Commodities are the primary elements or raw materials in the trading sectors. Since the beginning of history, people have exchanged goods of their possession with goods of their desire. Now it has become easier with the availability of technology and the concept of trading. People have been exchanging goods and services with money, and trading commodities have also become easier.

In ancient times, trading commodities was a matter of huge research, investment, and time-consuming. Now you can enjoy trading commodities and make money from the market with little investment, sufficient research and transection occur by some simple clicks. Trading commodities varies from person to person, region to region.

Let’s discuss all the basic concepts about commodity trading for beginners, such as definition, types, CFD trading, and risk factors. This article will guide you to a one-step advance in being a commodity trader.

What are commodities?

They are basically interchangeable goods that you can exchange with another same type of commodity or other. Commodity trading is an essential part of the global economy, as you can call it the primary building block. We use a group of assets or goods essential for daily living or raw materials to produce goods and services you can call a commodity. You can find commodities all around the globe, and these items are derivatives.

The price of commodities may vary from region to region. For example, suppose a region with very positive weather and farming may be an integral part there. Then you can’t neglect that commodity trading such as livestock and corps trading will be a considerable part of that area.

Besides bonds, stocks, real estate, and other financial assets, commodities are also leading investment assets in the financial market. Commodities are fungible items, so you can swap them with each other if the quality remains intact. For example, suppose two mines produce high-quality aluminum. If you are a buyer of mine-grade aluminum, then both will be the same to you. You will seek the quality or purity of the aluminium; it won’t matter who the producer is.

Types of commodities

You can find several types of commodities available worldwide. In general, you can differentiate them into two groups, such as hard and soft commodities. Hard commodities are raw materials that include natural resources or mining products such as gold, oil, aluminum, etc. On the other hand, soft commodities are agriculture or farming products. Soft commodities are prone to spoilage and incline to be seasonal.

For more specifications, you can classify commodities into four groups such as:

- Metal commodities

This group of commodities contains metals such as gold, silver, aluminum, copper, platinum, etc. You can split metal commodities into groups, such as copper, aluminum, industrial metals, gold, and platinum are precious metals, etc.

- Energy commodities

This group of commodities are natural resources or mining productions used to produce energy such as natural gas, crude oil, gasoline, heating oil, etc.

- Livestock commodities

These are in the group of soft commodities. Pork, castles, chickens, etc., are on the list of livestock and meat commodities.

- Agriculture commodities

This group includes agricultural and farming products such as wheat, corn, soybeans, rice, coffee, etc.

There are also some technology commodities available recently such as bandwidth internet, mobile call minutes, etc.

Trading commodities with CFDs

Participants buying and selling commodities in expectation of profit in the marketplace is commodity trading. Two types of commodity trading are available such as spot trading and futures trading. Spot trading involves trading commodities in traditional ways. For example, you buy mine-grade gold from a gold mine.

On the other hand, futures trading involves contracts for difference or CFD trading. This type of trading involves contact between buyer and seller of any specific asset. In this case, the buyer pays the seller between the current price and the contact ending price. In most cases, the CFD trading occurs between the trader and the broker. In CFD trading, participants focus on the price changing of the asset, not the actual underlying value of the asset.

