Stenvall Mark III uses a hybrid method of approach to ensure maximum profits and low risk. It is the third generation Stenvall EA that is suitable for long-term investment as per the developer, Gennady Sergienko. It is also appropriate for use in trust management accounts.

Gennady Sergienko is the developer of this FX EA. He is based in Russia and has more than 5 years of experience in developing FX trading tools. He has made 7 products and one signal. Other products he has created include North Star, Alexis Stenvall, Ruxzo, and Franc Pacific. For support, the author provides a Telegram channel link and the messaging option on the MQL5 site.

This FX EA is available for $980. A rental package costing $399 for one year is also present. The developer offers a free demo account. There are no further details on the features available with the package. No refund is offered for the product which makes us suspect its reliability.

Key features

As per the author, the main features of this FX EA that set it apart from its competitors are:

- The performance of the EA has been confirmed by testing its strategy for many years.

- It does not use rollover trading at 0:00 hours.

- It is not sensitive to spread, broker, and requotes.

- It does not use dangerous methods like grid or Martingale.

- It uses true algo-trading and trades 24 hours per day.

- The MT5 tool uses complex wave analysis and a long hold of trading positions.

- An SL is present for each position.

- 76 functions are present for use in this automated system.

- An average TP of 150 pips is present with the average load on the deposit being 5%.

- It works on the EURUSD pair with the M5 timeframe.

Stenvall Mark III trading approach

As per the developer, the initial Stenvall system used the night scalping method but later improvements were made to the strategy and it began trading 24 hours a day with accuracy increased to 70%. It uses the trend and counter trend approaches for effective trading.

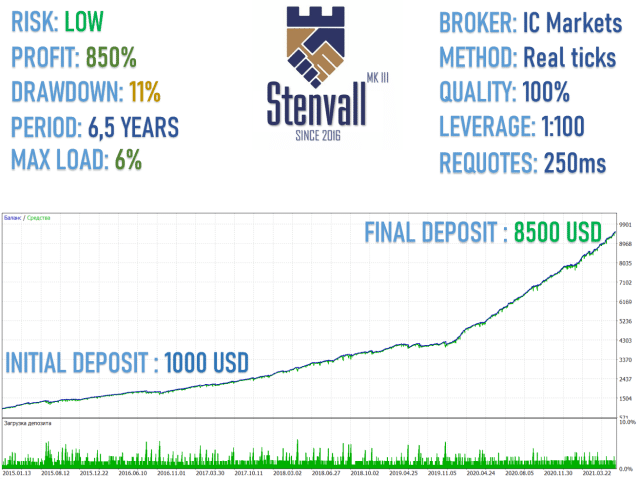

Backtesting results

A couple of backtests are present on the MQL5 site with low and high-risk settings. Shown above are the backtesting results for the low-risk setting. From the stats provided, we find that the drawdown was low at 11% for the initial deposit of $1000. A profit of 850% was generated by the EA using the leverage of 1:100 and the ‘real ticks’ method on the IC Markets broker. We find the profits are high and the drawdown low indicating a decent performance.

