ABCD pattern is a simple price action pattern that represents a correction in the current momentum. Once the correction is over, traders can jump into the trade immediately. Moreover, this pattern has a higher accuracy rate in a trending market.

However, one of the biggest challenges in the ABCD pattern is to find it correctly. Although it is a correction of a major trend, you can not consider every correction as an ABCD correction. They might seem the same, but they might lead you in the wrong direction without a proper formation with Fibonacci numbers.

If you are interested in building your trading career in crypto trading, you should know how this pattern forms and open trade in short-term and long-term trading.

What is the ABCD pattern?

One of the harmonic price patterns works as a trend continuation system for both bulls and bears. In crypto trading, using the ABCD pattern would be an excellent tool to buy an asset.

If you are interested in buying a cryptocurrency, you cannot rely on hope alone. Buying a financial instrument needs additional attention with proper risk management. For the cryptocurrency market, this attention is more important as it is the most volatile marketplace in the world. Therefore, using the ABCD pattern, investors can find the major trend reversal area that will allow them to find the more precise entry point.

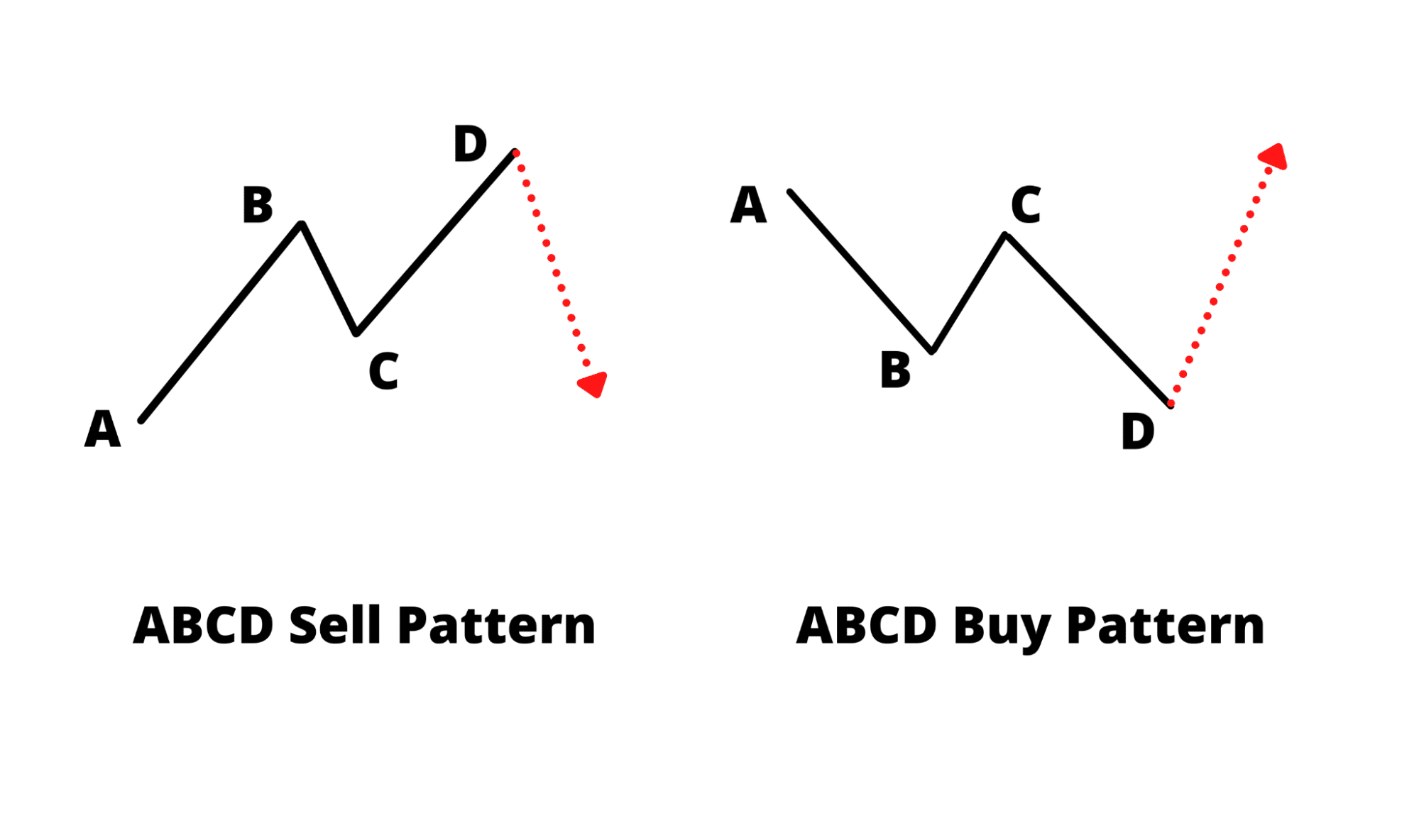

The ABCD pattern comes with the basic trend trading concept where an impulsive pressure comes after a correction, and a correction comes after an impulsive. Therefore, the basic approach of the ABCD pattern is to find when the correction is over, and the major trend is likely to continue.

