Momentum trading is a common way to approach the financial market. It enables traders to ride on the current trend and make enormous amounts of profits. Sadly, most novice traders lose money as the financial market involves a high amount of risks. Ambitious traders seek sustainable trading methods to achieve the goal of financial freedom, independence, and security.

However, traders create strategies depending on momentum, volume, price action, technical or fundamental outlook, etc. This article will introduce you to momentum trading. It also contains different momentum trading strategies with chart attachments besides listing the top pros and cons of momentum trading.

What is a momentum trading strategy?

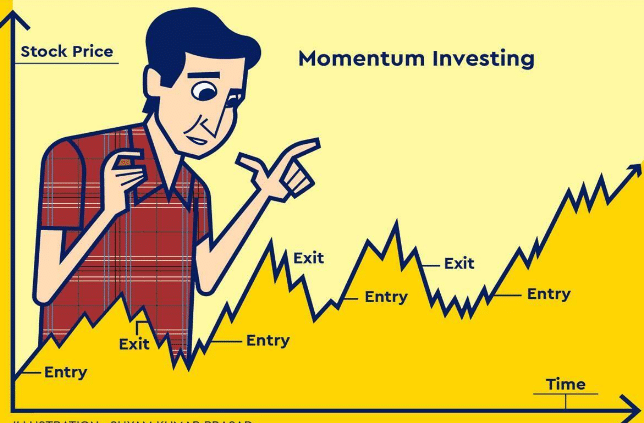

It is a trading approach to buy/sell any asset depending on the recent strength of price movement. A common textbook talk in wall street is “buy at low, sell at high”. The momentum trading still enables your opportunities to make precious entry/exit positions.

For an example of momentum trading, you can compare it with a train. In the starting, the train keeps accelerating, and after reaching a sufficient speed, it makes the speed stable. Later comes the stop part. A train may use brakes before miles away from where it may start to stop.

Momentum traders seek to enter the market just after the acceleration and have a goal to ride. Meanwhile, they exit near the stop point of the train or momentum. The critical elements of momentum trading are time, volatility, and volume.

How to trade using momentum trading strategy?

Momentum trading techniques can apply to assets by following some simple steps:

- Select assets with sufficient volatility.

- Conduct an analysis that supports your trading strategy.

- Determine trading positions.

- Execute trades according to your trading technique.

Some most popular momentum indicators are moving averages, volatility, stochastic oscillator, RSI, MACD, momentum, etc. Remember, in momentum trading, you are following in the footsteps of other participants. So better be aware of different market contexts when making entry/exit positions.

It will reduce your risk on trading besides increasing profitability. Momentum trading gives you the flexibility to catch trades for both short-term and long-term periods using these methods. These methods allow you to buy winning assets with increasing value and sell losers whose prices are declining.

A short-term trading technique

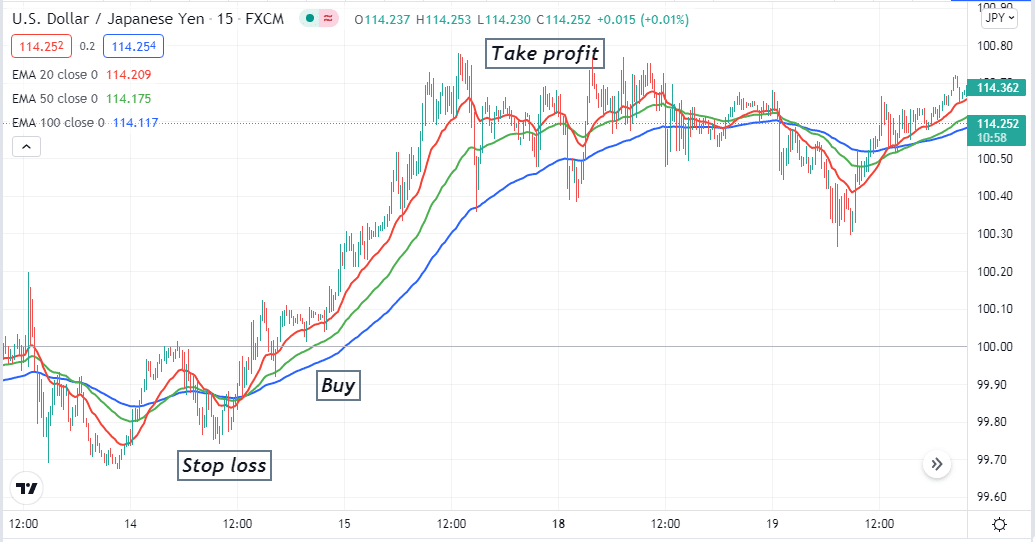

Our short-term strategy involves using MA crossover to seek precious trading positions:

- EMA 20 (red)

- EMA 50 (green)

- EMA 100 (blue) lines to generate trade ideas.

