Trading in the financial market involves executing trades with proper strategies. Such strategies contain complete trade setups, which include entry/exit points for any executing trades. Successful traders follow trading techniques to execute any position with precious stop loss and take profit levels as a vital part of risk ratio management.

However, the financial market is a vast marketplace for any individual, and no strategy will always guarantee a hundred percent profitability. Moreover, defining the exact take profit and stop loss levels may involve some confusion to novice trades. This article contains definitions of these two vital factors besides trading strategies with chart attachments.

What are the stop loss and take profit?

The “stop-loss” is an advance order for any trading position that will execute if the price doesn’t move toward the order direction. Traders use this concept as a part of risk management to reduce their risks on trading. The financial market is volatile, and no one knows the future direction for sure. Traders and investors use many technical and fundamental tools to determine potential trading positions. Meanwhile, they use stop loss for their executing trades to save their capital in non-fair price movements.

Take profit or TP is an advance instruction to exit from any executing order when the price movement reaches any level. Simply traders and investors place TP at the level where they expect the price to go according to their trading strategies.

So, the stop loss defines how much you are willing to take risks on your trade, and the exact opposite, take profit, represents the profit target for your trade.

How to use stop-loss and take profit

Stop loss and take profit is a mandatory part to any trader who follows a trading approach with discipline. You can follow the steps below:

Step one

First, identify the potential trading position according to your trading strategy.

Step two

Execute your trade according to when your trading strategy suggests the most potential.

Step three

Set take profit and stop loss according to your trading strategy. This step may come last, but you will get these levels at step one if you follow a proper trading strategy.

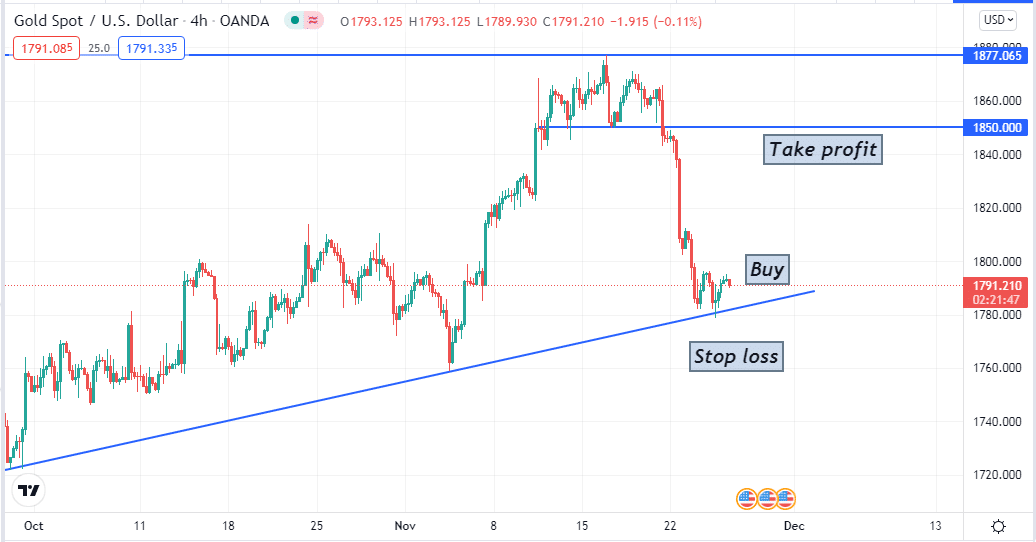

For example, the XAU/USD price is floating near 1791$. We draw a trendline on the H4 chart that suggests price may bounce on the upside from here. So we may place a buy order here. Meanwhile, our stop loss level is below the trendline, as according to our strategy, the price won’t break below the trendline and take profit is below 1850$, which is an excellent price action level and previous short-term support.