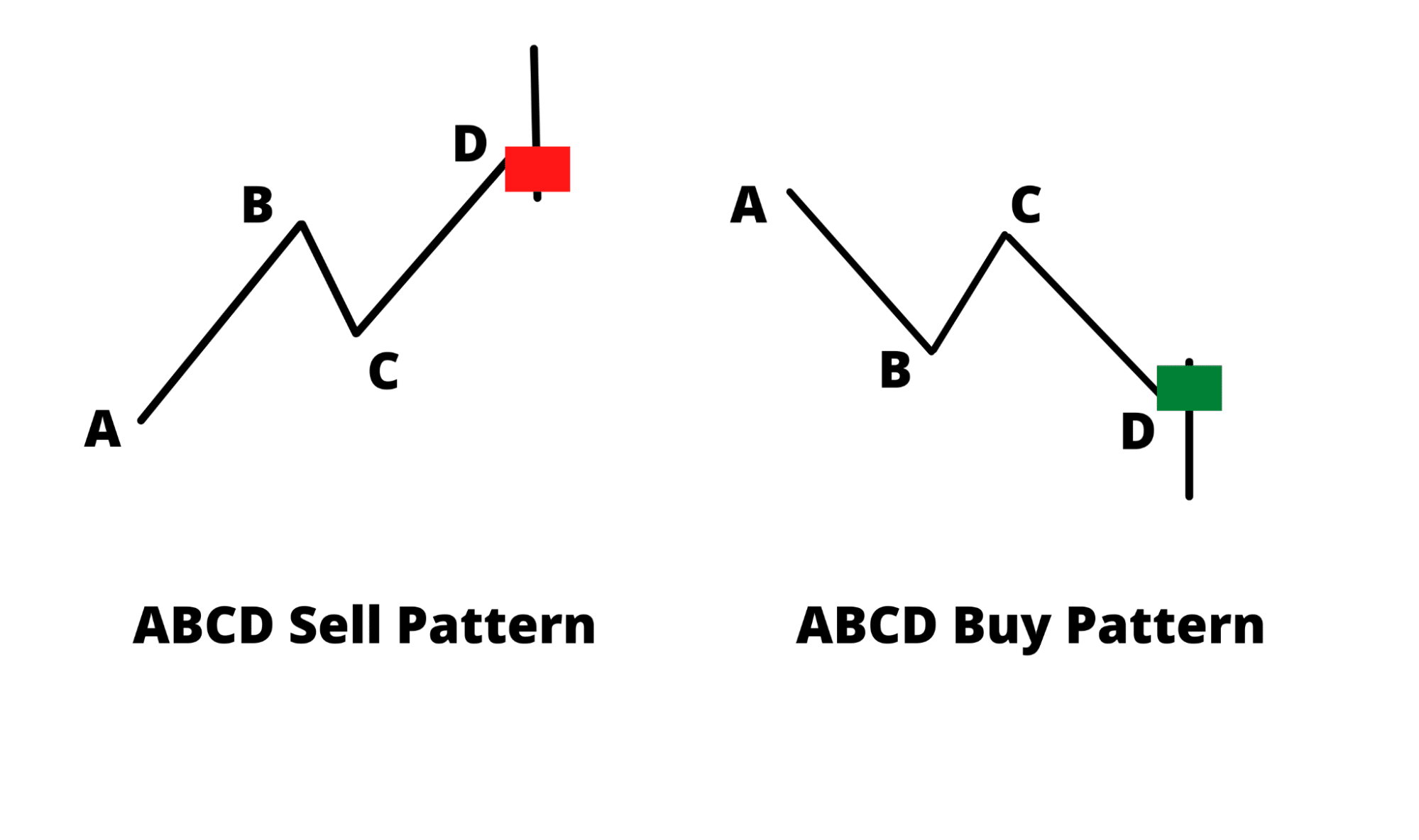

The above image shows what the ABCD pattern looks like. In this pattern, the length of AB and CD should remain the same where BC is the correction of AB. The ABCD pattern is valid until point C is moving below or above 50% of the AB. However, the ABCD pattern becomes tradable once it reaches point D and shows a strong reversal candlestick formation like the image below.

How to identify the ABCD pattern?

As it is a reversal pattern, it will appear at the bottom or top of a swing. The ABCD buy pattern will appear in a downward market and indicate that the price is likely to rise. On the other hand, the ABCD sell pattern should appear at the top of a trend and indicate a bearish pressure.

Therefore, to identify the ABCD pattern, investors should find it in the opposite direction of the price. Later on, make sure to confirm the length of these swings within the pattern. AB and CD should be the same, where BC should be within the AB in a corrective nature.

Later on, once the price reaches the D point and shows price reversal candlestick, the pattern becomes valid. However, traders should consider where the major trend is heading and how the fundamental news is coming.