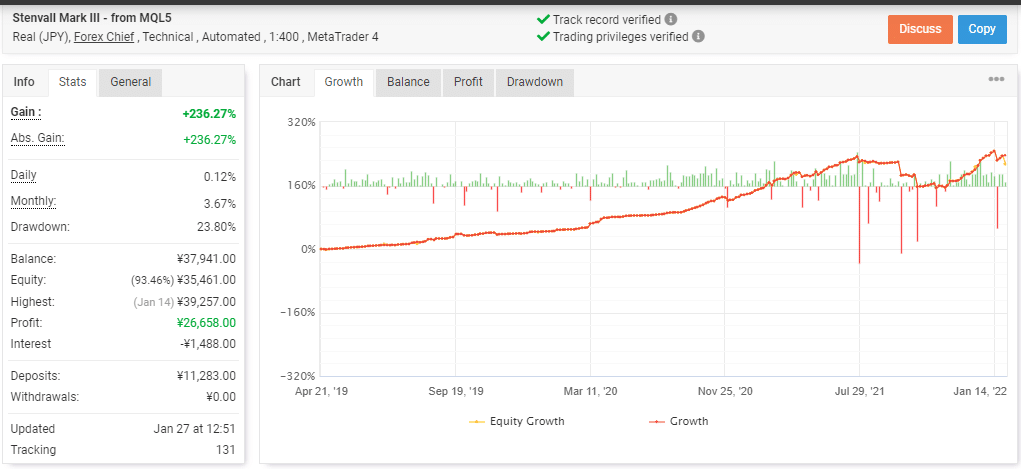

Stenvall Mark III live trading results

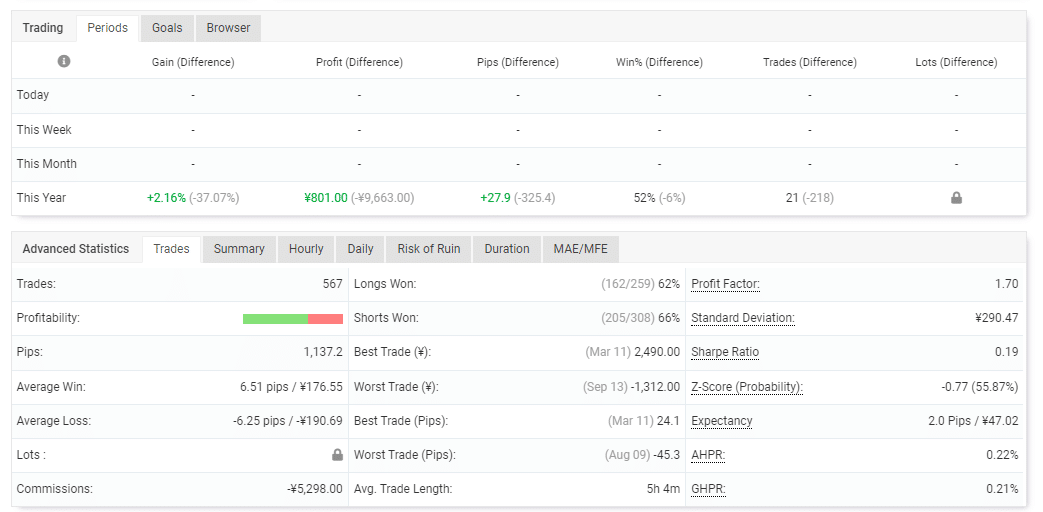

The developer provides a real JPY account verified by the Myfxbook site. Here are a few screenshots of the trading stats for the account using the leverage of 1:400 on the MT4 platform.

From the above stats, we can see the total return for the account is 236.27% and the absolute profit is of similar value. The daily and monthly profits are 0.12% and 3.67% respectively. A drawdown of 23.80 % is present for the account that started in April 2019.

For a deposit of ¥11,283, the account has completed 567 trades with 65% profitability and a profit factor of 1.70. The information on the lots is hidden by the user which looks suspicious. Further, the drawdown is more than 20% which most traders would not feel comfortable with. When compared to the backtesting results, we find the drawdown is higher and profits are lower in real trading.

What are the risks with Stenvall Mark III?

Here are some important factors that can influence your decision on the reliability of this trading system:

- Real trading results show a marginally high drawdown and hidden data that makes us suspicious of the results.

- The pricing is exorbitant and much higher than the market average. Further, there is no refund offered which does not speak highly of the system’s reliability.

Worth noting!

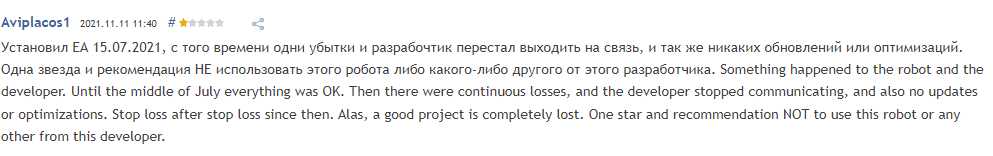

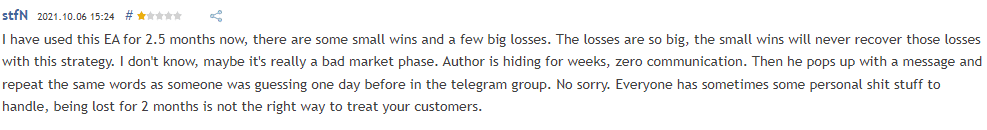

We found 20 reviews for this FX EA on the MQL5 site with a rating of 1.89/5. Here are a few of the reviews from users:

From the above feedback, it is clear that the users are not happy with the EA. They complain of heavy and continuous losses.

What are the pros & cons of investing in Stenvall Mark III?

| Pros | Cons |

| Verified trading results | Hidden data and high drawdown in real trading results |

| A fully automated system | No money-back-guarantee |

| Pricing is expensive |

Although the author provides backtesting results and real trading stats, we find the hidden data and marginally high drawdown suspicious. Furthermore, the pricing is also expensive.

Stenvall Mark III Conclusion

Stenvall Mark III promises a stable system that is ideal for long-term investment. Our assessment of the trading results shows that while the profits look decent, the hidden data on the lots and the high drawdown are suspicious. When compared to the market average, we find the pricing is exorbitant and there is no money-back assurance.

-

Features

-

Pricing

-

Strategy

-

Performance

-

Reliability