The forex market is a vast marketplace that operates 24-hours during any business day of the week. So, it creates many opportunities to make profits for traders and investors depending on many factors. The arbitrage trading technique is a unique technique to approach the forex market.

However, executing successful trades through any arbitrage trading method requires a particular level of understanding and skills. In this article, we will discuss the triangular arbitrage trading technique besides trading strategies using this method. Later we list the top pros and cons of the triangular arbitrage trading method.

What is the triangular arbitrage trading

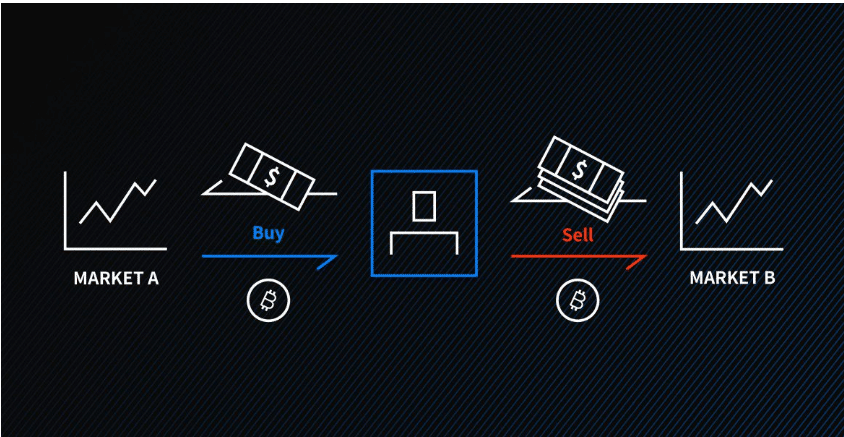

The triangular arbitrage trading method is a unique way to approach the marketplace that is different from the traditional “buy and hold” method. This trading technique involves simultaneously buying and selling the same asset on the same or different marketplaces.

Traders make profits by taking advantage of the price inefficiency of different marketplaces for the same financial asset. You can group the triangular arbitrage trading in the pure arbitrage category. In contrast, the other two available methods are merger arbitrage and convertible arbitrage.

For example, Mr. Smith may purchase a pack of Coca-cola for 50 cents, containing six bottles; later, he sells each bottle of Coca-Cola for ten cents. In this way, Mr. Smith makes ten cents profits from each pack of Coca-Cola.

How to trade using triangular arbitrage trading?

Triangular arbitrage trading is a low-risk trading method that suits hedge funds and institutional trading. The reason is simple: this trading technique involves making profits from small price changes, so larger volume increases profitability. To make more profit, you have to increase your investment size. So no wonder that this trading technique is popular with investment banks and hedge fund managers.

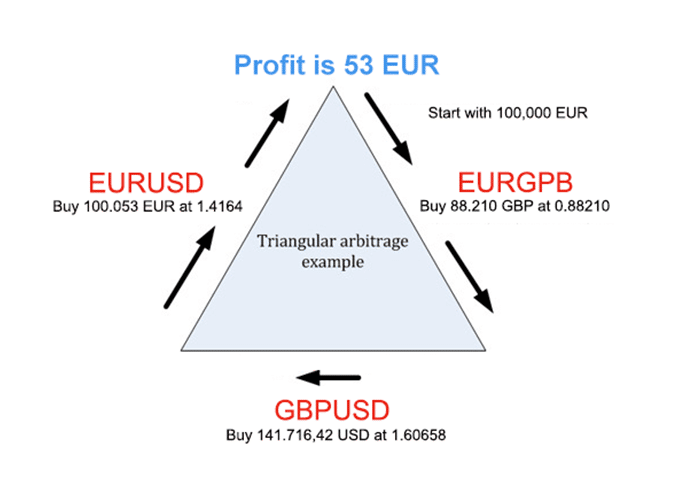

In forex trading, arbitrage trading requires the real-time price of any currency pair to make profits. For example, suppose two banks C and D, offer different prices for the currency pair USD/CAD. Bank C may offer 3/2 dollars per CAD; meanwhile, bank D may offer 4/3 dollars.

When you apply triangular arbitrage, you may buy CAD and exchange for dollars from bank C. You may return to CAD on bank D. In this way; you get 9/8 CAD while the starting amount was only one CAD. So you make a profit of 1/8 CAD if you don’t consider the transaction fees.