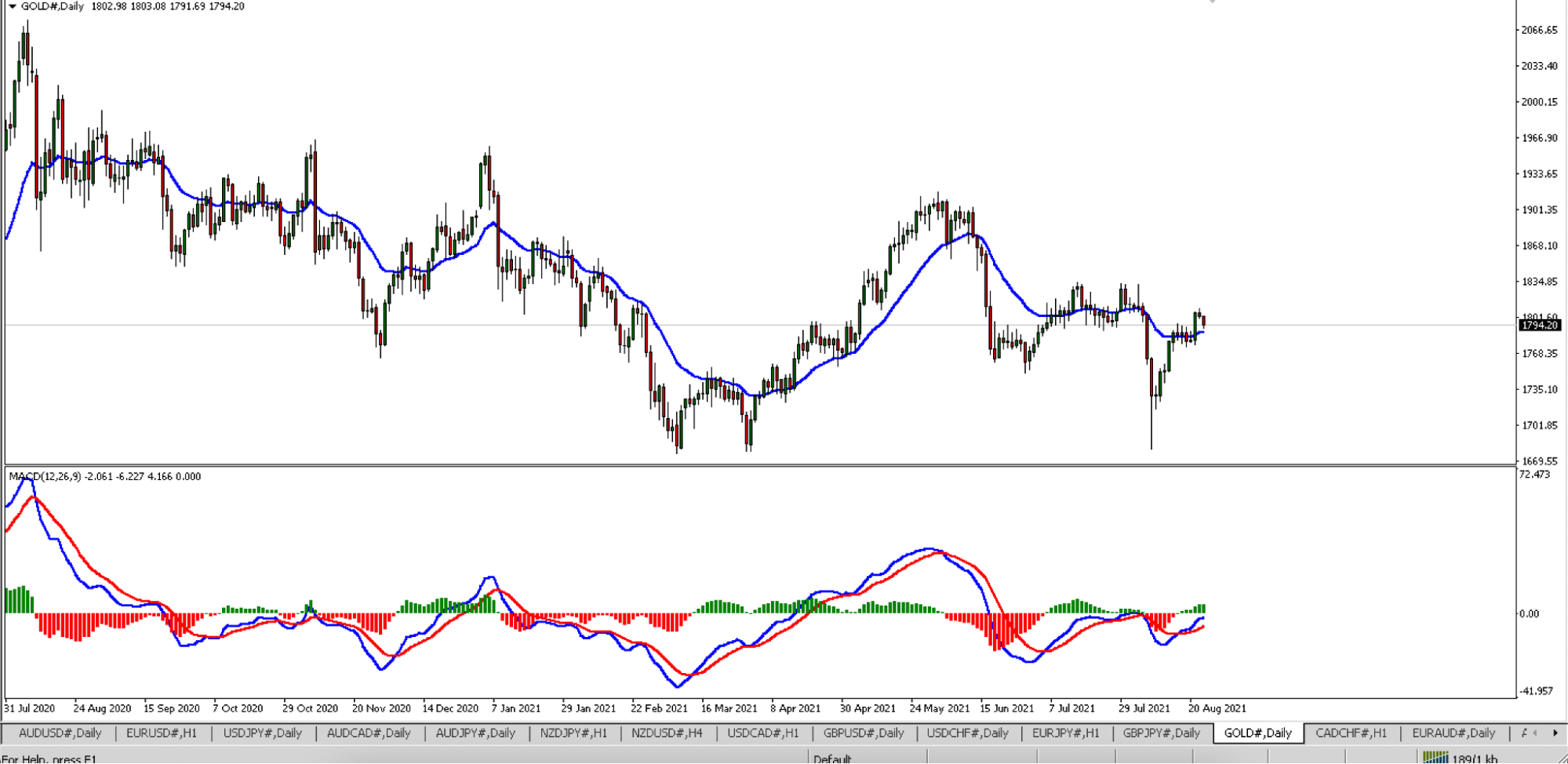

The above image shows an example of gold CFDs trading through the MetaTrader 4 platform.

CFD trading allows various features such as leverage, easy execution, hedging, etc. These features make trading commodities with CFDs attractive to individuals. Anyone can trade commodities through CFD trading with a small investment and make larger positions through the leverage feature. Additionally, CFD trading allows you to go long and short on the same asset.

Commodity trading with CFDs requires a lower cost in comparison to spot trading. You don’t need to purchase or preserve the actual asset in CFD trading. You can make money from price changes. CFD trading is a very accessible way to trade commodities as you can enter or exit from trades with some simple clicks.

Risks of trading commodities

Although technology makes commodity trading easier and accessible to anyone, it introduces methods like CFD trading. So individuals get huge opportunities in the commodity market. There are several risks or limitations involves in commodity trading, such as:

Volatility

Commodities are a highly volatile asset class in the financial market. The price of commodities is very dependable on the supply-demand factor. Prices can double quickly in commodities with increasing demand.

