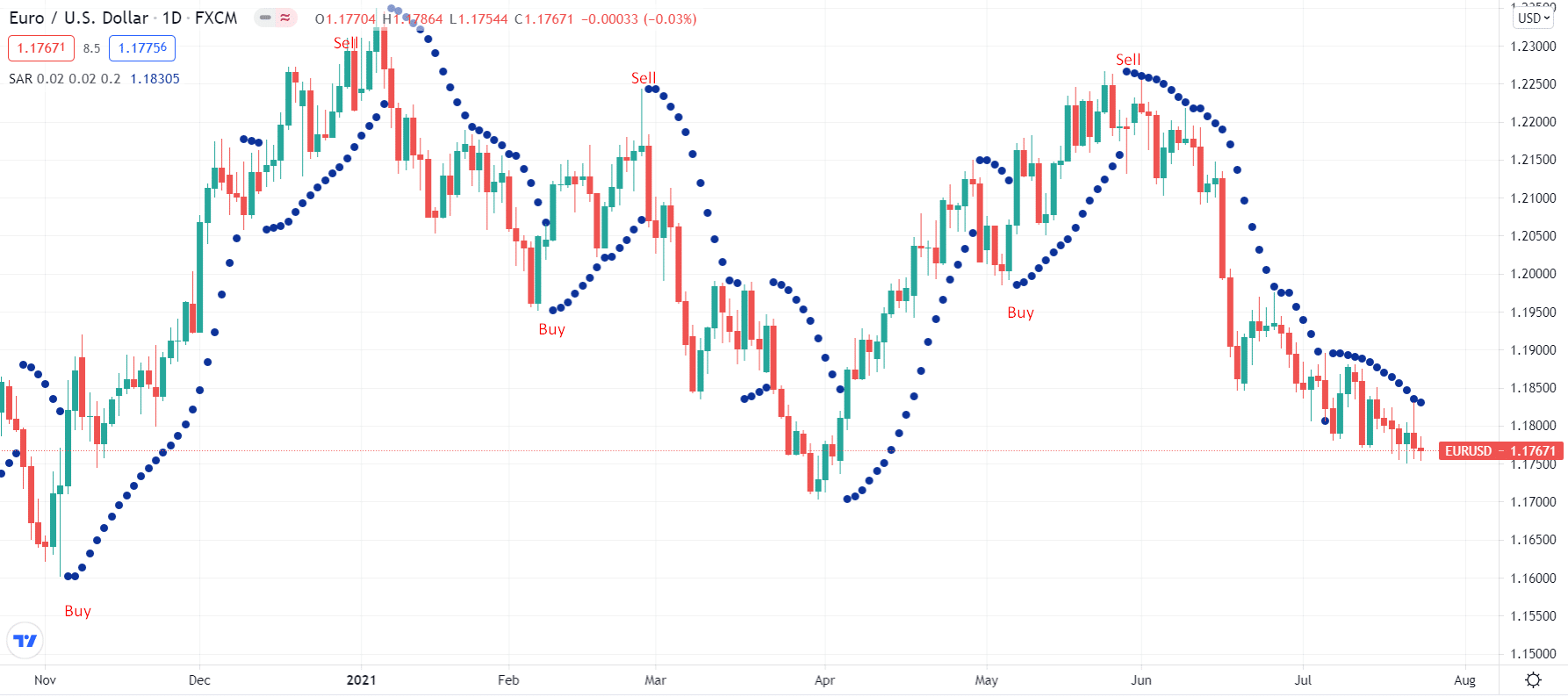

This leaves no room for over or under-trading. Instead, the robot will automatically close the trade once all the rules have been met. So, for example, if your robot is based on Bollinger bands, it will only open and close positions when the conditions are fulfilled. Look at the chart below.

- Provides backtesting

Backtesting is the process of using historical data to find out how well a strategy will perform. If the results are positive, the investors can employ the technique with confidence.