A short-term trading strategy

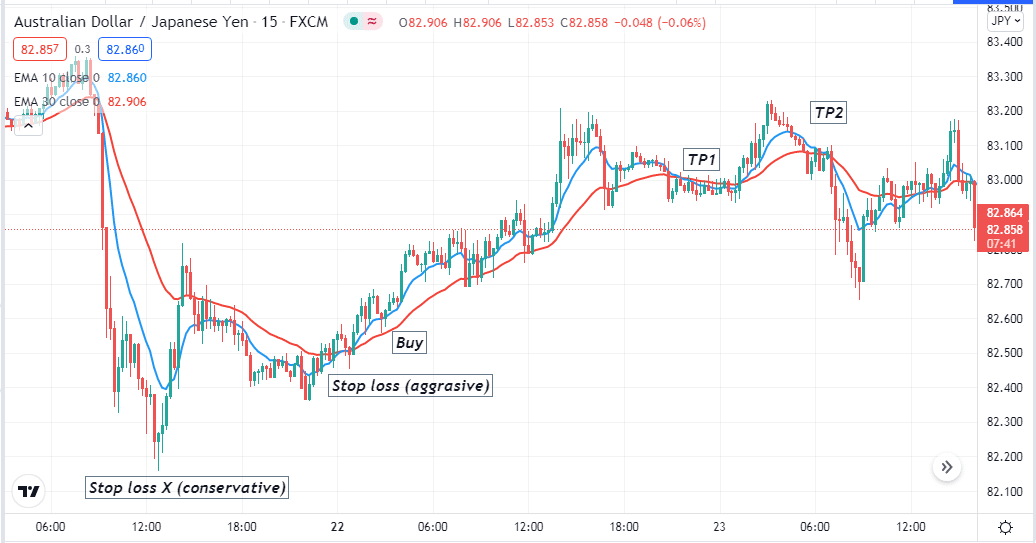

In our short-term trading strategy, we use two EMA lines to generate trading ideas. Our trading strategy contains EMA 10 (blue) and EMA 30 (red) crossover to sort out entry/exit positions.

This trading technique suits any time frame chart; we recommend using a 15-min or H1 chart to catch short-term trades. Determine the long-term trend from upper timeframe charts and execute trades at London and US sessions as you will get sufficient volatility.

Bullish trade scenario

When price creates a low and starts to bounce back, observe the EMA lines to seek buying opportunities.

Entry

Place a buy order when the blue EMA crosses above the red EMA and both EMA lines are heading toward the upside.

Stop loss

When making stop loss, you can place an initial stop loss below the current swing low of the EMA crossover, which will be an aggressive stop loss position. Meanwhile, for more safety, you can place the stop loss below the swing low, where the uptrend begins; that will be a conservative stop loss placing. Conservative stop losses keep your position safe, but the return ratio against your risk won’t be as much as aggressive stop-loss positions.

Take profit

This type of trading technique always generates trade ideas with at least 1:2 risk ratios. The initial profit target can be 2X than your stop loss. If you place a conservative stop loss, then the risk ratio can be 1:1 or lower than that. Otherwise, you can close your trade when the blue EMA crosses the red EMA on the downside.

