Candlestick is one of the most effective trading tools in the financial market. It can reliably explain the investor’s activity. However, many people wonder how candlestick works in cryptocurrency markets. If you want to learn and earn crypto coins, you can do it by following candlesticks.

The following section includes everything you should know about cryptocurrency trading using the candlestick. After completing the whole section, you will learn how to earn Bitcoin, Ethereum, and other cryptocurrencies using the candlestick analysis.

What is the crypto candle?

Crypto candle is a process to anticipate the market movement of a particular cryptocurrency using the candlestick analysis. Many people don’t know how to implement this vital trading tool in the cryptocurrency market. They only rely on the project of a particular crypto coin and open trade based on its potentiality. Thanks to the modern world, where technical charts are available on most of the crypto exchanges.

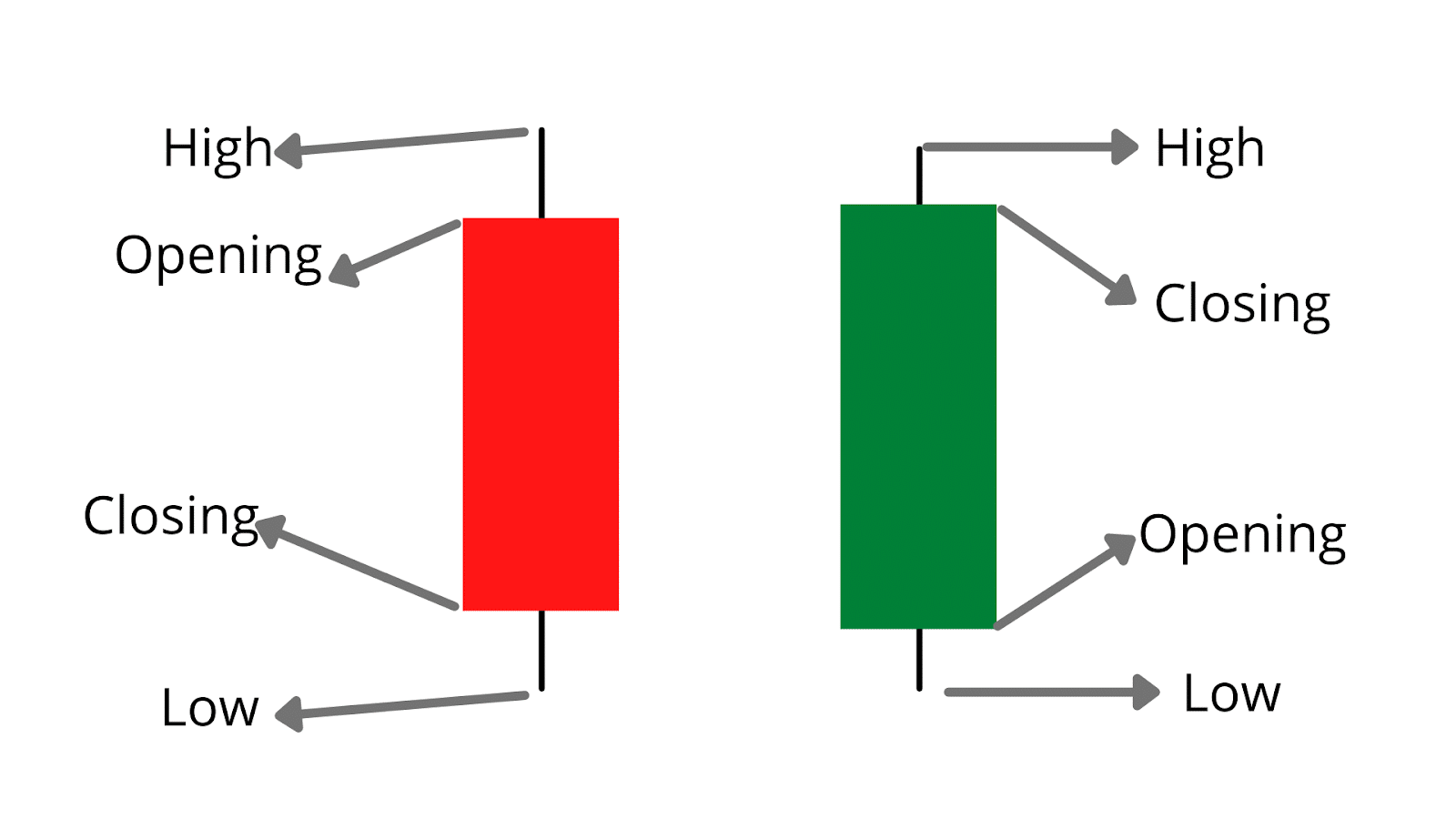

Candlesticks is an old way to find the possible market direction using how bulls and bears impact the market. The four major elements in the crypto candle include:

- Open

- High

- Close

- Low

Let’s see the basic structure of a crypto candle from a simple illustration.

According to the above image, if you find any buying opportunity in a cryptocurrency, make sure to explain the market using candlesticks before opening a trading position. Ask yourself the following questions before proceeding to trade:

- Where is the major trend heading?

- Are bears losing their momentum?

- Are bulls read to take the price higher?

You are ready to open a trade once you can anticipate the price direction using the candlestick analysis.

How to identify the trend using the crypto candle?

Finding the price trend using the candlestick analysis needs additional attention to the market trend in the higher timeframe. In that case, you should know some basic candlestick analysis besides support and resistance.

