The financial market has become more accessible than ever due to the availability of technology. So algorithmic trading or using robots to profit is becoming popular among traders besides banks and institutions. High-frequency trading (HFT) is one of the standard profitable ways to approach the financial market for institutions.

However, many individual traders still do not know this trading approach, although following HTF strategies can be more reliable than other trading methods. This article will introduce you to high-frequency trading and trading strategies using HFT.

Later, we list the top pros and cons of using HFT.

What is high-frequency trading?

The goal of HFT is to make quick profits through high volume in the financial market. It is a systematic way to approach the market depending on computer programs or algorithms. Algorithms can execute many orders and use large volumes to profit from the marketplace depending on the market context.

This trading method applies to many trading instruments and market participants who are flexible to trading using software or apps. It is a typical trading approach to investment banks, hedge funds, and large institutions that can afford large volumes. High or robust computation, high-speed internet, and the fastest servers are desirable facts for HFT.

The fundamental elements or features of HFT are:

- Powerful computation.

- Algorithmic trading.

- Considerable high-volume trading.

- Fastest execution of trades.

- The holding period is low.

- All trading activity duration won’t last longer than the trading day.

- The profit target is smaller than the manual traders.

- It depends on complex algorithms to detect price direction.

- Large institutions and banks frequently use this method.

- Requires a considerable amount of investment to cover the desirable volume.

High-frequency trading forces the market makers to charge a larger spread to be profitable and reduces the market liquidity.

How to trade using high-frequency trading methods?

When you want to trade using any HFT method, it requires having some elements, such as a profitable trading algorithm, a certain amount of investment, implementation knowledge, etc. HFT can be an alternative method if you are not comfortable with manual trading or can’t spend too much time that day traders follow, etc., as trading executions occur through an automatic way.

Trading algorithm

It is a primary element of HFT trading. You can create your trading algorithm through many trading logics. For example, you can use the logic of MA crossover, parabolic SAR, MACD, or any other technical indicator logic. Otherwise, you can make one with the help of an expert.

Spending amount

The HFT trading requires some amount of operating the whole operation successfully. It includes the computation fee, fast server fee, high-speed internet cost, etc. This amount can be between 2-5k dollars or more, depending on the capability and other fundamental facts.

Trading capital

Making profits excluding the spending cost requires a particular amount of investments. So you can cover the expenses and make a net profit. Using the HFT requires having a minimum 25k investment. The return amount from the investment capital should be above the spending amount.

A short-term trading method

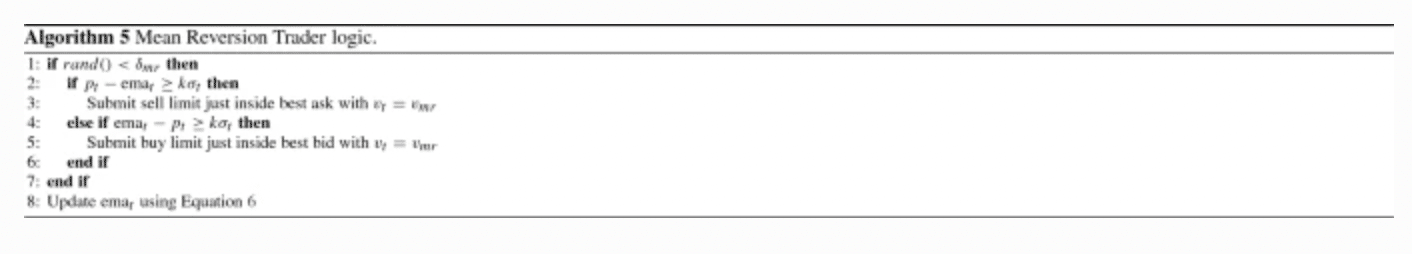

In this short-term trading method, we use an algorithm that allows us to execute buy orders when the price comes below a certain level and similarly execute sell when the price reaches above a certain level. You can use this algorithm to apply to any trading instrument that has sufficient volatility. We use the following formula.