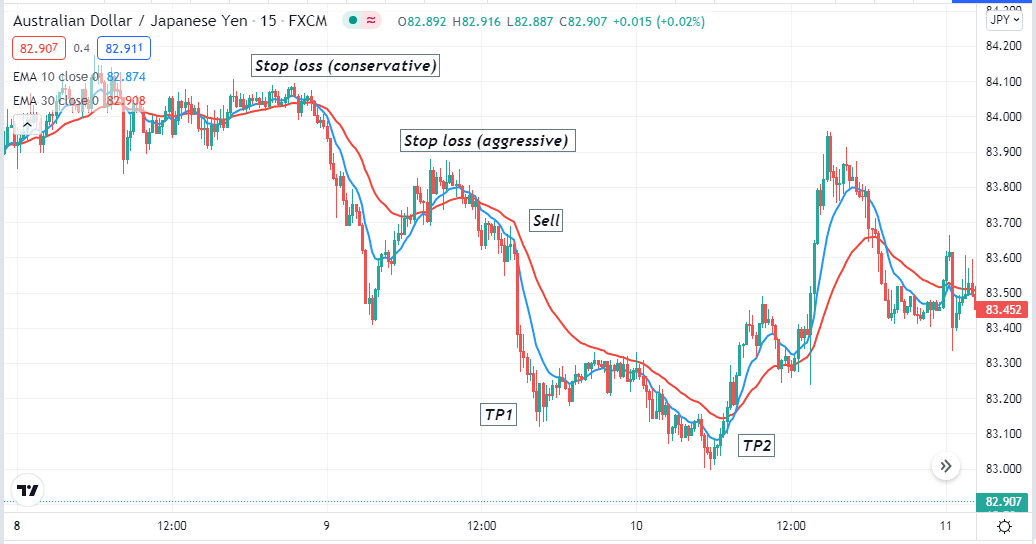

Bearish trade scenario

When the price movement creates a high and declines, observe the EMA lines to seek sell opportunities.

Entry

When the blue EMA crosses below the red EMA line, it signals a possible upcoming downward movement. It’s a potential place to make a sell order.

Stop loss

The initial stop loss will be above the current swing high where the crossover occurs between the EMA lines, an aggressive stop loss position. You can place a conservative stop loss above the swing position where the downtrend begins for more safety.

Take profit

Your initial profit target will be 2X more distance than your stop-loss position if you place an aggressive stop-loss for your trading position, as this strategy suggests trade ideas with a risk ratio of 1:2. Meanwhile, if you use a conservative stop-loss for your sell position, your risk ratio can be 1:1 or lower than that. Otherwise, you can continue your sell order till the blue EMA crosses above the red EMA line.