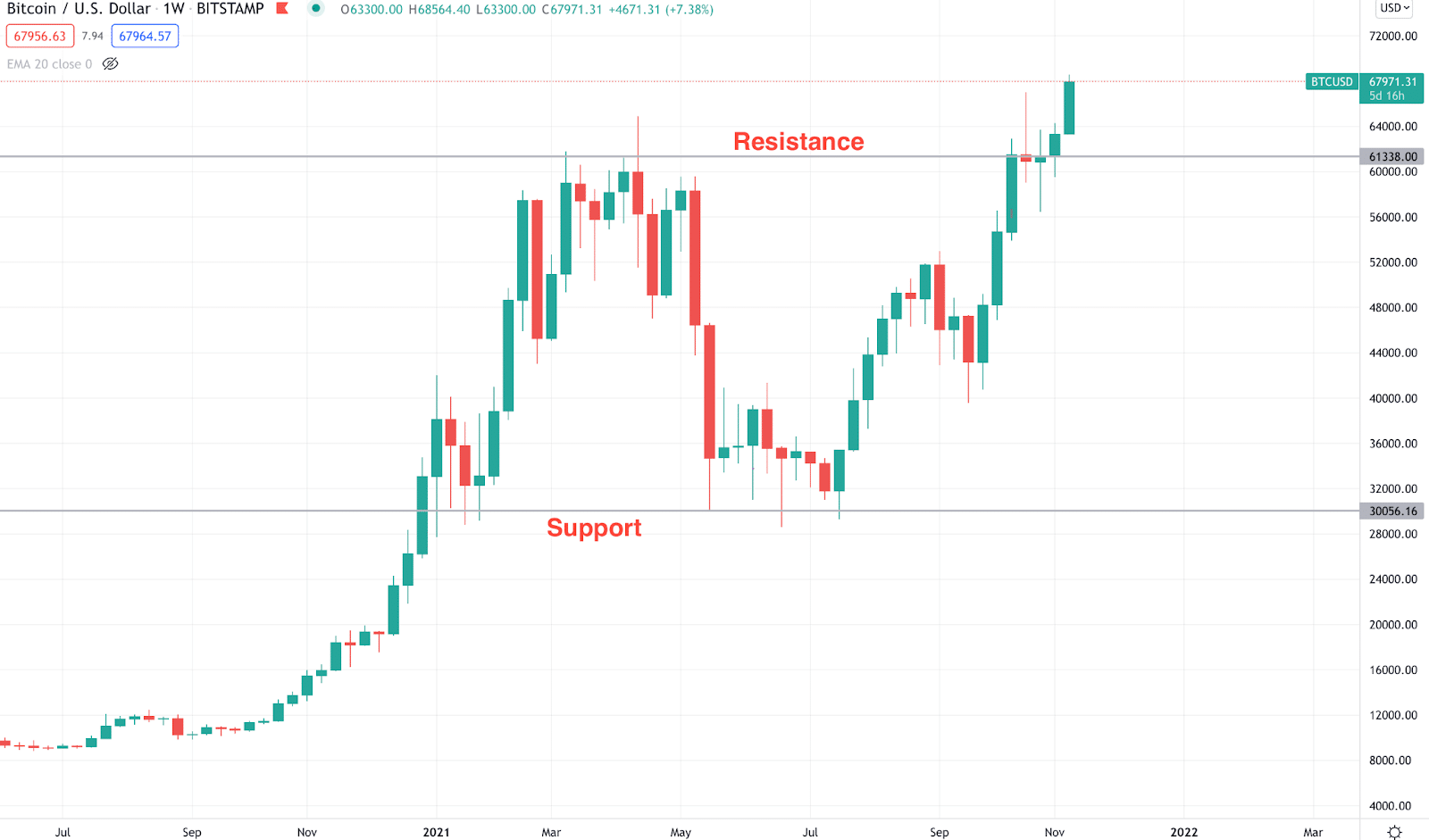

Support and resistance

It is easy to spot in the naked chart. It is a price zone from where a strong price reversal happens. As shown in the image below, you can observe the previous price level and mark support or resistance zones.

