Contract for difference, or CFD in short, is a way to speculate the price of a particular asset without owning the actual product. Many brokers and financial institutions offer CFD trading to their clients as it is a way of making money from bullish or bearish price movement without owning the actual asset.

However, CFDs would not be the same as owning a real cryptocurrency. Therefore, traders often become confused to choose whether they choose CFDs or owning the real asset.

What is a CFD?

It is a financial derivative that acts as a contract between the broker and trader. Thus, you never own the asset instead of making money from the asset’s changing value. CFD is a leveraged product, which means you can make money from CFD with a small deposit.

Although your deposited capital is small, the term ‘leverage’ allows you to trade in a larger volume than your trading capital. For instance, you found that the Bitcoin prices may increase in a short time. Therefore, you can open your position by Bitcoin CFDs at your broker and make money from it without even owning an actual Bitcoin.

But the question remains, “Should you choose CFDs over owning the asset or not”?

This article includes all about cryptocurrency’s CFDs trading, including how it works in the financial market, the differences between ETF and CFD trading, etc.

How CFDs work in the traditional financial market?

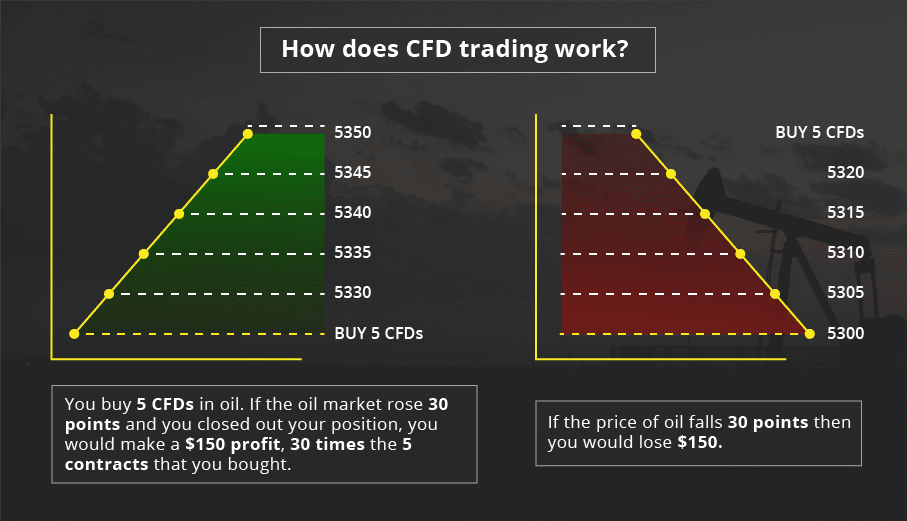

This type of trading enables individuals to trade or invest in certain products by the price movement of that product. This investing doesn’t allow participants to have ownership of the actual product. The contact is more likely to occur between a trader and a broker. As it is a leveraged product, you can earn more money than the usual investment.

The CFD trading works in the traditional market by some simple steps:

Step 1. Choose a CFDs-enabled broker. It can be FX, stocks, currencies, an index, or any investment that brokers have in their collection.

Step 2. Open a position and set parameters: long or short, invested amount, leverage, etc.

Step 3. After opening the position, the order will be active. Before reaching this step or agreeing, you must check the conditions and other information such as additional fees, hidden costs, etc.

Step 4. The position is open and will continue until the trader closes it or executes any automatic command: take profit, stop loss, contact expiration, etc.

Step 5. If the position closes with profits, the brokers pay the trader. On the other hand, the broker charges the trader if the position closes with loss.

CFD trading is as simple as that. Moreover, such trading offers advantages that direct trading doesn’t provide, such as leveraged trading, access to the overseas markets, holding short positions for the asset, and so on.

However, you can’t ignore the risk of CFD trading, as leverage may allow you more profit, so you will also lose more money by this type of trading.

What’s the difference between CFDs and ETFs?

CFDs and ETFs are different financial products, where the similarity is that both are derivatives.

- An ETF or exchange-traded fund is a collection of various tradable financial assets into one asset.

- A CFD is a contract between broker and trader, by which traders speculate on the price movement of certain assets. In both cases, investors don’t have ownership or directly purchase the underlying asset.

Brokers or financial institutions offer CFDs to enable individuals, and ETFs are composed of various financial institutions by following specific market strategies.

CFDs and ETFs — both can help to create a portfolio that follows a market strategy. Both allow users to have absolute control over the asset, which means you can hold or close the positions at your risk.

- ETFs are primarily suitable for long-term strategies

- CFDs are ideal for both short-term and long-term investments

Finally, some similarities in some characteristics of ETFs and CFDs seem to be similar, but these two are different products.

Is crypto CFDs profitable?