When the red EMA crosses the green on the upside, it declares a bullish pressure. When both the red and the green EMA signal line crosses above the blue EMA, it signals a possible upcoming bullish trend. Conversely, the exact opposite crossover occurs between these EMA lines when the price movement shifts to a downtrend. This strategy suits any trading asset on many time frame charts. We recommend using a 15 min or hourly chart to determine short-term trading positions.

Bullish trade scenario

Set EMA 20, 50, and 100 lines at your target asset chart. Observe the chart when:

- The red EMA crosses the green EMA on the upside.

- The green EMA crosses the blue EMA on the upside.

- Both the red and the green EMA lines are above the blue EMA line heading toward the upside.

Entry

When these conditions above match with your target asset chart, place a buy order.

Stop loss

The stop loss level will be below the current swing low.

Take profit

You can continue the buy position till the current bullish trend remains intact. Close the buy position when:

- The red EMA crosses the green EMA on the downside.

- The green EMA crosses the blue EMA on the downside.

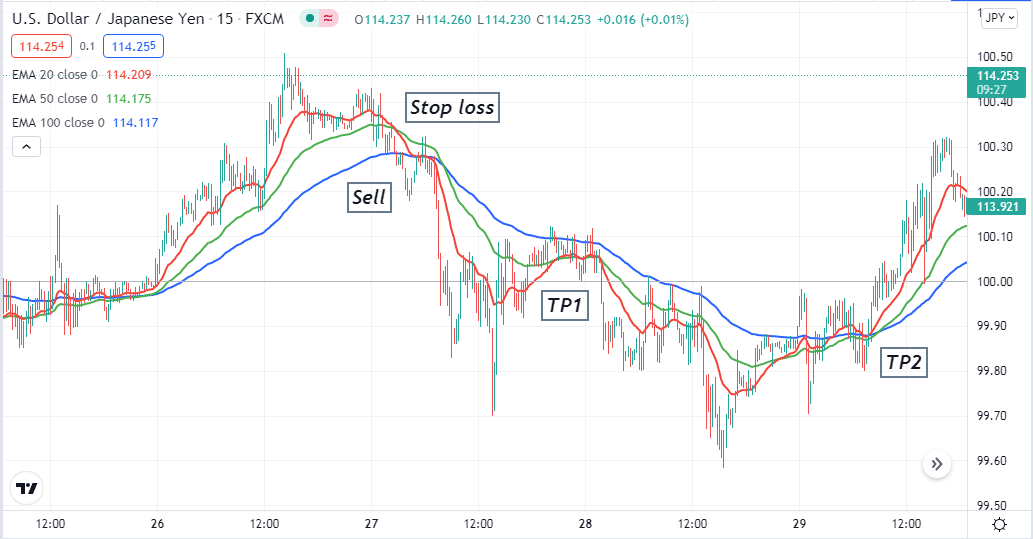

Bearish trade scenario

Set EMA 20, 50, and 100 lines at your target asset chart. Observe the chart when:

- The red EMA crosses the green EMA on the downside.

- The green EMA crosses the blue EMA on the downside.

- Both the red and the green EMA lines are below the blue EMA line heading toward the downside.

Entry

When these conditions above match with your target asset chart, place a sell order.

Stop loss

The stop loss level will be above the current swing high.

Take profit

You can continue the sell position till the current bearish trend remains intact. Close the sell position when:

- The red EMA crosses the green EMA on the upside.

- The green EMA crosses the blue EMA on the upside.

