Making money from online trading needs additional attention as it involves a lot of risks and uncertainty. Reading the price chart from a different angle is essential to remain one step ahead. In that sense, Grid trading would be great for market participants who want to build a trading portfolio with extensive profitability.

Making profits from Grid trading is not simple. It needs additional attention to the entry and trade management. Moreover, this method is not like traditional technical analysis, and it requires a better understanding of how it works with a proper entry and exit point.

Let’s check everything a trader should know to start with this method.

What is the Grid trading strategy?

The Grid trading approach has a record of providing good profitability in any currency pair. Therefore, you can extend your profitability by using this in your portfolio, or you can use this as a primary trading strategy.

It is a method where all deals happen automatically, without the touch of traders. However, if you understand the logic behind every trade, you can quickly implement this method in the chart.

You have to take both buy and sell trades in the Grid method after a specific gap in a particular time frame. Once the price moves, either bullish or bearish, it will hit pending orders and provide profits. Therefore, you can easily make money from this strategy if you don’t know where the primary market direction is and where the higher time frame traders are taking the price.

Other key features of Grid trading are shown below:

- You can apply it in any currency pair.

- It does not require knowing the broader market direction.

- This method cannot provide a guaranteed profit.

- Good opportunity for EA traders and builders.

How to identify the Grid?

In this trading method, you can make money from both bullish or bearish movements of a trend. In that case, you have to find a price point from where a good movement may happen. Later on, open buy stops and sell stops orders from that level by maintaining a fixed gap.