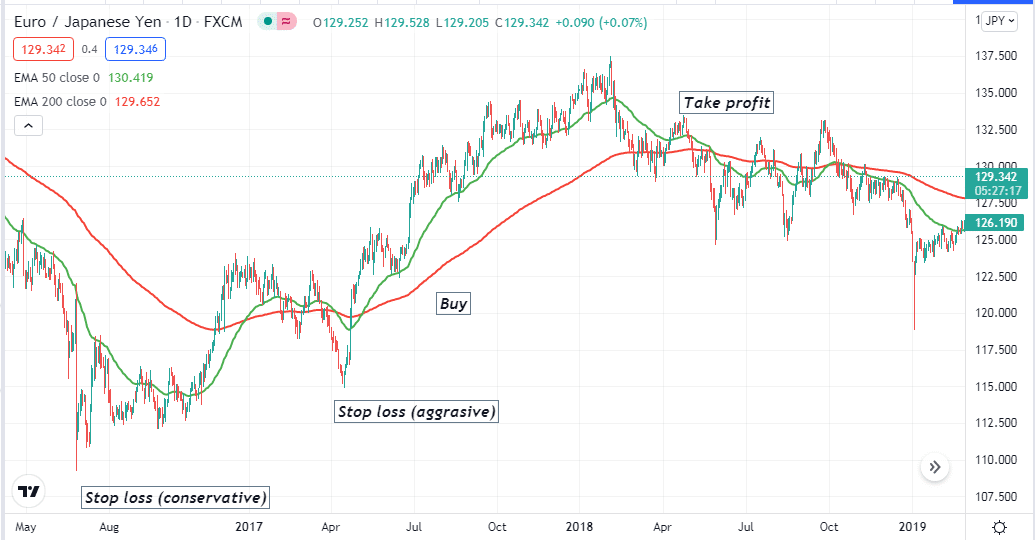

A long-term trading strategy

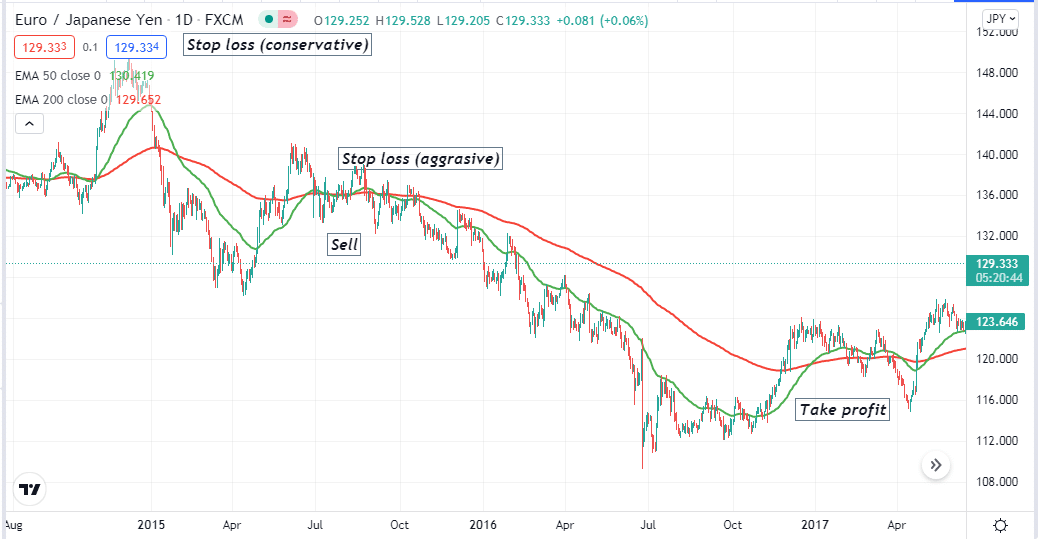

We use the golden crossover in our long-term trading strategy. We use EMA 50 (green) and EMA 200 (red) lines to generate trade ideas. This strategy suits the D1 charts.

Bullish trade scenario

Set the EMA lines on your target asset chart and seek to buy orders when the price creates a swing low and starts bouncing upside.

Entry

When the green EMA crosses above the red EMA, it signals a bullish pressure on the asset price. Place buy order.

Stop loss

You can place an initial stop loss below the current swing low if you are comfortable making an aggressive stop loss. Otherwise, put a conservative stop loss below the swing low where the price starts making an uptrend.

Take profit

The initial profit target will be 2X distance (if you use an aggressive SL) than the stop-loss above the buy position, as this strategy suggests 1:2 risk ratio trades. Otherwise, close the buy order when the green EMA crosses below the red EMA.

Bearish trade scenario

When the price movement creates a valid swing low and starts to decline, observe the EMA lines.

Entry

Place a sell order when the green EMA crosses below the red EMA.

Stop loss

The initial stop loss will be above the recent swing high, an aggressive SL position. Meanwhile, above the swing high of the downtrend beginning will be the conservative SL position.

Take profit

If you place an aggressive SL, the initial profit target will be below 2X distance than the distance between breakeven and SL. Otherwise, close the sell order if the green EMA crosses above the red EMA.

Pros and cons

| Pros | Cons |

| These are essential elements to create a complete trade setup. | You will always have tension for open positions. |

| Using this on trading enables traders to make a trading approach with discipline. | You won’t create or follow complete executing trading strategies without using these on trading. |

| Reduce making emotional trade decisions and help to avoid overtrading. | If you don’t use stop loss and TP, you won’t know how much you risk in your open position. |

Final thought

Finally, now you have a clear concept of the SL and TP, besides learning the top pros and cons. How much you will risk depends on your trading strategy and trading styles. For example, swing traders use aggressive stop loss, so their trade executions are with a risk ratio of 1:3 or above.

Meanwhile, a day trader may execute trades with a 1:2 risk ratio but make frequent trading positions. The risk ratio is also a dependable factor for winning rates of all trade executions. We suggest using SL and TP wisely for all trade executions. In this way, your capital will be safer — moreover, it’s the professional way to approach the marketplace.