Foreximba claims to be a simple system that traders of any experience level can use easily. It works mainly on two currency pairs, namely the AUDUSD and EURUSD pairs. As per the vendor using this automated system will ensure you achieve high returns every time you trade with it.

ForexStore is the company that promotes this FX EA. Other than the mention of the EA being powered by the company there are no details concerning the firm. We could not find details like the founding year, location address, developer info, etc.

For support, an online contact form is present. You can buy this FX EA for $194.99. The package includes a lifetime license for a real account, three demo accounts, friendly support, a user manual, and a 30-day money-back assurance.

Key features

Some of the significant features that the vendor highlights for this FX EA that make it highly competitive are:

- It uses a fixed lot size.

- The ATS does not use the Martingale approach.

- It has a good drawdown control.

- The FX robot is compatible with any broker.

- The AUDUSD and EURUSD are the only pairs the system works on.

We could not find info on the recommendations like the minimal deposit, leverage, timeframe, and other settings.

Foreximba trading approach

The vendor does not disclose the approach used by this FX robot. Instead, there is mention of drawdown control and the use of a fixed lot size. As per the vendor, the Martingale approach is not used by the FX EA. The lack of info on the approach makes it difficult to know the efficacy of the system.

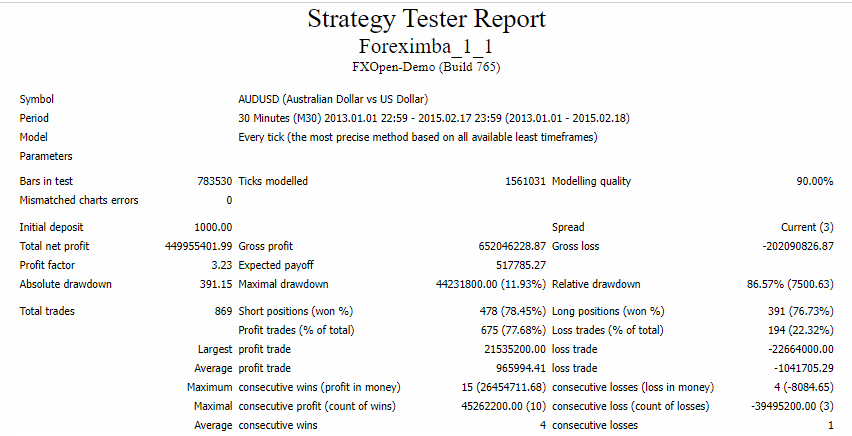

Backtesting results

A few backtests are present on the official site. Here is one of the backtests done for the AUDUSD pair using the M30 timeframe.

From the above details, we can see the test was done from 2013 to 2015. For an initial deposit of $1000, the total net profit generated was 449955401. For a total of 869 trades, the profitability of 77.68% and a profit factor of 3.23 were present. The maximum drawdown for the account was 11.93%. From the results, we can see that the system uses a low-risk approach that was successful in achieving high returns.

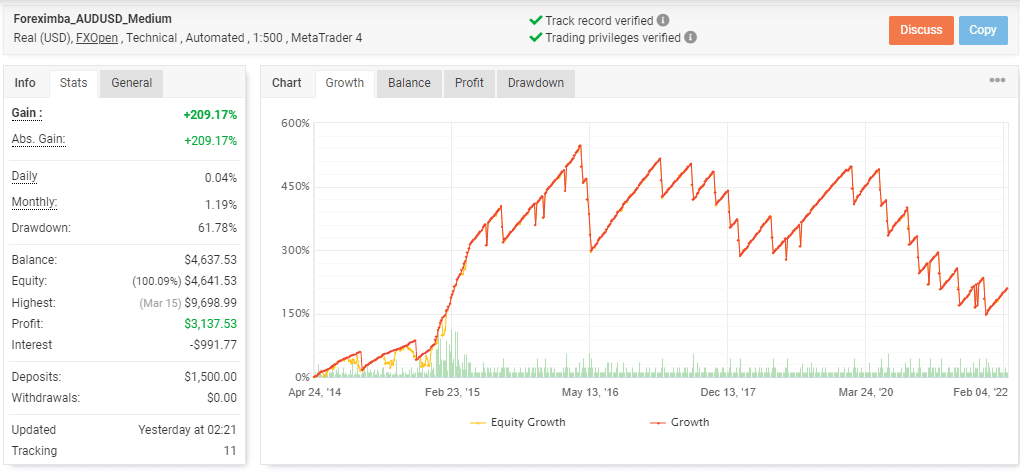

Foreximba live trading results

A real USD account verified by the myfxbook site using the FXOpen broker and the leverage of 1:500 on the MT4 platform is shown here.