Reversal candlestick formation

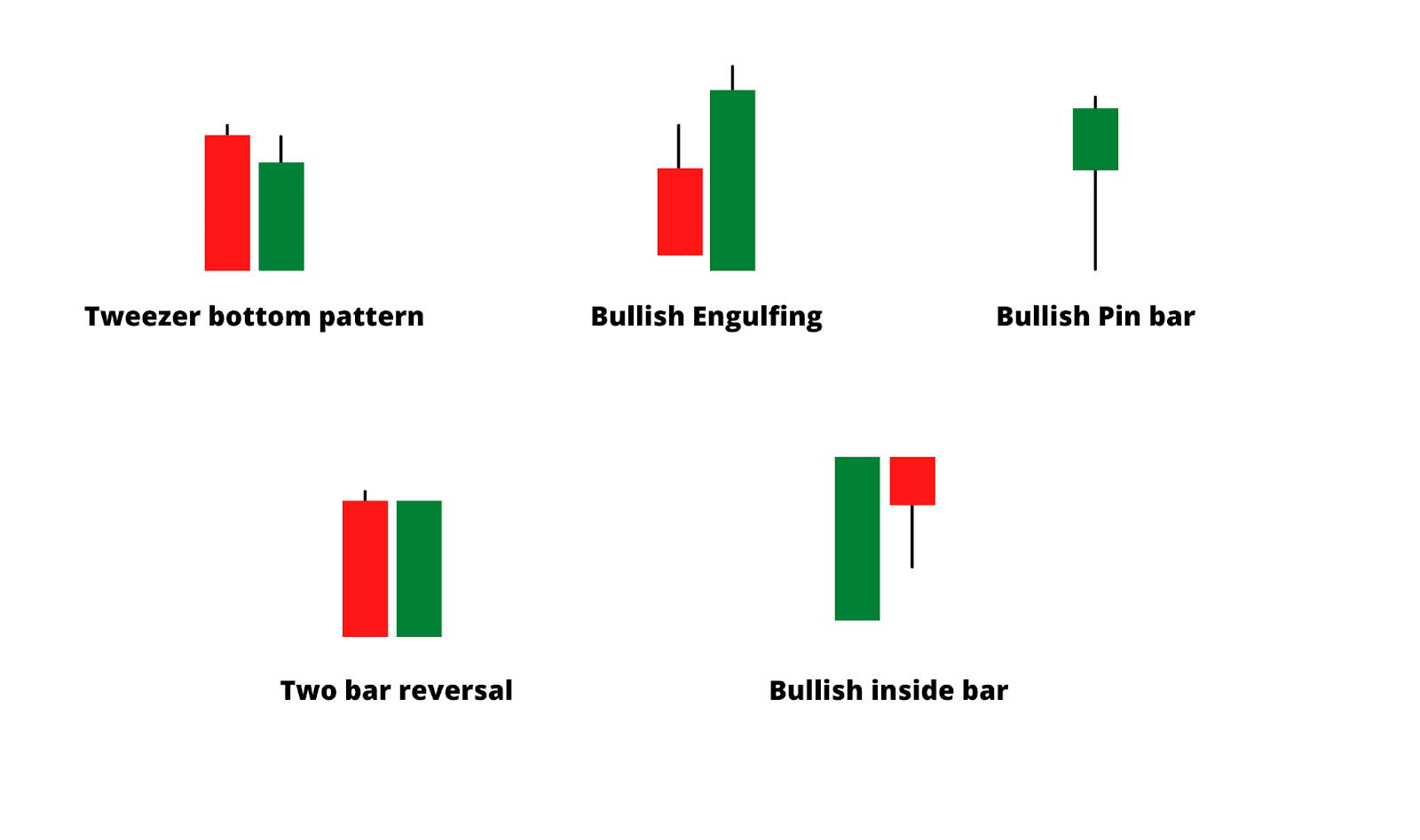

It is an essential part of this method. After finding a vital level, investors should identify a reversal candlestick formation before opening a trade. When you try to buy an asset in the crypto context, make sure to buy it from a support level with a bullish reversal candlestick formation. This method applies to any crypto-asset and on any time frame.

The above image shows the list of bullish reversal candlesticks. There are more with complicated names. You don’t have to memorize the name of all candlesticks. Instead, you can follow any formation that explains bears failure and buyers’ attempts.

A short-term strategy

In this section, we will see a simple candlestick analysis of Bitcoin and Ethereum. As it is a short-term trading system, follow the direction where the long-term traders are heading.

Bullish trade setup

This strategy is suitable for intraday traders and scalpers, but long term HODLers can use this method to find a reliable buying entry.

Make sure to open a trade once the following conditions appear:

- The market is heading up in a higher time frame.

- Price showed an impulsive bullish pressure and is currently on a bearish correction.

- The price moved lower and offered a bullish reversal candlestick from a support zone.