A short-term strategy

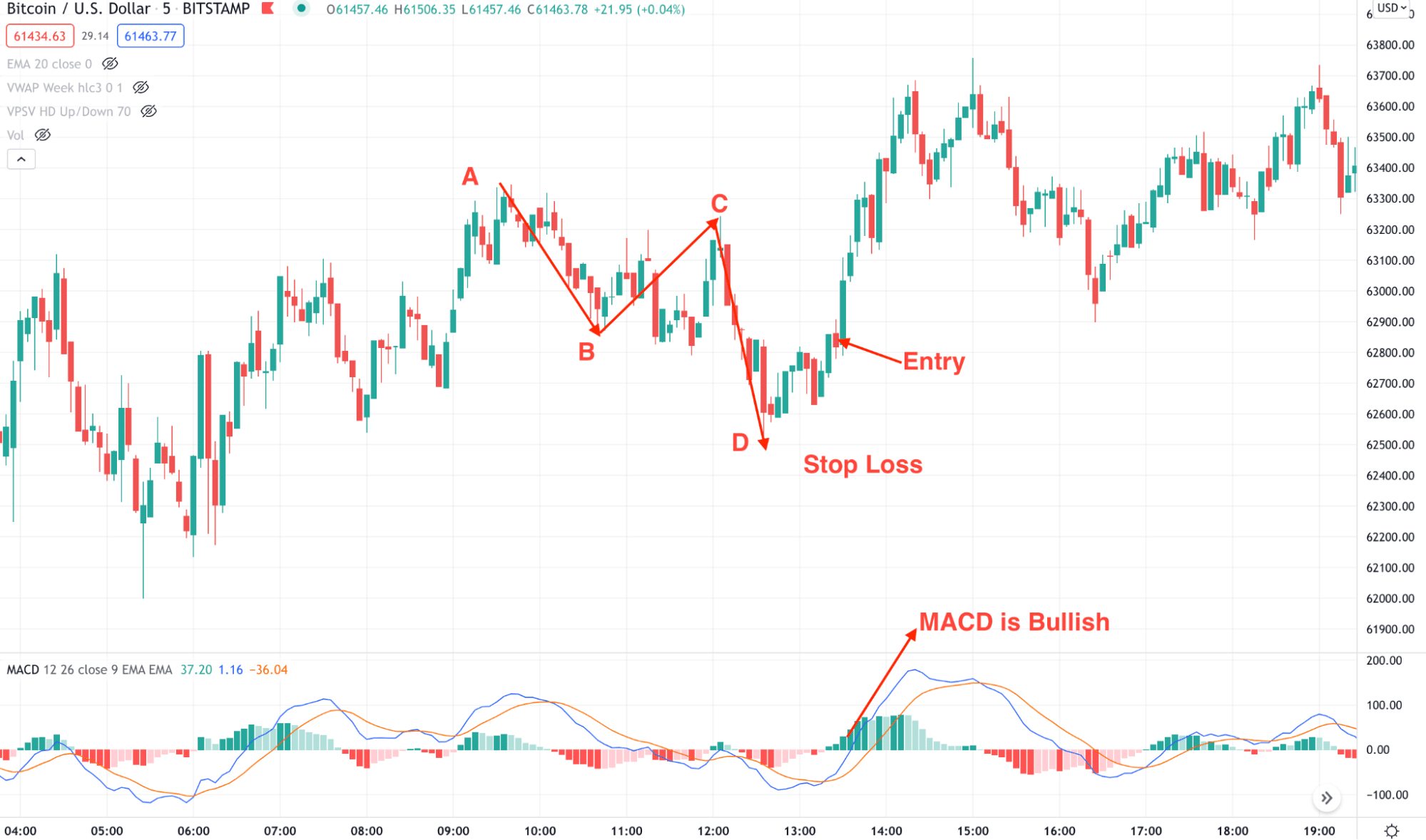

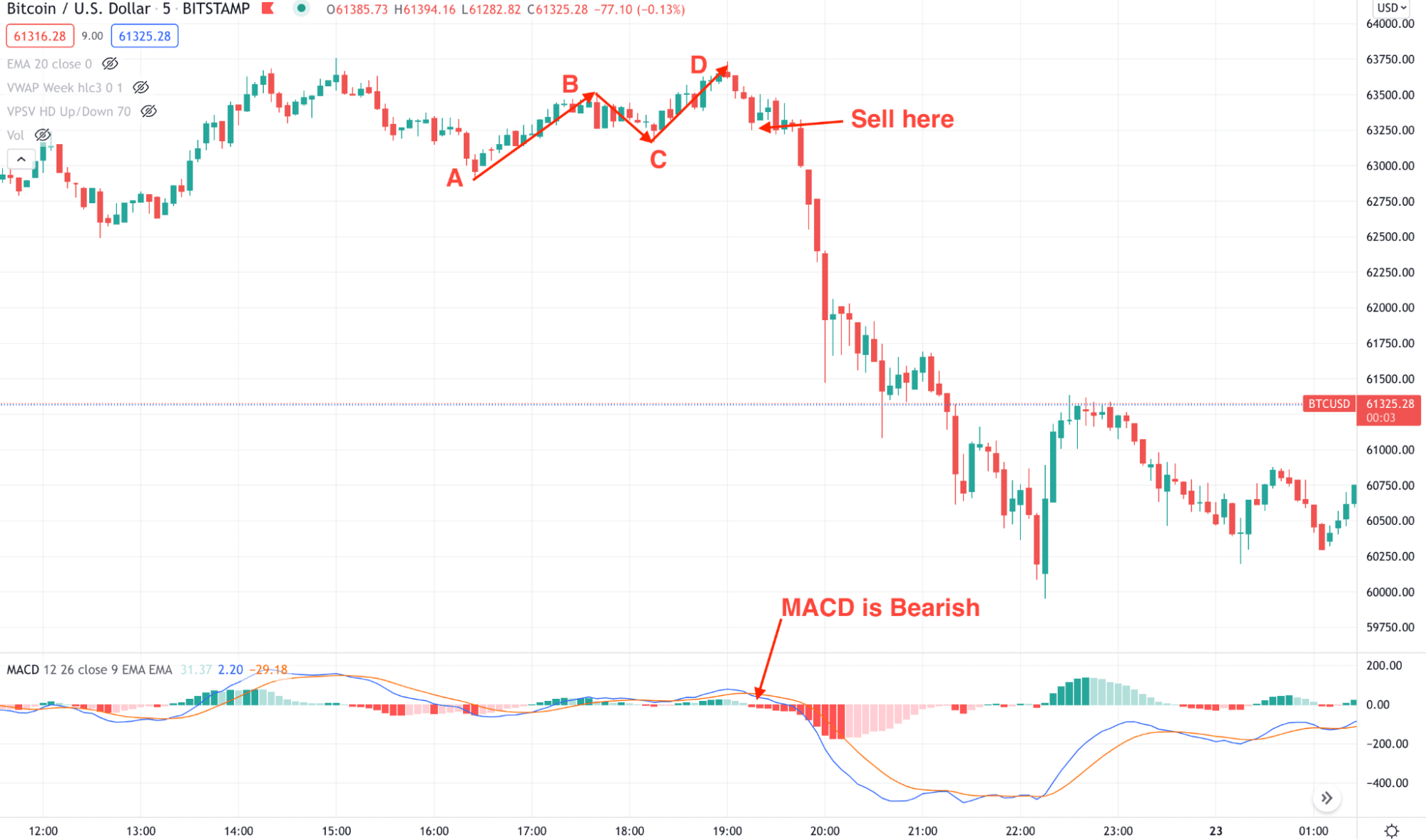

In this section, we will see the intraday buying and selling techniques using the ABCD pattern. This method includes MACD as an additional confirmation of the trade. When the MACD histogram is green, we should buy and red for a sell.

Bullish trade setup

Make sure to find the following confirmation before opening a buy trade:

- The overall market context is bullish, and there is no uncertainty in the price.

- The price is above any significant support level in the higher time frame.

- An ABCD buy pattern appeared in the five minutes chart, after a bullish swing and a bullish reversal candlestick formed at the point D.

- Open a buy trade after the candle closes with the stop loss below it with some buffer.

- Set the primary take profit at the horizontal level from point A and keep the trade active for further gains.

Bearish trade setup

It is the opposite version of the bullish trade, but in crypto trading, this method is applicable on any CFDs:

- The overall market context is bearish, and there is no uncertainty in the price.

- An ABCD sell pattern appeared in the daily or H4 chart after a bearish swing, and a bearish reversal candlestick formed at the point D.

- Open a sell trade after the daily candle closes with the stop loss above it with some buffer.

- Set the primary take profit at the horizontal level from point A and keep the trade active for further gains.

A long-term strategy

It is applicable for investors who are looking for gains by HODLing. However, the bearish trading strategy might provide you with a sign to get out of the market.