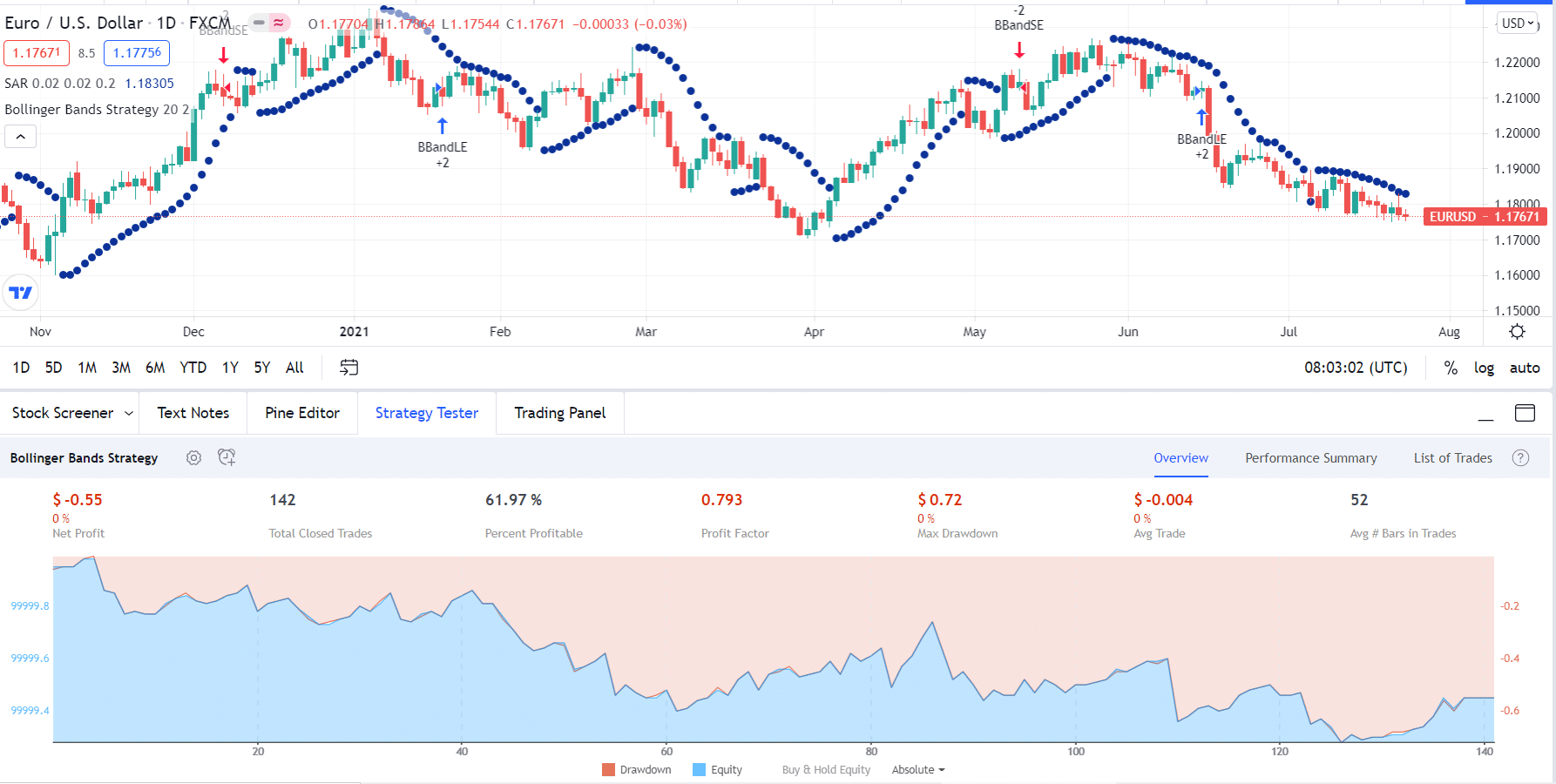

In an automated approach, the trading plan is being implemented without any changes and improvisation. This provides you with the opportunity to backtest with accuracy. If the results are good, you can use the strategy in live trading as well.

As the algorithm has historical records as well, beginners can go through them to quickly find out what works best. Take a look at the chart below-showing backtesting of Bollinger Bands strategy.

Diversifies trading

Automated trading systems allow you to trade with multiple strategies simultaneously. So this divides your risk over various instruments, reduces the chances of losing, and will help you in improving your portfolio.