EMA 𝑡 = EMA (𝑡−1) + 𝛼 (𝑝𝑡 − EMA (𝑡−1))

This strategy executes trades that may have durations of minutes or even seconds.

Entry

The price pt reaches above the EMA t; this algorithm will execute a sell-limit order. Conversely, it will open a buy order when the price comes below the standard deviation point.

Stop loss

This algorithm will automatically manage the stop loss level, depending on the market context and calculations.

Take profit

The goal of this algorithm is to trade the average price for the asset.

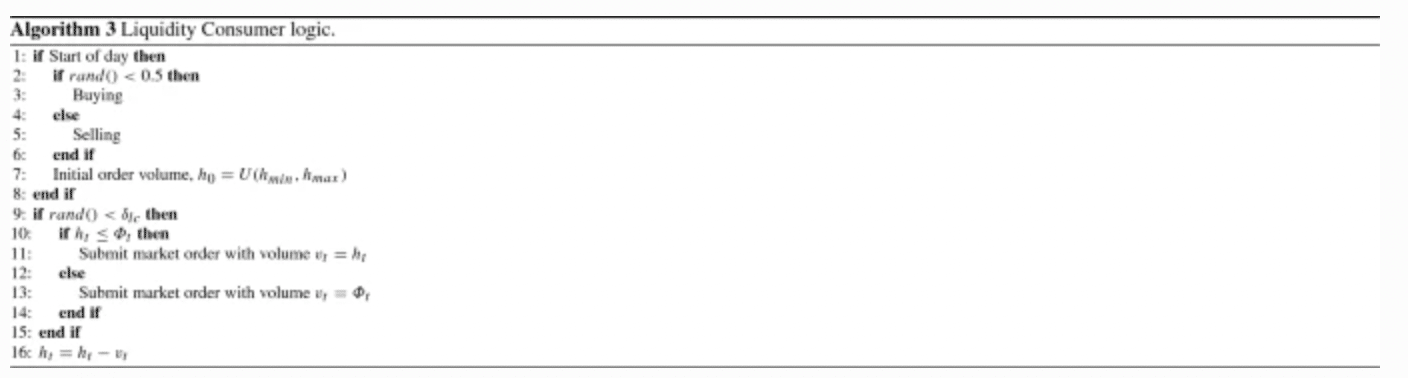

A long-term trading strategy

This long-term HFT trading method requires applying on trading assets that may move slower. It is a suitable strategy for large institutions or hedge funds that are comfortable with trading methods that involve buying/selling vast amounts of trading assets to cover the spending cost. This trading strategy obtains good results on higher time frames may a D1 chart is recommendable.

Entry

Users will open a vast position when the trading asset volume is best in the opposite direction.

Stop loss

This trading method uses conservative stop loss positions and open trades on different phases of the price movement. In many cases, this trading method doesn’t use any stop loss.

Take profit

This trading method or algorithm closes the open positions when the position is open, depending on the opposite party’s actions.

Pros and cons

The HFT is a profitable trading technique for traders and investors who can afford the spending and capital. Before choosing any HFT trading method, it is better to check on detailed facts if it is suitable for you.

| Pros | Cons |

| HFT allows you to manage significant investments or use this unique technique as a liquidity provider. | Using HFT requires trading costs and a large deposit amount that is often unsuitable for individual trades. |

| HFT reduces arbitrage or price inefficiency. | HFT always creates some volatility on the market, so it involves making the asset price volatile. |

| HFT allows having high profitability. | HFT involves the risk of a massive loss if there is any massive market crash. |

Final thought

Many trading firms that use high-frequency trading have bad names due to using secret trading methods. However, it reveals to individuals the availability of technology and increasing demand. You already know that it requires vast investment and cost rather than traditional trading methods. Gathering knowledge of HFT enables us to understand the market context as it is common to the market makers and prominent investment institutes.