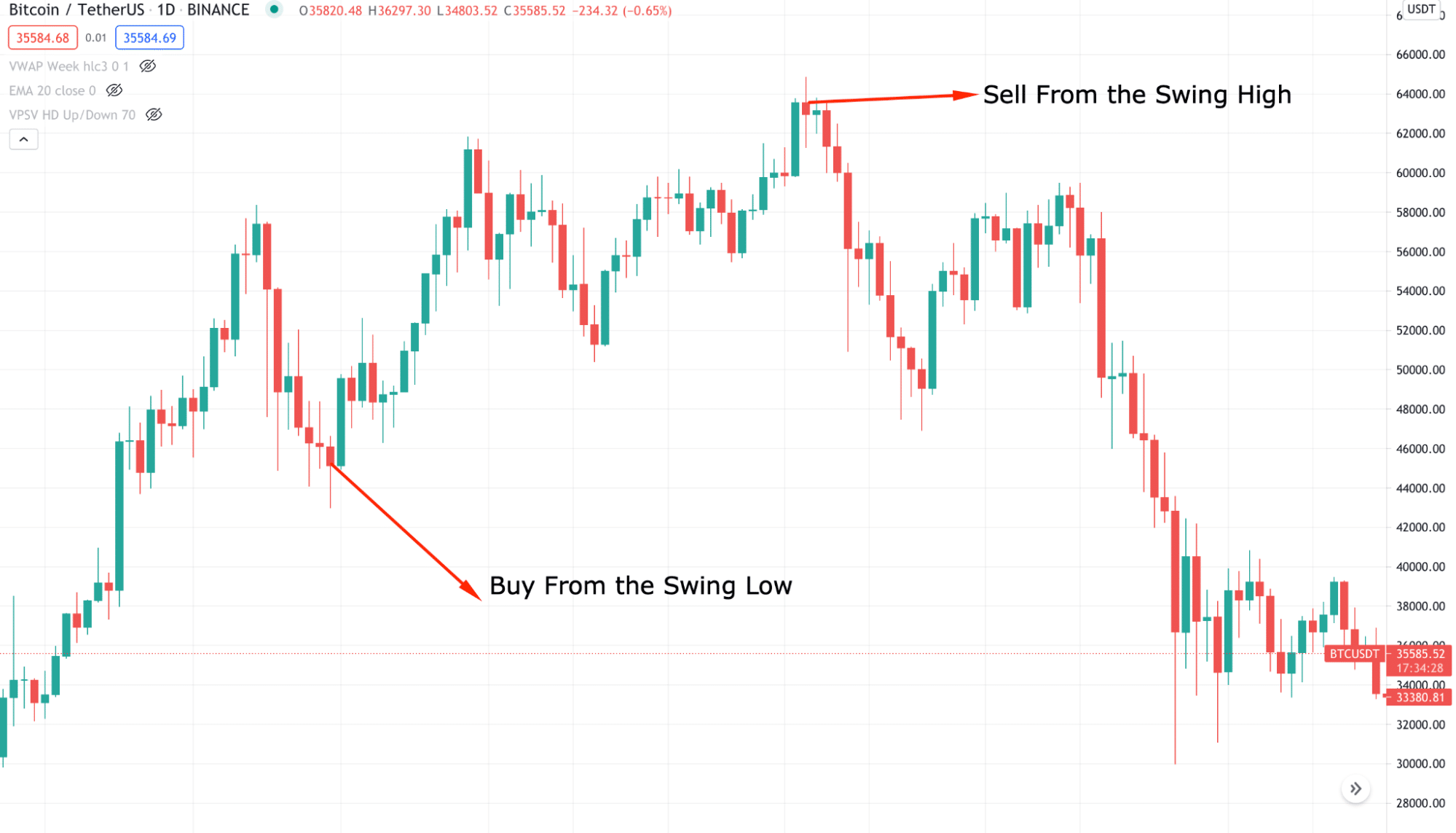

Cryptocurrencies became an exciting sector to invest in nowadays as investors frequently choose this as a payment method. Many of them made fortunes by putting their wealth in cryptocurrencies. So investors from sectors like stock traders, currency traders, tech investors, and so on seek opportunities to speculate on cryptocurrencies.

As a result, the crypto CFDs have also become famous for their leveraged trading feature. This margin trading allows you to magnify gains without even owning the actual asset. Moreover, CFD trading platforms provide much better customer support than traditional crypto exchanges.

There is no need to have a crypto wallet for trading crypto CFDs, and it is easy to start with little capital. You can make money from gaining or losing markets. Besides, this type of trading allows you to use stop loss, take-profit, etc., which helps reduce losses.

In the above image, we can see the Bitcoin chart, where you can make profits by buying from the swing low and selling from the swing high. Making money from both buying and selling is possible with CFDs trading.

Crypto CFD trading also carries some limitations, risks, or disadvantages, such as margin trading means losing amount is also magnified. You can lose more than your trading capital, and the crypto market is speculative and highly volatile. Crypto CFDs are also volatile and not suitable for long-term trading.

So clearly, anyone can make a fortune by trading crypto CFDs but needs to do more research, choose a reasonable broker or trading partner before deposit. Then manage that capital wisely by trading with proper strategy.

Final thoughts

Whether you purchase cryptocurrencies or trade crypto CFDs depends on your trading nature. It’s always better to check the regulatory, trading partner, and product before making any investment.

In addition, we suggest you do more research before making any investment, as CFD trading involves risk and volatility. Find a CFDs trading broker that has a storing regulation with a minimum cost. Lastly, find trading costs and inject your money if the cost is lower.