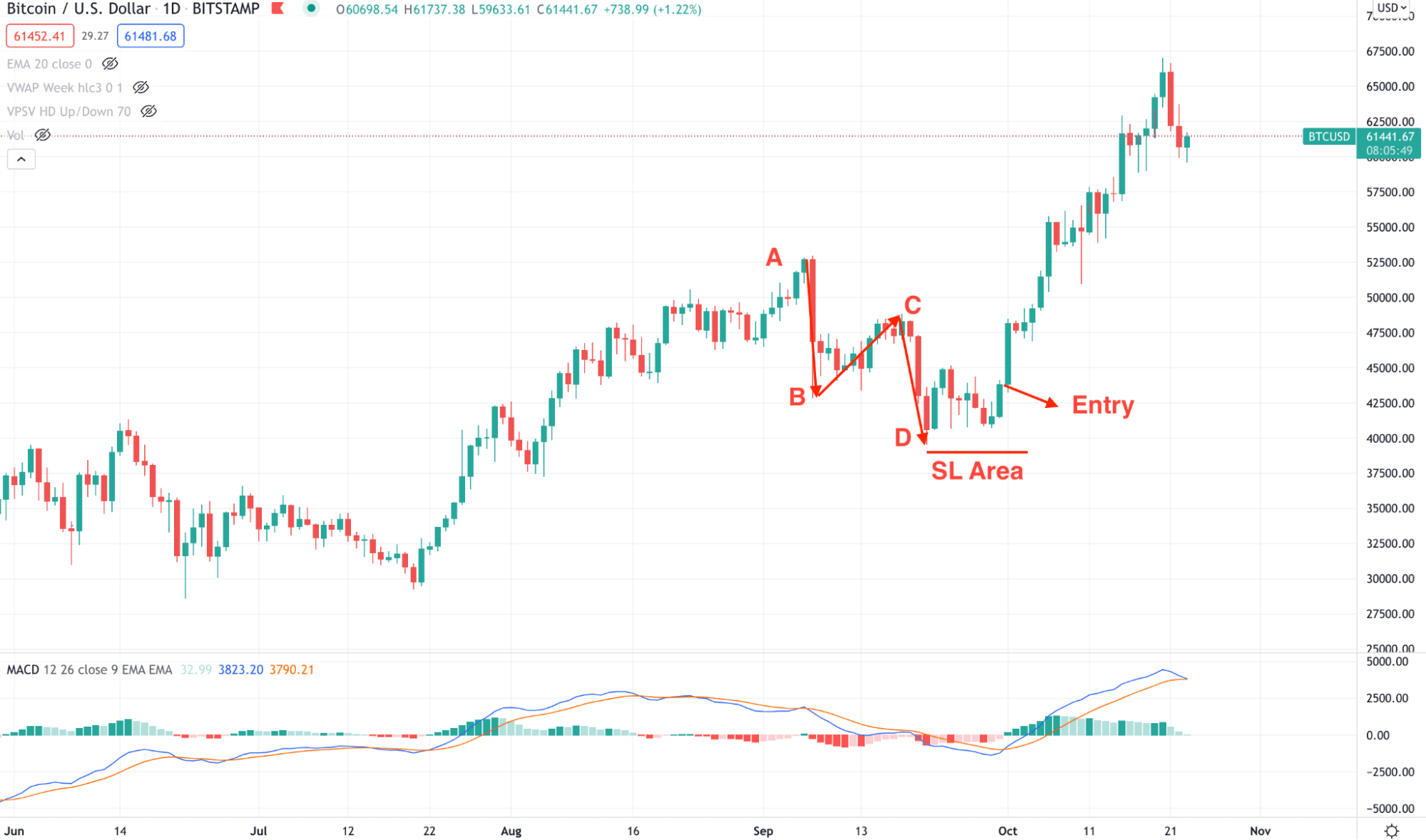

Bullish trade setup

- The overall market context is bullish, and there is no uncertainty in the price.

- An ABCD buy pattern appeared in the daily or H4 chart, after a bullish swing and a bullish reversal candlestick formed at the point D.

- Open a buy trade after the daily candle closes with the stop loss below it with some buffer.

- Set the primary take profit at the horizontal level from point A and keep the trade active for further gains.