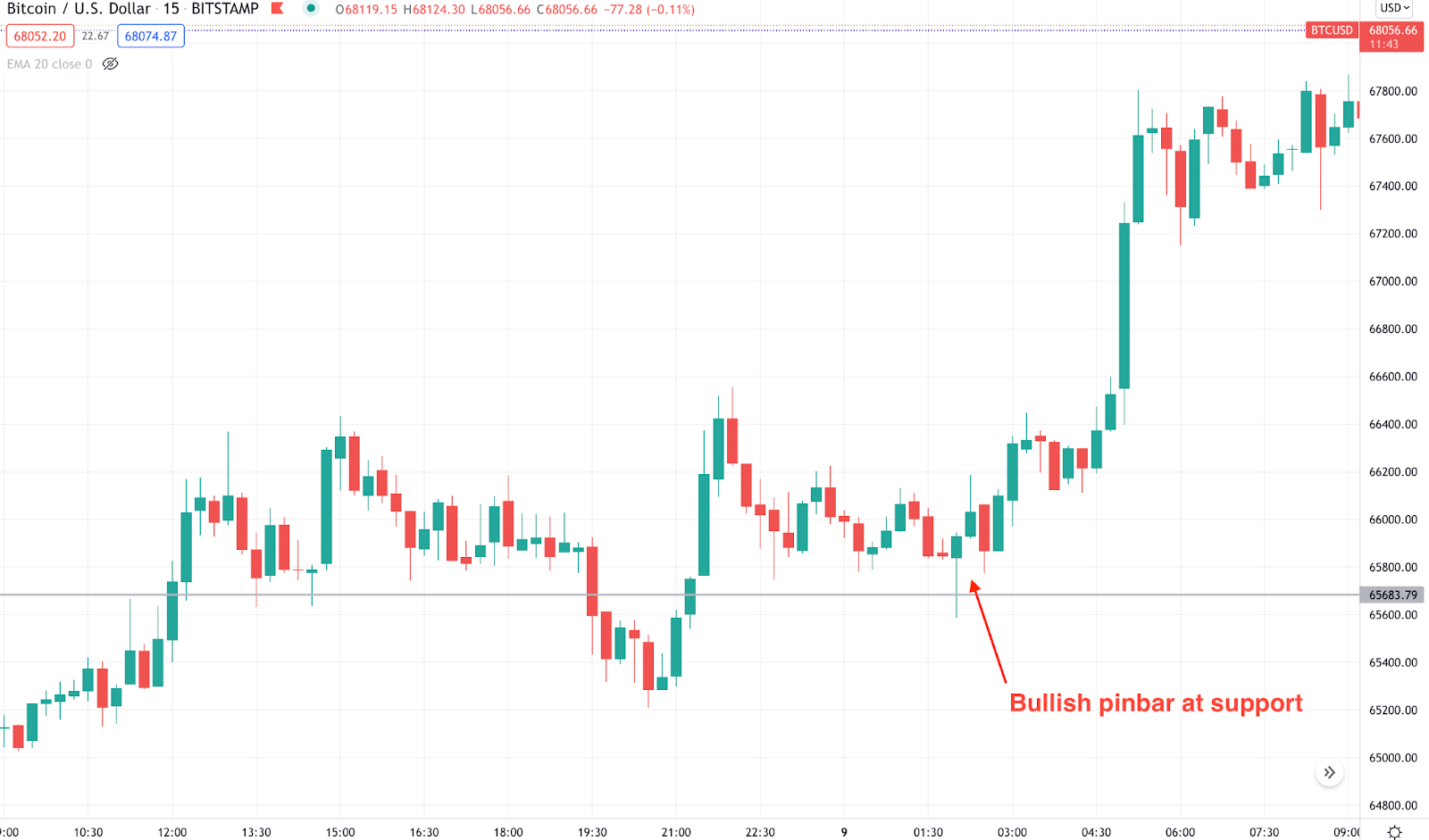

The above image explains how the bullish trade appears in the m15 time frame. The overall market direction is bullish, and the price showed a nice bullish pin bar from the support level before heading up.

Bearish trade setup

It helps traders to get out from the previous buying position. Moreover, you can open sell trades in CFDs using this method.