Cons of automated trading

Following are the downsides of this method:

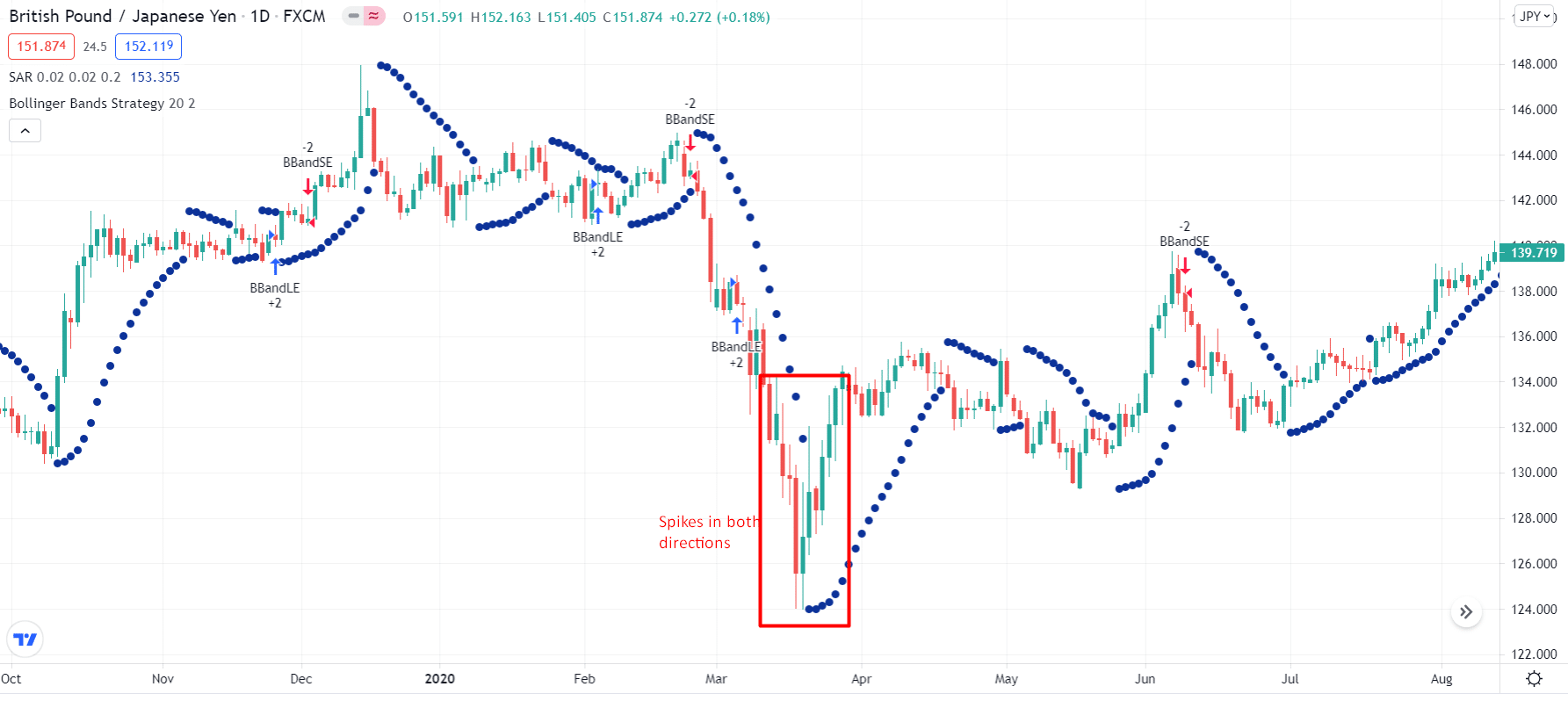

- Market changes rapidly

The past cannot always predict the future. Therefore, you can’t assess the credibility of a system solely on its past performance. Every day something new happens in the market. Each event impacts the business differently.

You cannot find a shoe that fits all. Furthermore, the algorithm approach leaves no room for quick improvisation, resulting in heavy losses on occasions.

- It can be super expensive

If you are not a pro-trader, you will need to hire one to devise the trading rules for you. On the other hand, if you are already an adept investor, you still need a top-notch programmer to write the code for you and make it usable.

Not only this, but regular optimizations also cost a lot. It is safe to say that a large number of your gains will go to regularly updating your system, which might even face a mechanical failure.