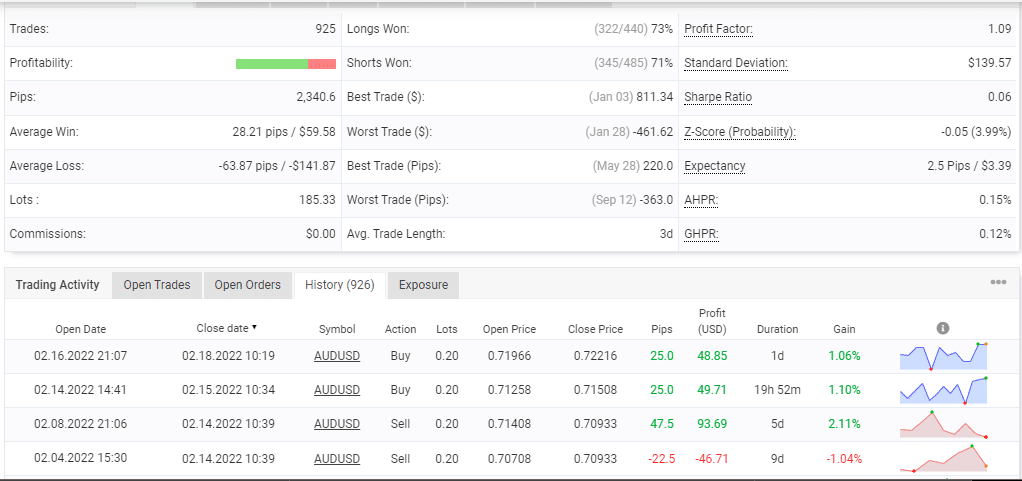

From the above results, we can see the EA has generated a total profit of 209.17% and an absolute profit of a similar value. The daily and monthly profits are 0.04% and 1.19% respectively. From the growth curve, we can see the system has several peaks and downward slopes indicating a risky approach. The high drawdown of 61.78% further confirms the risky approach used. For an initial deposit of $1500, the account that started in April 2014, has completed 925 trades with a profitability of 72% and a profit factor of 1.09.

From the trading history, we can see that a lot size of 0.20 is used. The high drawdown and low profit factor indicate a risky approach. Further, comparing the backtesting result with real trading stats, we can see the drawdown is high and profits are low. The comparison shows that backtests cannot predict future performance.

What are the risks with Foreximba?

If you are interested in this FX robot, here are the main influencing factors we identified in this system:

- There are no details present concerning the developer team, their experience, location, etc. which shows a lack of transparency.

- When compared to the market average the price is not very expensive and comes with a money-back offer.

- Real trading results show a very high drawdown that indicates a risky strategy.

Worth noting!

Unfortunately, we could not find user reviews for this FX EA on trusted sites like Forexpeacearmy, Trustpilot, etc.

What are the pros & cons of investing in Foreximba?

| Pros | Cons |

| It is a fully automated software | Lack of vendor transparency |

| Verified real trading results | High drawdown |

| Refund offer |

Although the vendor offers verified trading stats and backtesting reports, the high drawdown and lack of vendor transparency are factors you should mull over.

Foreximba Conclusion

Foreximba guarantees high profits with minimal risk. The vendor provides backtesting and verified real trading stats for the FX robot. On analyzing real trading stats, we found the drawdown is very high indicating a risky approach. Further, the absence of company info shows a lack of vendor transparency. However, when compared to the market average, we found the price is not very expensive and the vendor provides a refund offer.

-

Features

-

Pricing

-

Strategy

-

Performance

-

Reliability