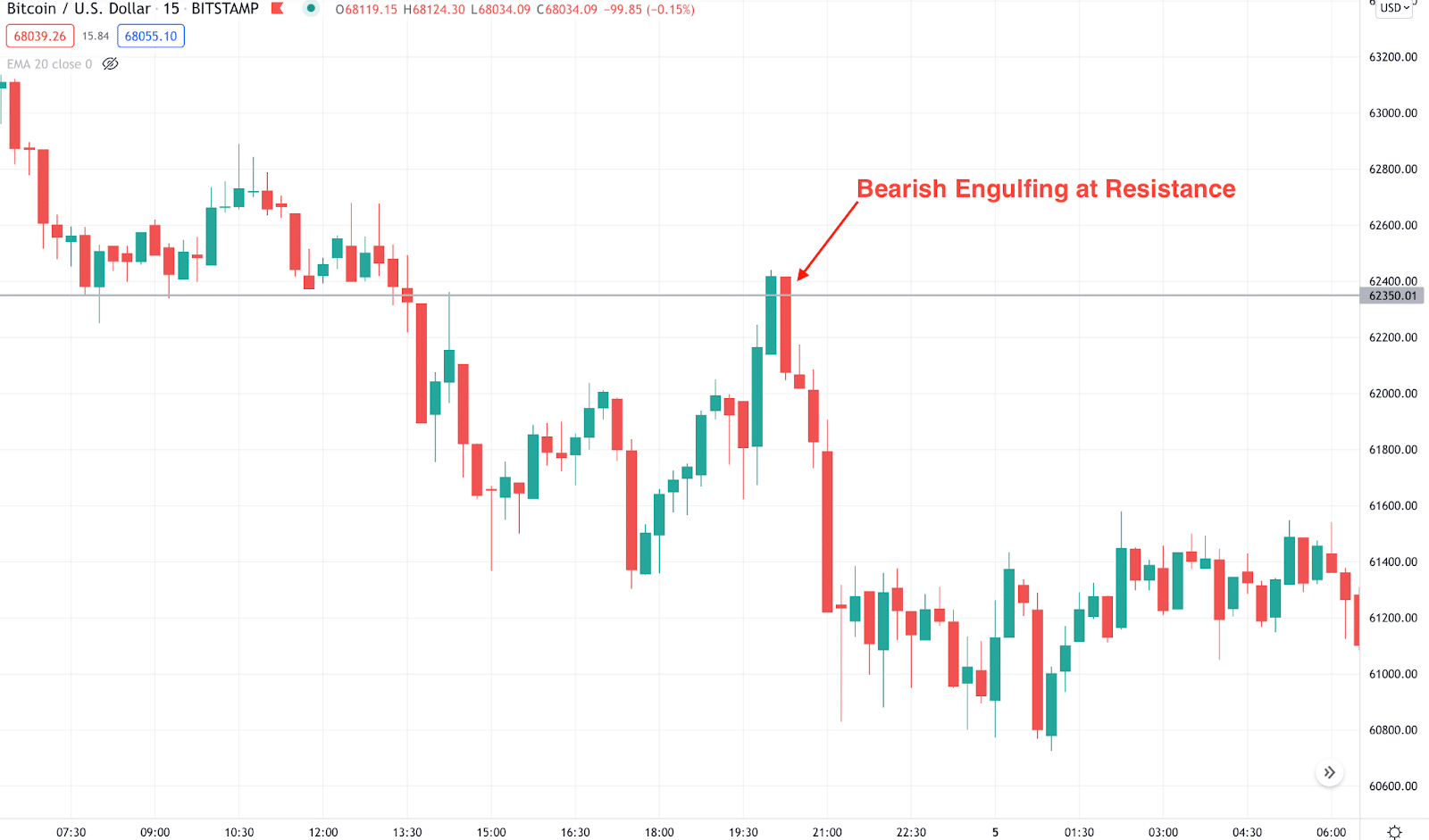

Make sure to open a trade once the following conditions appear:

- The market is heading down in a higher timeframe.

- Price showed an impulsive bearish pressure and is currently on a bullish correction.

- The price moved higher and showed a bearish reversal candlestick from a resistance zone.

A long-term strategy

If you want to earn BTC and ETH in the long run, you should invest in a bull market at a discounted price. In that case, find the market trend as bullish and wait for a considerable correction. In any financial need, the price should come down to a strong level before heading up. So there will always be an opportunity to buy with a discount. All we need is patience.