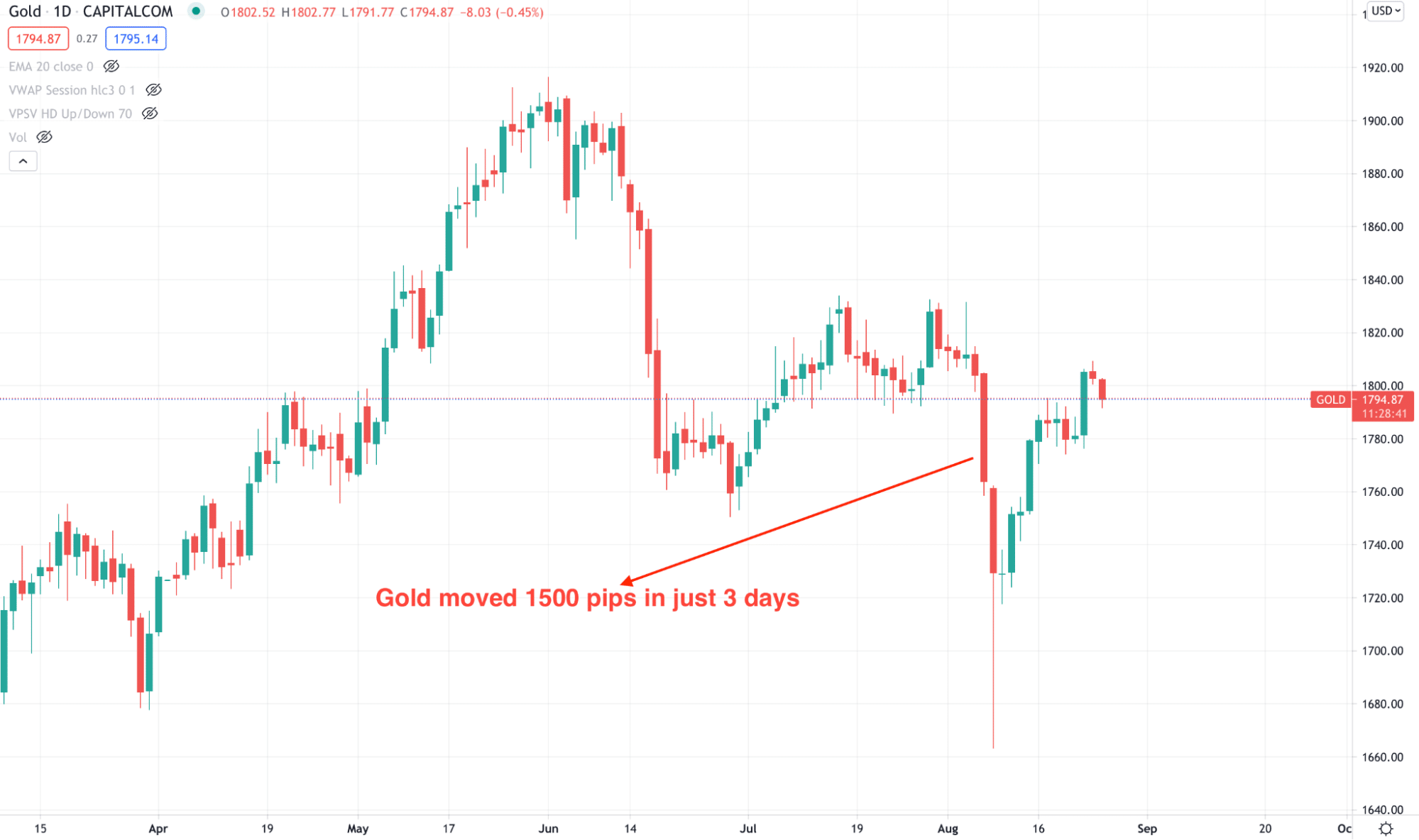

The above image is the perfect example of how volatile the commodity market is. Gold crashed from 1813 to 1662 level in just three days, while the hawkish tone came from the Fed after the post-pandemic recovery of the US economy. However, the volatility became extreme once the price rebounded higher from the collapse.

Leverage

Another risk factor for commodity trading is the leverage feature. Using the leverage feature, you can make larger positions, but you will lose more money if the price movement is against your trading positions. You always need to use margin carefully and make trades carefully to survive for a longer period in this marketplace.