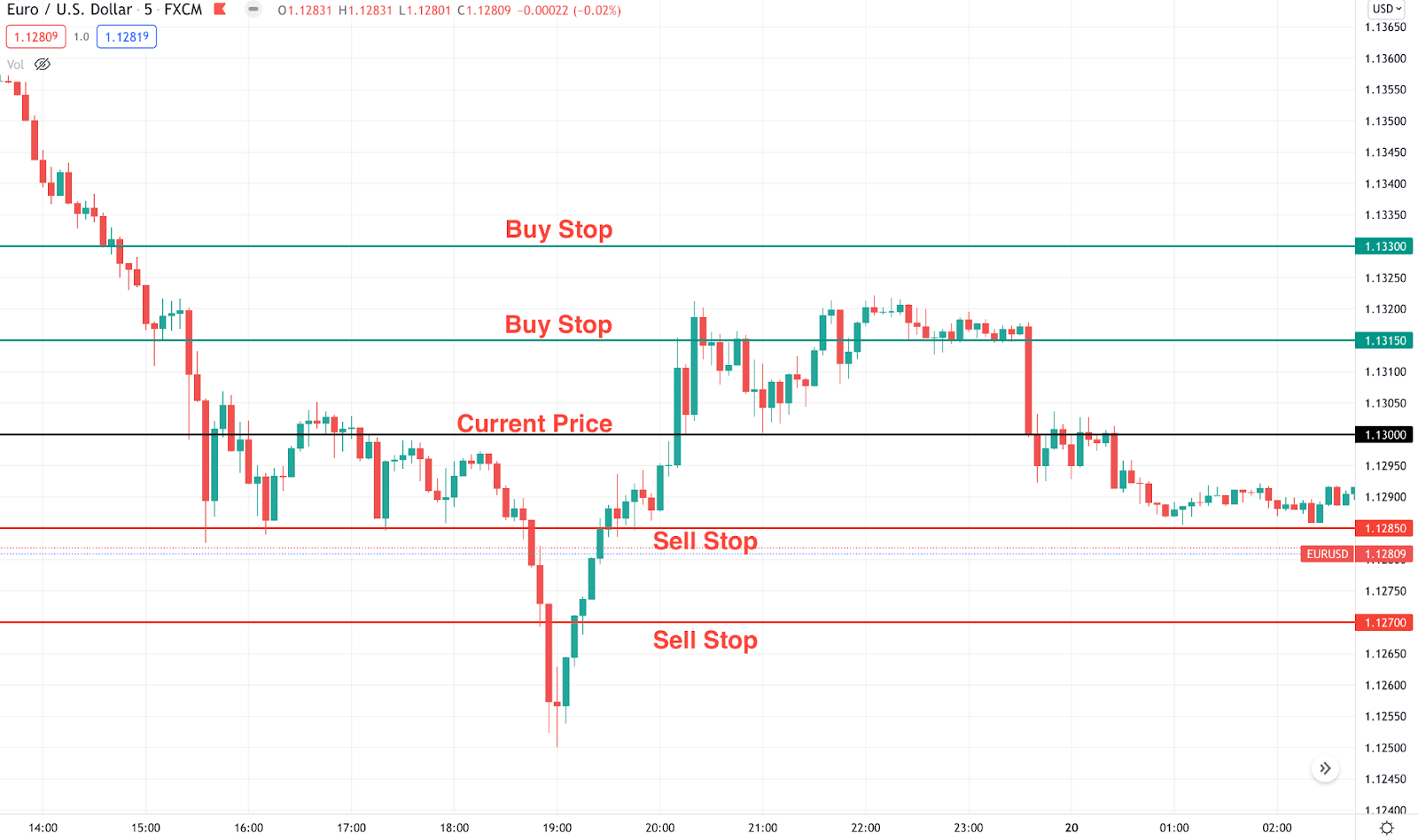

For example, if you want to apply the Grid in the EUR/USD chart where the current price is at 1.1300 level, you can open order by following orders:

- Buy Stop 1- 1.1315

- Buy Stop 2- 1.1330

- Buy Stop 3- 1.1345

- Sell Stop 1- 1.1285

- Sell Stop 2- 1.1270

- Sell Stop 3- 1.1255

The above image shows the five minutes chart of EUR/USD where the current market price and pending orders are marked within 15 pips gap.

After opening all trades with the following gap, it is time to open trades based on the gap. If the price moves up, it will automatically hit buy stop orders and provide profits. A similar theory applies to the bearish side, where a downward movement will activate sell orders and provide profit. If the price remains stalled at the current price, the trade will not activate in this method.

A short-term strategy

The method is suitable for short-term trading where keeping the price gap between 5 to 20 pips has a higher possibility of hitting within a trading day. Besides, traders need to have close attention to where the major price is heading to increase profitability.

Bullish trade setup

In the Grid method, it is hard to say whether the price will move bullish or bearish. However, traders can open pending orders on both sides, and if the price moves up, it will hit buy stop orders and keep providing profits.

Managing trades is the key factor of this method. Once the price starts moving up, it raises the question of how long it will move. The ideal approach is to take some profits from the second step and move the stop loss to breakeven.