Bullish trade setup

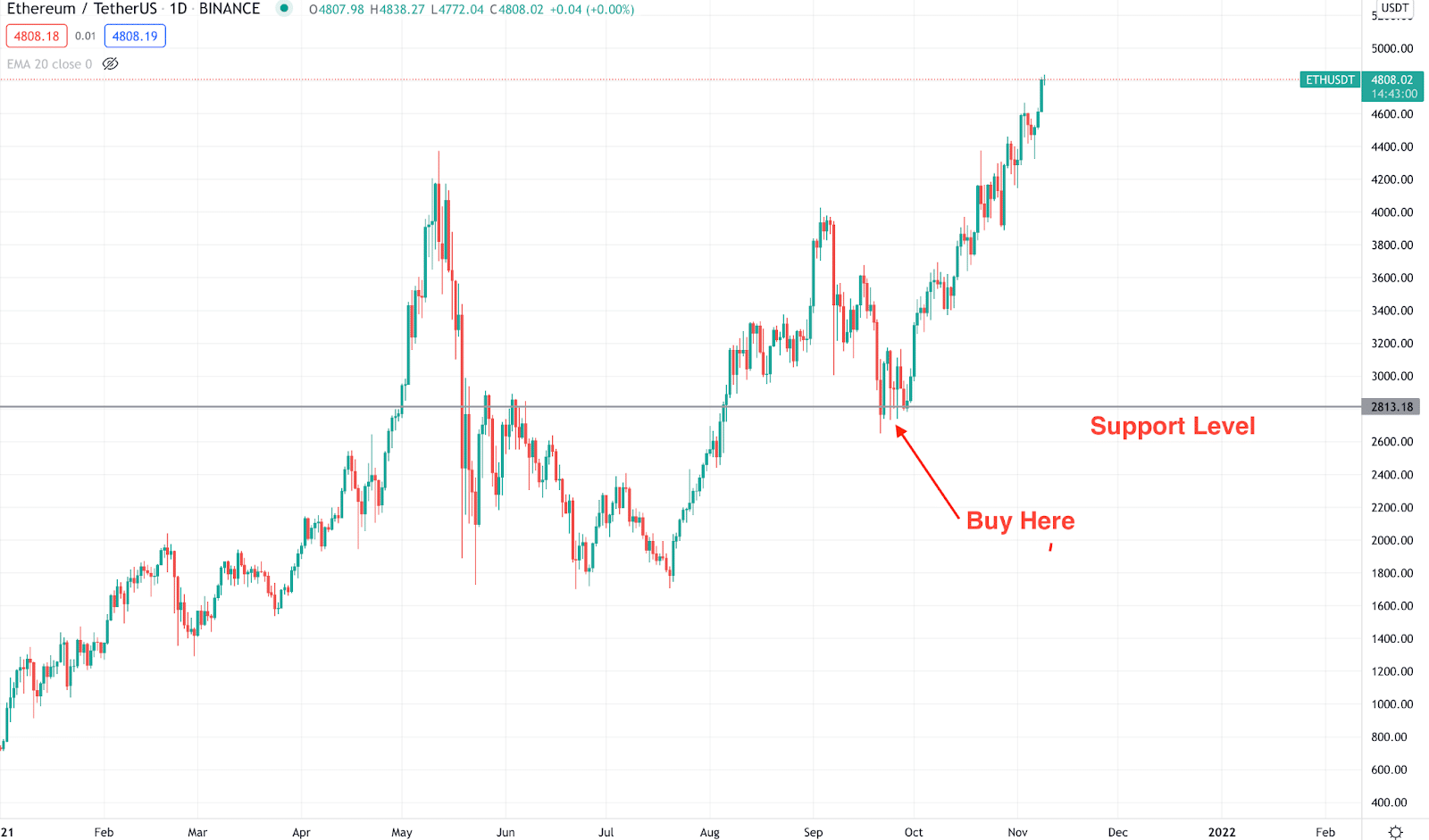

After a sudden bullish movement, the price should come down to a support level and show a bullish reversal candlestick before opening a buy position.

The above image shows how Ethereum provided a decent profit of more than 90% gain with a short stop loss.