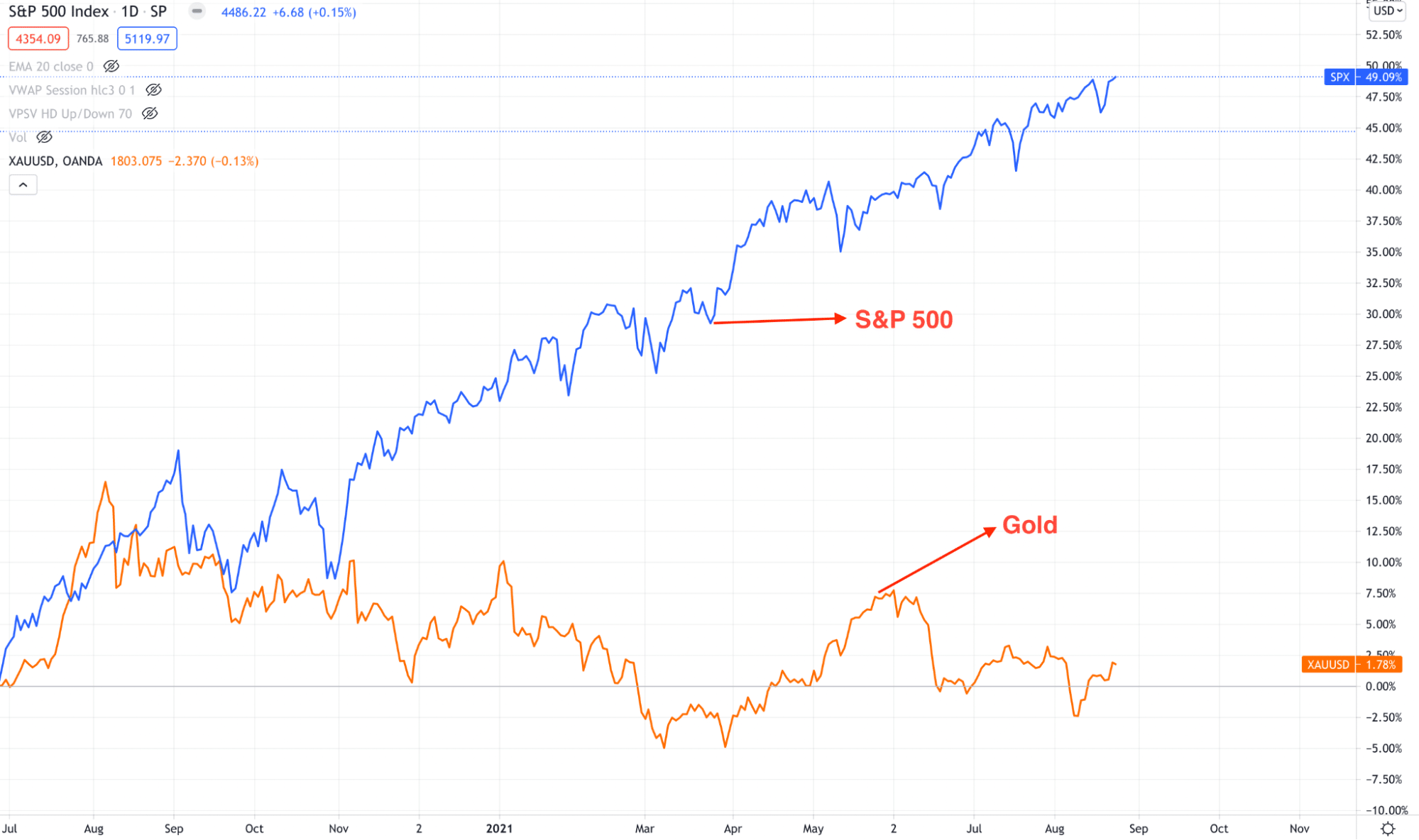

Diversification fact

There is a negative correlation between stock prices and commodity prices. When stock prices go down, commodity prices go up. However, there is no ideal diversification fact. For example, the financial crisis of 2008 shows failure for this theory of diversification.

The above image shows how the Gold and S&P 500 moves in the opposite direction.

Final thoughts

Finally, now you know all the basic facts about commodity trading. It is a very potential market to make money and can be used as an alternative investment option to the other financial assets such as stocks, forex, etc. Alongside many positive features, commodity trading also involves risks. We suggest learning and researching more to gather sufficient knowledge before starting commodity trading.