Bearish trade setup

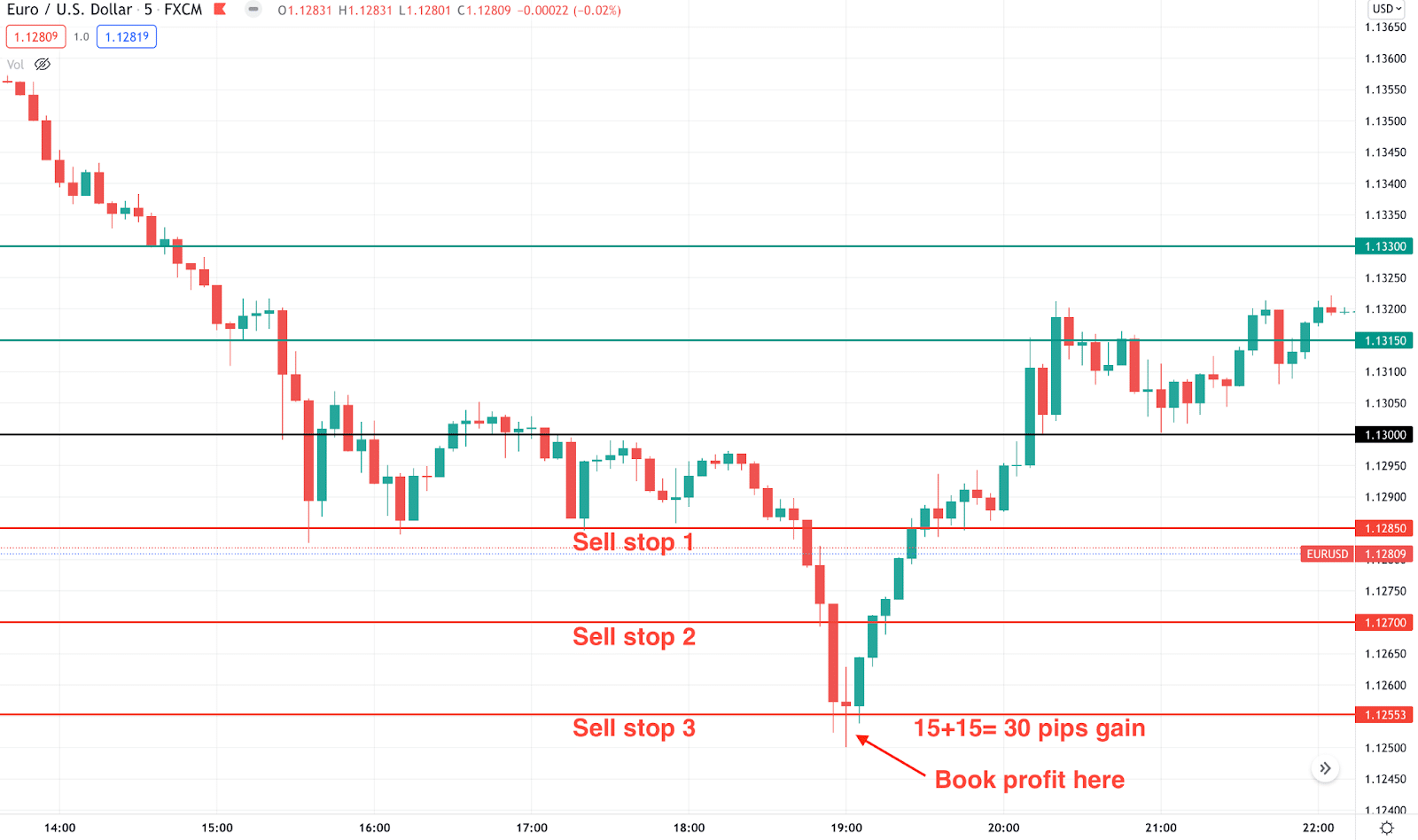

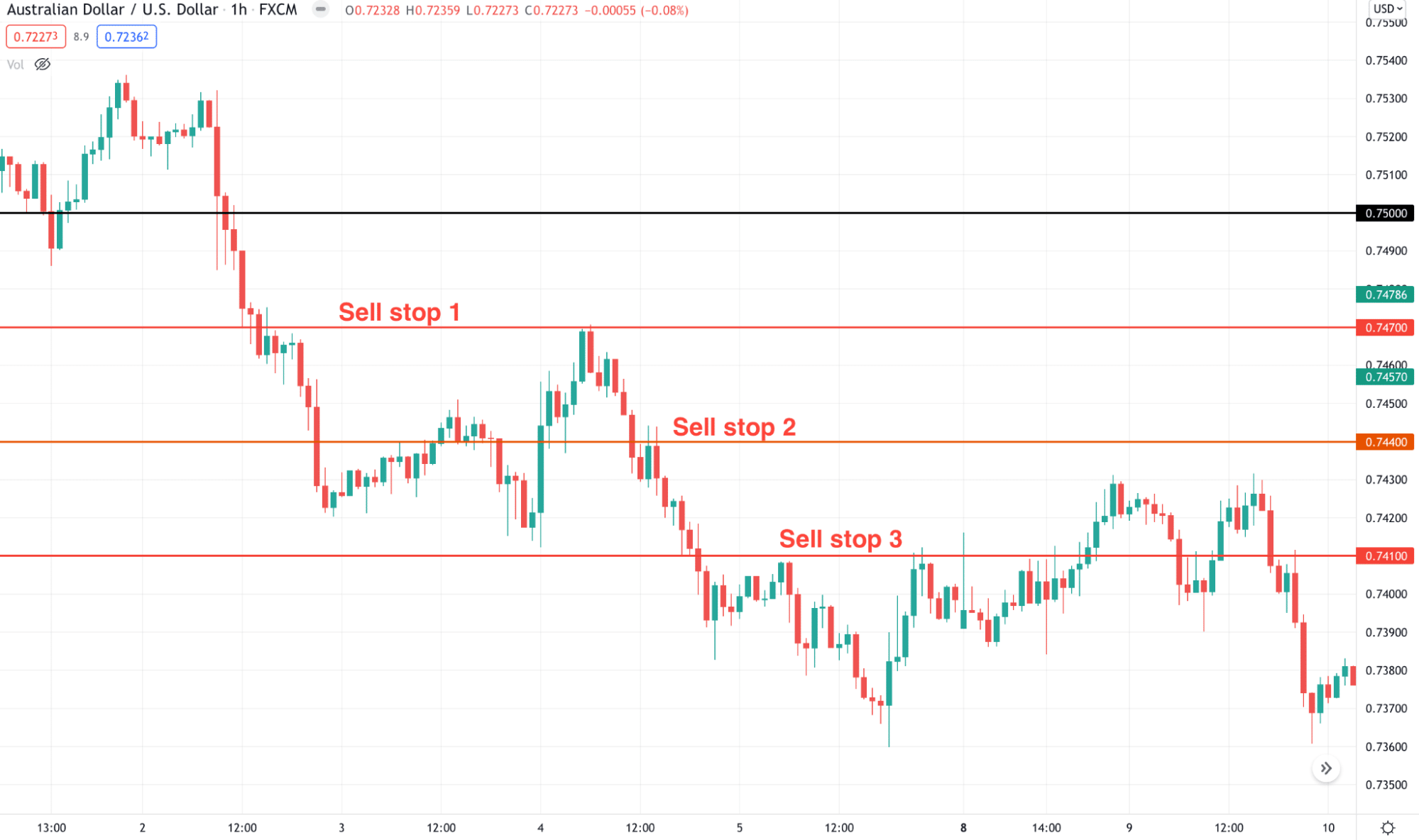

After creating the Grid, if the price moves down, it will activate the bearish trade setups, and further bearish movement will provide profits.

Let’s see an example of the bearish trade setup from the real price chart.

The above image shows how the short-term sell trades work in Grid trading. For example, if the price moved down and reached the third sell stop order, you can hold it for more gains or close all trades with +30 pips profit.