Bearish trade setup

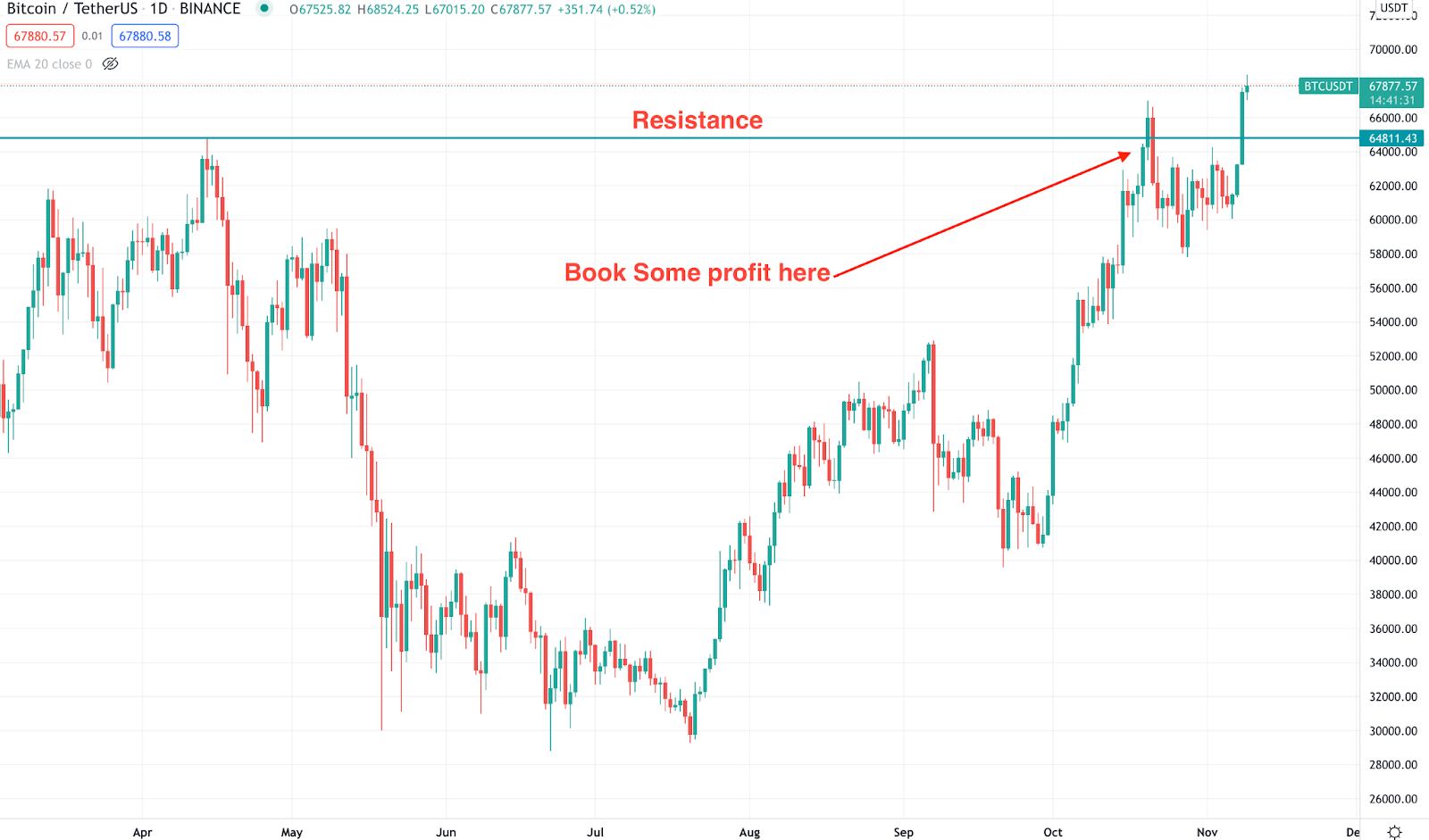

After buying a crypto asset, you can observe the price and book some profit in the spot market if the price reaches any critical resistance level and shows a bearish rejection. However, you can let the profit run for additional gains.

The above image shows that Bitcoin moved to a significant resistance level and delivered a bearish rejection. Therefore, if you are a BTC buyer, you can profit from this area and let the rest of the trade run.

Pros & cons

Let’s see the pros and cons of the crypto candle.

| Pros | Cons |

| Crypto candle eliminates the possibility of HODLing by providing a buying opportunity from a probable high zone. | Crypto candles need additional attention to technical analysis that is often hard for new traders. |

| Candlestick helps traders to find the market trend accurately. | Even if you follow the crypto candle, there is no guarantee of profits. |

| It can show the buying and selling zone. | Investors need to know further confirmations from other methods than candlesticks. |

Final thoughts

Crypto candles can show the most accurate price direction to find a profitable buying position in BTC and ETC. However, the financial market is very volatile where investors need additional attention to trade management. In uncertain market conditions, investors might have to HODL to get a long-term benefit.