A short-term trading strategy

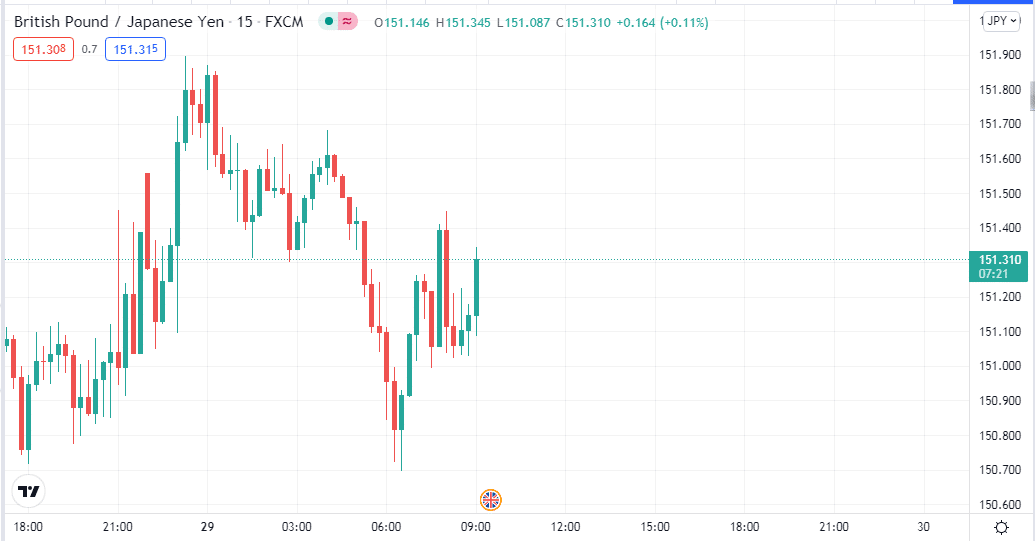

We all live in an era of automatic trading where sometimes there is no need for human intervention to execute trades. The forex market is always open and shifts to different time zones. Although it is a decentralized marketplace, often you can see price inefficiencies in different assets. The price of GBP/JPY may be floating near 151.30 in a bank in Tokyo.

Meanwhile, a bank in London may offer 151.34 for the same pair. You may have access to both banks. So you open a buy position on GBP/JPY in the bank in Tokyo and sell in the bank in London. Later the price may converge to 151.35, and you close both open positions.

The result is, you lose one pip in London and make five pips from the trade on the bank in Tokyo when trade volume remains the same for both positions. So you make four pips profits, not including transaction fees.

Many trading robots are available to identify those inefficiencies on currency pairs. You can use them or make manual entry/exit for executing trades using this short-term triangular trading method, which will last for maybe a few minutes or an hour. This simple arbitrage trading strategy applies to any trading asset that has sufficient volatility. This trading method follows charts of 1-min-15 min timeframes.

A long-term trading strategy

You can make money for longer-term using the triangle arbitrage trading method. In this way, we use the difference between interest rates between two different currencies rather than price differences on currency pairs.

For example, the Federal Reserve keeps the interest rate of USD between 0-25; meanwhile, the bank of Russia still holds the interest rate of the ruble above 5 percent.

You can easily make money from this interest rate difference using two procedures. You may invest your wealth in any Russian Ruble savings account and enjoy the interest rate by the end of the year. An issue can rise on exchange rate risk that you can tackle by buying a forward contract and closing the exchange rate.

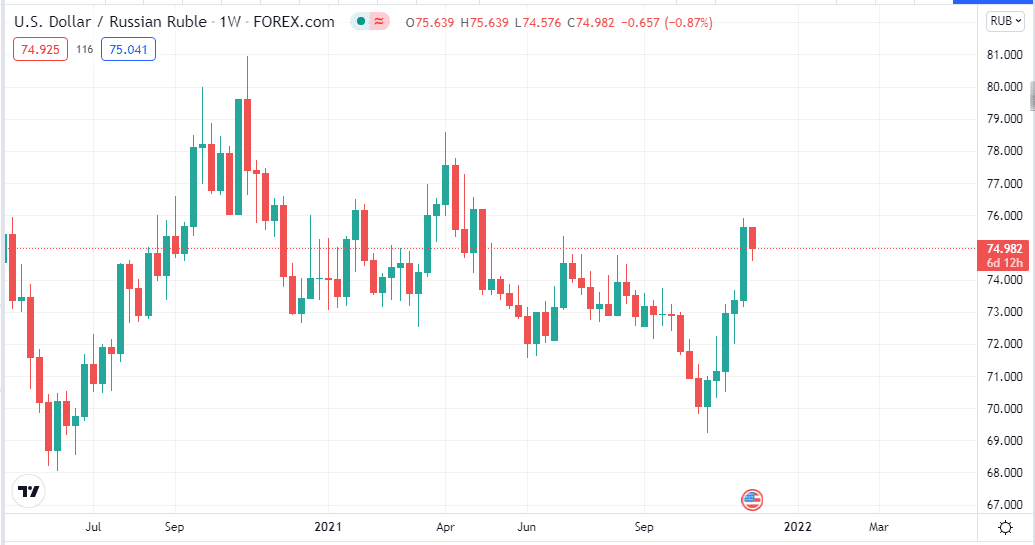

Then when the time expires, convert your investments in USD. You may open a short position on the USD/RUB pair at the price of 75, exit from that order when the price reaches 75.50 with an investment amount of 100,000$. After one year, the price may reach 72, and you get a payout of 10,259$.

Where 5,420$ is interest swap and 4,839$ from the trade, on the other hand, if the price hits 75.50, you will have 763$ loss, and an interest swap will be 7,080$. Reducing the loss amount, you will get a 6,317$ profit by the year-end.

Pros and cons

| Pros | Cons |

| Any trading instrument supports this method. | The triangular trading method does not involve any trade management plans. |

| This method doesn’t require any vast technical analysis skills. | Requires sufficient volume or use of leverage is common to obtain attractive returns through this type of trading that involves risk on trading capital. |

| The triangular trading strategy supports automatic trading. | It requires real-time price to apply the triangular arbitrage trading strategy on forex pairs. |

Final thought

The triangular arbitrage trading method is an attractive and low-risk trading method for many investors in the forex market. We recommend having close attention to the unavoidable risks and money management besides mastering the concept by spending more time with it before applying it to real trading.