A long-term strategy

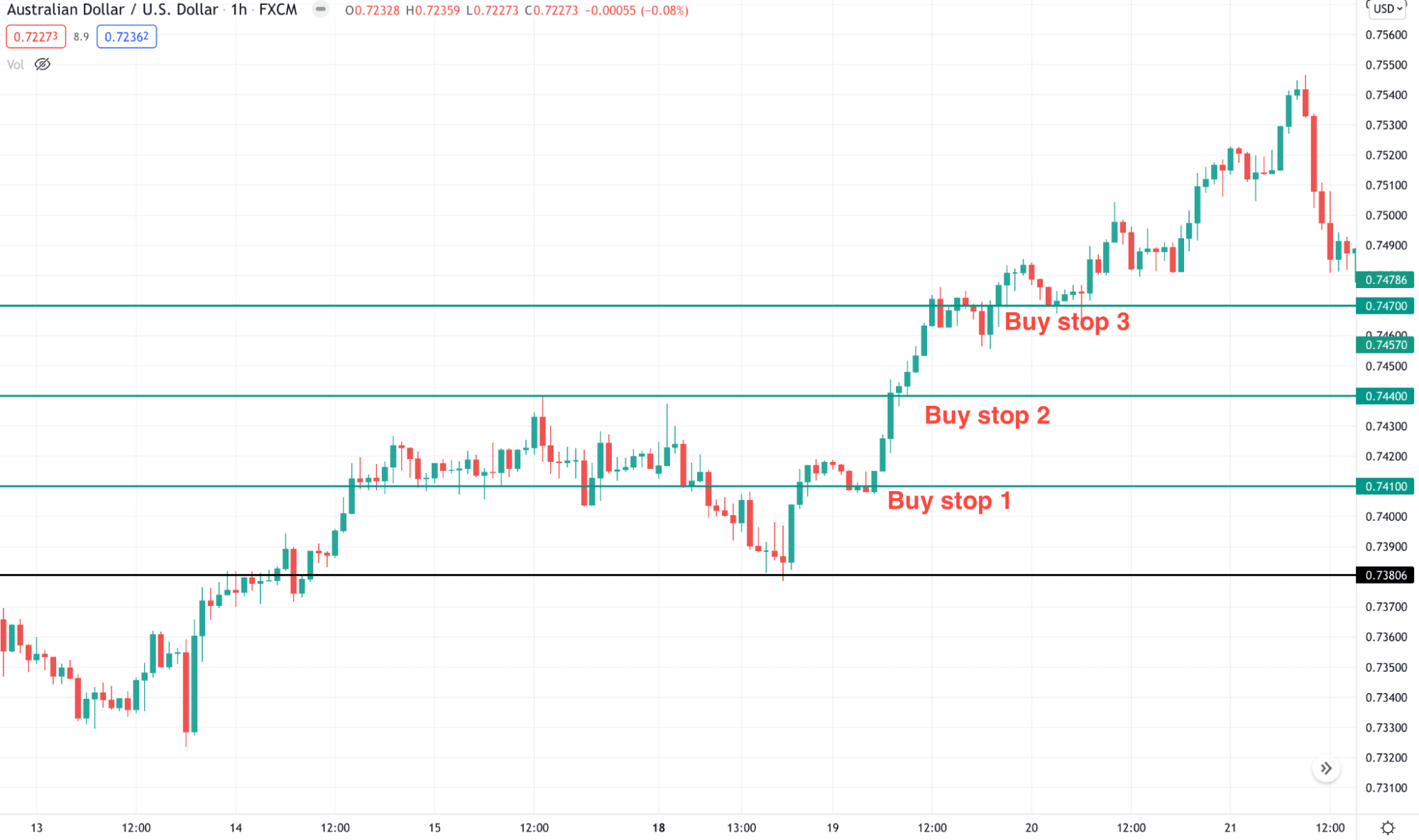

This method is suitable for any currency pair where the profit target is higher than the short-term method. However, based on the daily price movement, this method needs a trending market condition.

Therefore, investors should find a market where the trend is strong. In that case, using indicators like ADX or MACD would increase the trading accuracy.

Bullish trade setup

The bullish trade will be activated if the price moves up after setting buy and sell stop orders. In that case, before making any trade follow these conditions:

- ADX is above 20 line, and the higher time frame direction is bullish.

- The price moved up and reached the first and second buy stop order set with 30 pips gaps.

- Move the stop loss at breakeven after getting 60 pips from two sets.

Bearish trade setup

The bearish trade will be activated if the price moves up after setting buy and sell stop orders. In that case, before making any trade follow these conditions:

- ADX is above 20 line, and the higher time frame direction is bearish.

- The price moved down and reached the first and second sell stop order set with 30 pips gaps.

- Move the stop loss at breakeven after getting 60 pips from two sets.

Pros & cons

Let’s see the pros and cons of the Grid trading method.

| Pros | Cons |

| This method is suitable for both automated and manual trading. | There is no exact trade management system for this method. |

| It provides profit in both short and long-term trading. | This method is low-probability in a volatile market. |

| This method is profitable in any time frame. | It needs confirmation from other indicators. |

Final thought

Financial market trading involves uncertainty and risks that you cannot ignore. So make sure to use proper trade management for everything besides syncing the trading method with the fundamental direction.