The NZD/USD pair posted some gains during the week of Aug 09-13. However, the pair could not sustain the gains on Monday and fell below the 0.7000 key support area.

- NZD/USD pair declines as the first case of Covid-19 found in the country.

- Fed tapering and key data are eyed for fresh impetus.

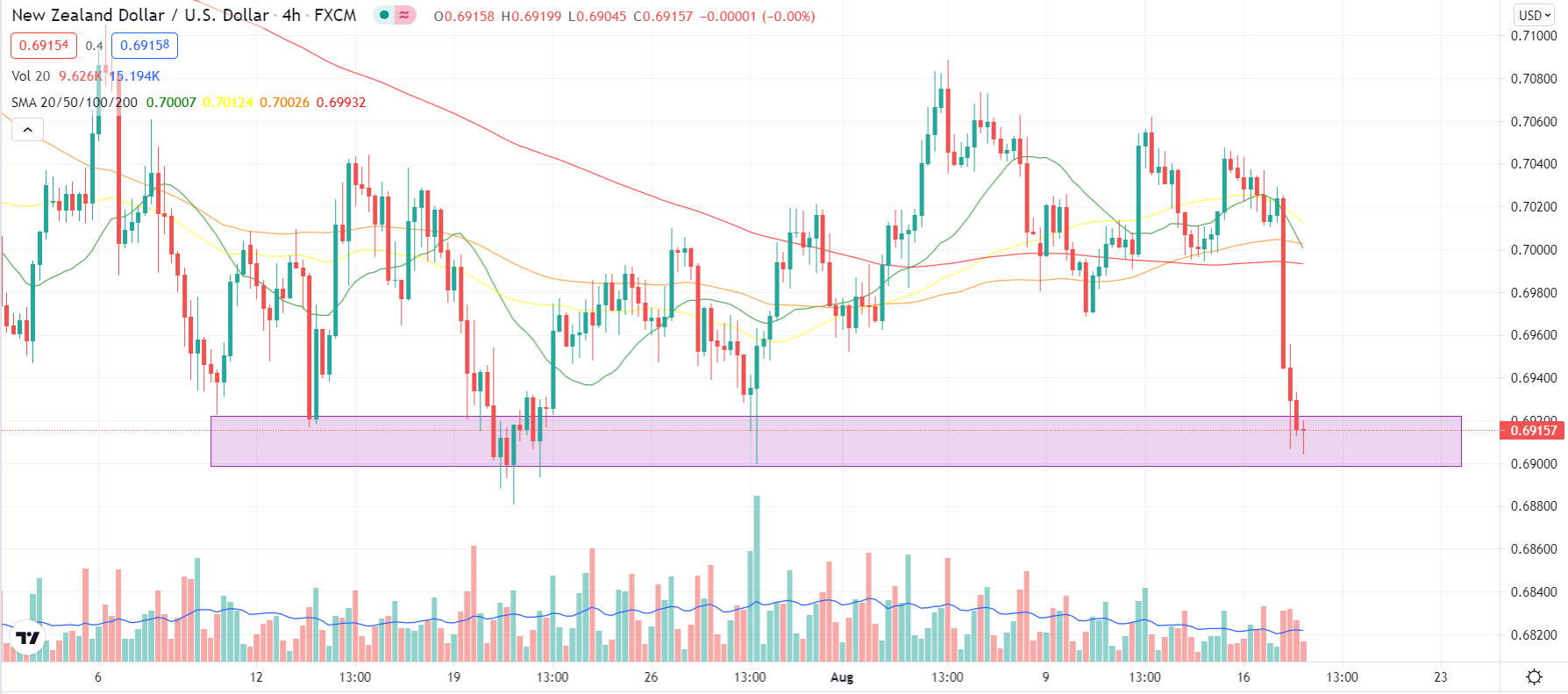

- Technically, the pair remains under clouds near the key support of 0.6900.

NZD/USD fundamental analysis: Covid-19 and RBNZ can weigh on the pair

In the last hour, a nearly 3-week low has been registered in the 0.6907 area as NZD/USD maintained its strongly bearish tone during the earlier European session.

Covid spread in New Zealand

Tuesday afternoon on Aug 17, the pair continued its downward trend from the 0.7050 supply zone and saw strong selling during the first half of trading. As a result of concerns about the rapidly spreading delta variant of Coronavirus, this was the second day of negative movement.

On Monday, disappointing macroeconomic data from China added to market worries about the economic impact of the steadily rising number of Covid-19 cases. Along with other factors, the situation in Afghanistan has affected global risk sentiment, benefiting the US dollar as a safe haven.

New Zealand Prime Minister Jacinda Ardern announced a three-day nationwide lockdown amid the Auckland incident, increasing pressure on the Kiwi. This was also one of the factors contributing to the sharp decline in the NZD/USD pair on Monday.

RBNZ rate decision

The NZD/USD pair was under downward pressure around the horizontal support at 0.6977-70, and some trading stops were required around this area. This is because RBNZ’s policy decision on Wednesday could create the conditions for a price decline.

US data front

In the meantime, traders will be guided by Tuesday’s US retail sales data and Fed Chairman Jerome Powell’s speech later in the US session. In addition, the minutes from Wednesday’s FOMC meeting will also influence the direction of the NZD/USD pair.

The retail sales figures hold much importance because they reveal the consumer spending habits and their sentiment that expose the economic activity in the country. If the figures beat expectations, it will lend more support to the greenback. Contrarily, if the figures miss expectations, we can see some downside retracement in the USD.

Fed tapering talks

The Fed officials are expected to outline their plan of cutting asset purchase programs in the Jackson Hole Symposium on Aug 26-28. If the Fed talks about tapering, it will provide additional strength to the USD across the board. However, riskier assets like the NZD will likely lose more on the way.

NZD/USD technical analysis: 0.6900 holdings as crucial support

The NZD/USD technical picture is quite bearish as the price took a dip of more than 100 pips on Tuesday, Aug 17. However, the price has found some support near the demand zone around the 0.6900 handle.

This is a solid bearish rejection point proven over the past several weeks. The 4-hour chart shows minor support for the pair. However, the key moving averages are way above the current price, and all the key SMAs are pointing downwards.

The volume is relatively high over the past few 4-hour bars. It indicates that the price may remain under bearish pressure for the whole week. Thus, any upside retracement can be taken off as an opportunity to sell.