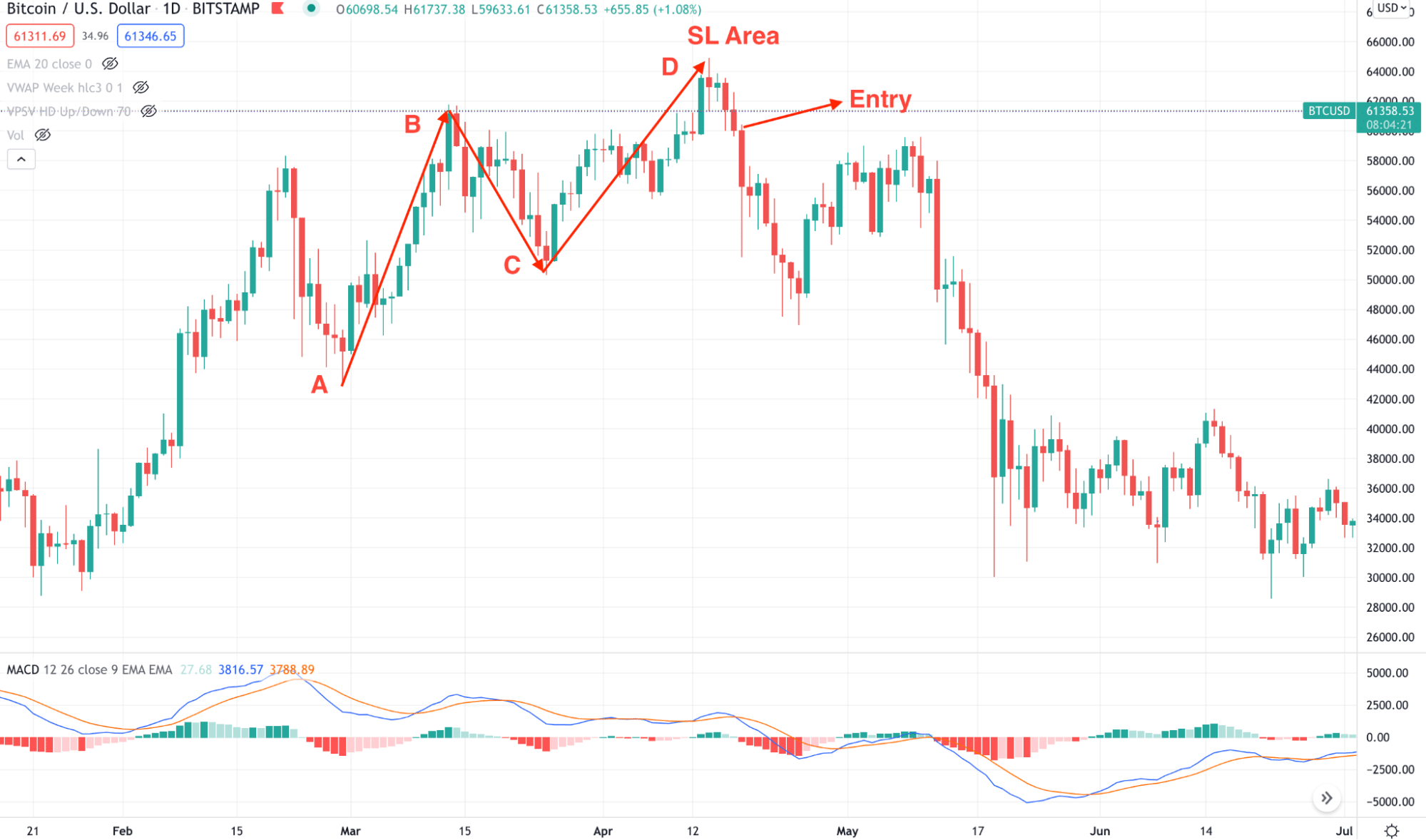

Bearish trade setup

- The overall market context is bearish, and there is no uncertainty in the price.

- An ABCD sell pattern appeared in the daily or H4 chart, after a bearish swing and a bearish reversal candlestick formed at the point D.

- Open a sell trade after the daily candle closes with the stop loss above it with some buffer.

- Set the primary take profit at the horizontal level from point A and keep the trade active for further gains.

Pros & cons

Let’s see the pros and cons of this strategy.

| Pros | Cons |

| ABCD pattern uses the trend trading concept that makes it applicable to any crypto asset. | ABCD pattern cannot produce high-quality trades, so traders need to use other confirmations from candlesticks, oscillators, etc. |

| This pattern is applicable in any time frame from one minute to weekly. | The accuracy of this strategy is weak in a lower time frame. |

| The risk and reward level is affordable. | This method may provide false signals in the volatile market. |

Final thoughts

Finally, we have seen how to trade any crypto-asset using the ABCD pattern. Remember that the cryptocurrency market is highly volatile, with 30% to 50% daily price changes. Therefore, investors should remain cautious about the market uncertainty. Make sure to use a stop loss in every trade to avoid unusual market movement.