- Over-optimization

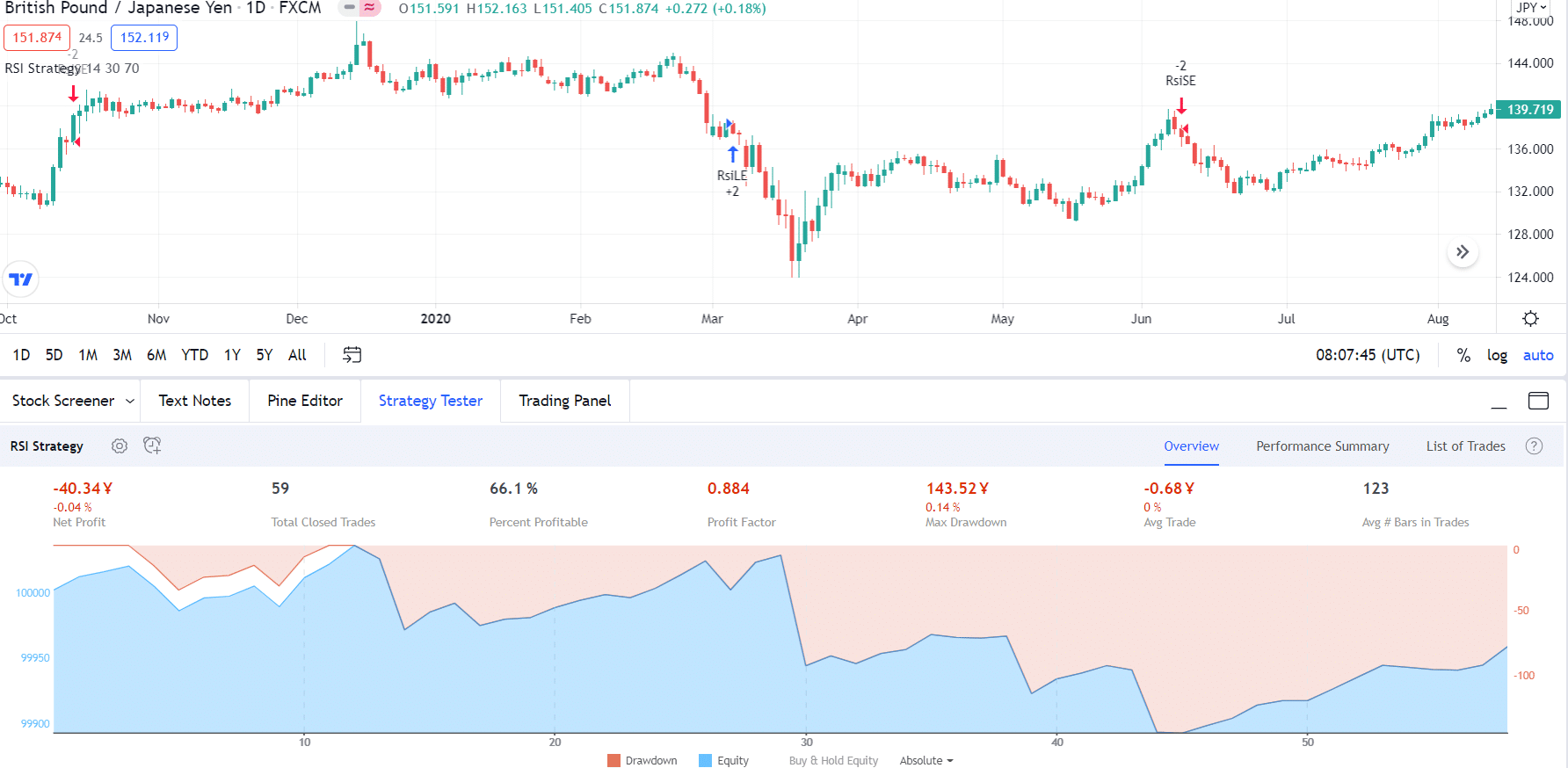

Sometimes traders end up creating systems that look good in theory but perform poorly in the practical market. For example, over-optimization means excessive curve-fitting that yields a strategy that does not fit the market behavior and results in a failure in live trading.

Thus over-perfection results in unrealistic strategies that are not applicable in the business practically. For example, the RSI strategy shows promising results in the chart below. However, live trading results may significantly differ.

Combination or standalone mode?

Both the systems have their gains and flaws. Therefore, it is advised to use both methods in synchronization. No one system is perfect on its own. However, the drawbacks of one can be covered using the advantages of the other.

You can benefit from the freedom of improvisation that manual trading provides, but at the same time, you can use the algorithm to set a stop-loss for you, after which the trades are automatically closed.

This will ensure that the rules are followed, and you don’t end up over-trading. So in a way, both the systems should be complementing each other to bear the best possible results.

Final thoughts

Traders who are willing to go with the algorithm system need to hire a reputable company to devise the code for them because scams are pretty common in this regard.

Investors who prefer the manual system should set distinct rules and practice discipline and risk management if they want to succeed.