A long-term trading technique

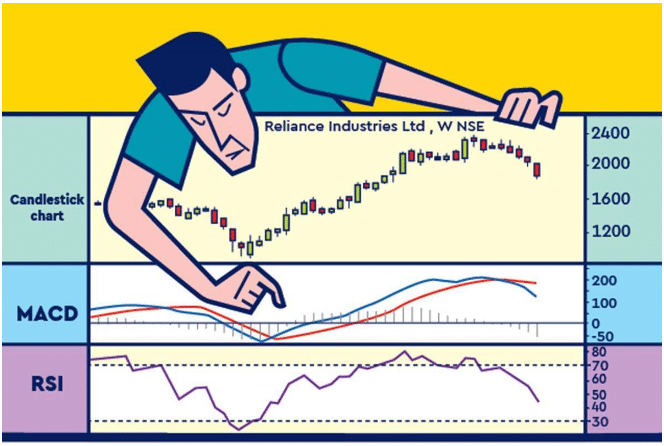

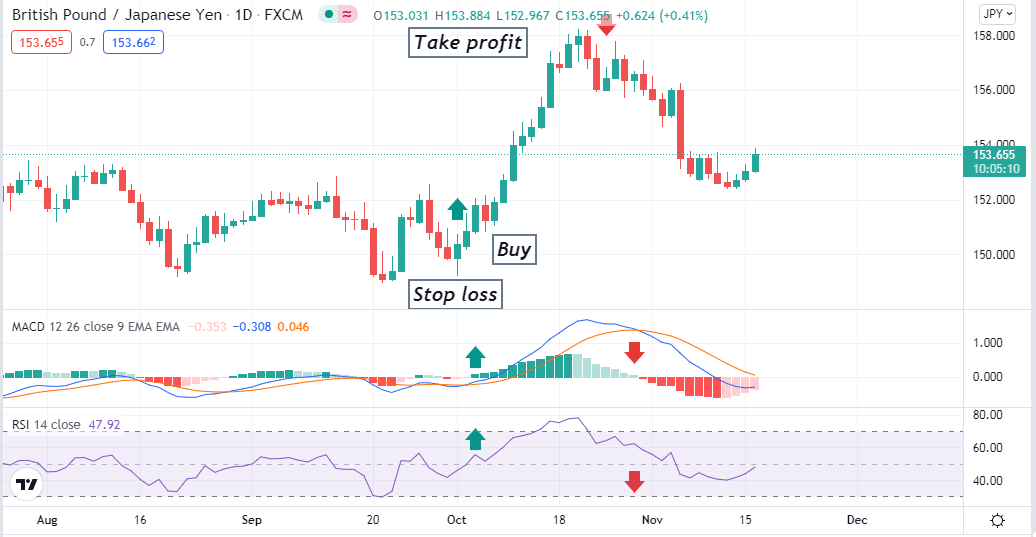

In our long-term trading technique, we use the two most popular momentum indicators, MACD and RSI. Both indicators show reading on independent windows. This strategy suits any time frame charts; we recommend using an H4 or above charts to get the best results.

Bullish trade scenario

This method declares bullish pressure when:

- The dynamic blue line crosses the dynamic red line on the upside at the MACD indicator window.

- Green histogram bars take place above the central line on the MACD window.

- The dynamic RSI line is at or near the central (50) line moving toward the upper (80) line.

Entry

When these conditions above match with your target asset chart, place a buy order.

Stop loss

The stop loss level will be below the current swing low.

Take profit

Continue the buy order until:

- The dynamic blue line crosses the dynamic red line on the downside of the MACD window.

- MACD red histogram bars take place below the central line.

- Dynamic RSI line is at or near the upper (80) line moving toward the downside.

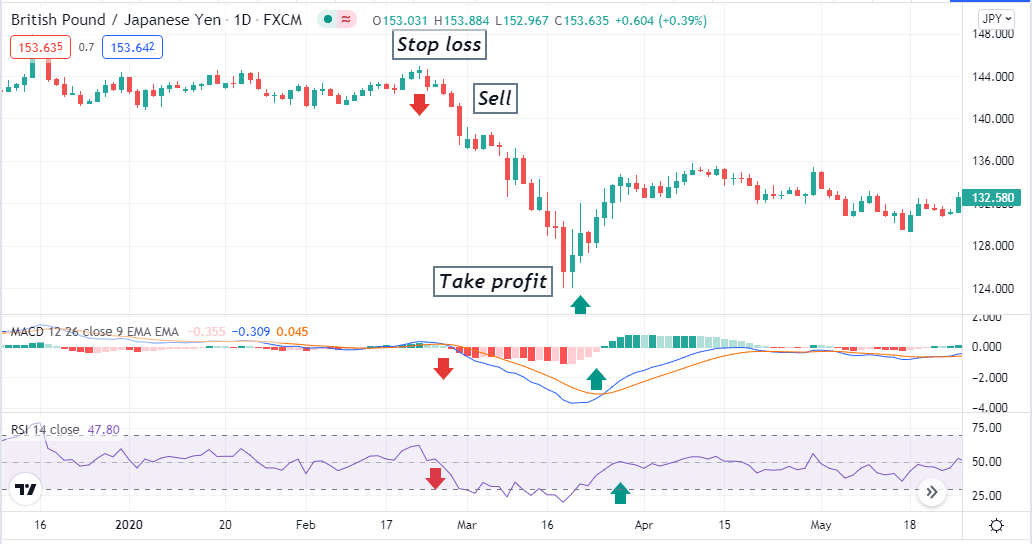

Bearish trade scenario

This method declares bearish pressure when:

- The dynamic blue line crosses the dynamic red line on the downside at the MACD indicator window.

- Red histogram bars take place below the central line on the MACD window.

- The dynamic RSI line is at or near the central (50) line moving toward the lower (20) line.

Entry

When these conditions above match with your target asset chart, place a sell order.

Stop loss

The stop loss level will be above the current swing high.

Take profit

Continue the sell order until:

- The dynamic blue line crosses the dynamic red line on the upside of the MACD window.

- MACD green histogram bars take place above the central line.

- Dynamic RSI line is at or near the lower (20) line moving toward the upside.

Pros and cons

| Pros | Cons |

| Allow traders to make positions with major participants. | Momentum trade ideas come from specific movements of price change while ignoring the whole picture. |

| Allow making quick profits rather than buy and hold trading methods. | Momentum trading ideas depend on technical views of market context while ignoring many fundamental reasons for price change. |

| Momentum trading applies to many trading assets. | Momentum trading strategies can fail due to unexpected economic news releases. |

Final thought

We discuss all the well-known facts of momentum trading in our article. We hope you find this article sufficiently educational and informative to use the momentum strategies above as your trading technique.