One of the best ways of successful crypto trading is to ride the trends. Expert crypto investors commonly use many technical tools and indicators to examine the market condition and create sustainable trading methods. Indicators enable an insight into the historical price, performance, volume, etc., and help predict future movements. The Crypto Wave Rider indicator strategy is a responsive method more minor lagging in executing constantly successful trades.

However, it is mandatory to clearly understand elements, strengths, and limitations alongside following particular ways to generate successful crypto trading ideas. This article will briefly discuss the indicator strategy with chart attachments for a better understanding.

What is the Crypto Wave Rider indicator strategy?

It is an exponential moving average (EMA) based trading method containing EMA parameters of different periods that reacts quickly according to market context. You can consider it a trend-following trading method that is rapid response and generates trend-following trading ideas.

This trading strategy offers simplicity in trading with minor lagging, and any crypto investors, including newbies, can execute trend-based entry/exits through its trading signals. The Crypto Wave Rider indicator strategy involves using five EMA lines of different parameters EMA 8, EMA 21, EMA 50, EMA 100, and EMA 200.

How to trade using Crypto Wave Rider indicator strategy?

Expert traders always follow trends while making trade decisions. It enables catching up more winning trades and reduces the number of losing trades as the market usually changes directions from support resistance levels. The concept is straightforward when smaller EMA lines cross above more extensive EMA lines, declare sufficient bullish momentum, and signal open buy positions. On the other hand, when sellers take control of the market, smaller EMA lines dive below more prominent EMA lines.

Short-term trading strategy

We use the indicator concept to determine this trading method’s short-term entry/exit points. We suggest choosing assets with sufficient volatility when trading using this trading method. We recommend using a 15min or hourly chart to catch the most profitable short-term trades through this trading strategy. This strategy contains four EMA lines: 21, 50, 100, and 200.

Bullish trade scenario

This trading method suggests buying trades when:

- The EMA 21 crosses the EMA 50 on the upside.

- The EMA 21 and EMA 50 crosses the EMA 100 on the upside.

- The EMA 21, EMA 50, and EMA 100 cross the EMA 200 on the upside.

Entry

When these conditions above match your target asset chart, the price already enters on a bullish trend. Enter a buy order after the current bullish candle closes.

Stop loss

The initial stop loss will be below all these crossovers with a buffer of 5-10pips.

Take profit

Close the buy position when:

- The EMA 21 declines below EMA 50.

- EMA 21 and EMA 50 drop below the EMA 100.

Bearish trade scenario

This trading method suggest opening sell trades when:

- The EMA 21 crosses the EMA 50 on the downside.

- The EMA 21 and EMA 50 crosses the EMA 100 on the downside.

- The EMA 21, EMA 50, and EMA 100 cross the EMA 200 on the downside.

Entry

When these conditions above match your target asset chart, the price already enters on a bearish trend. Enter a sell order after the current bearish candle closes.

Stop loss

The initial stop loss will be above all these crossovers with a buffer of 5-10pips.

Take profit

Close the sell position when:

- The EMA 21 crosses the EMA 50 on the upside.

- EMA 21 and EMA 50 crosses the EMA 100 on the upside.

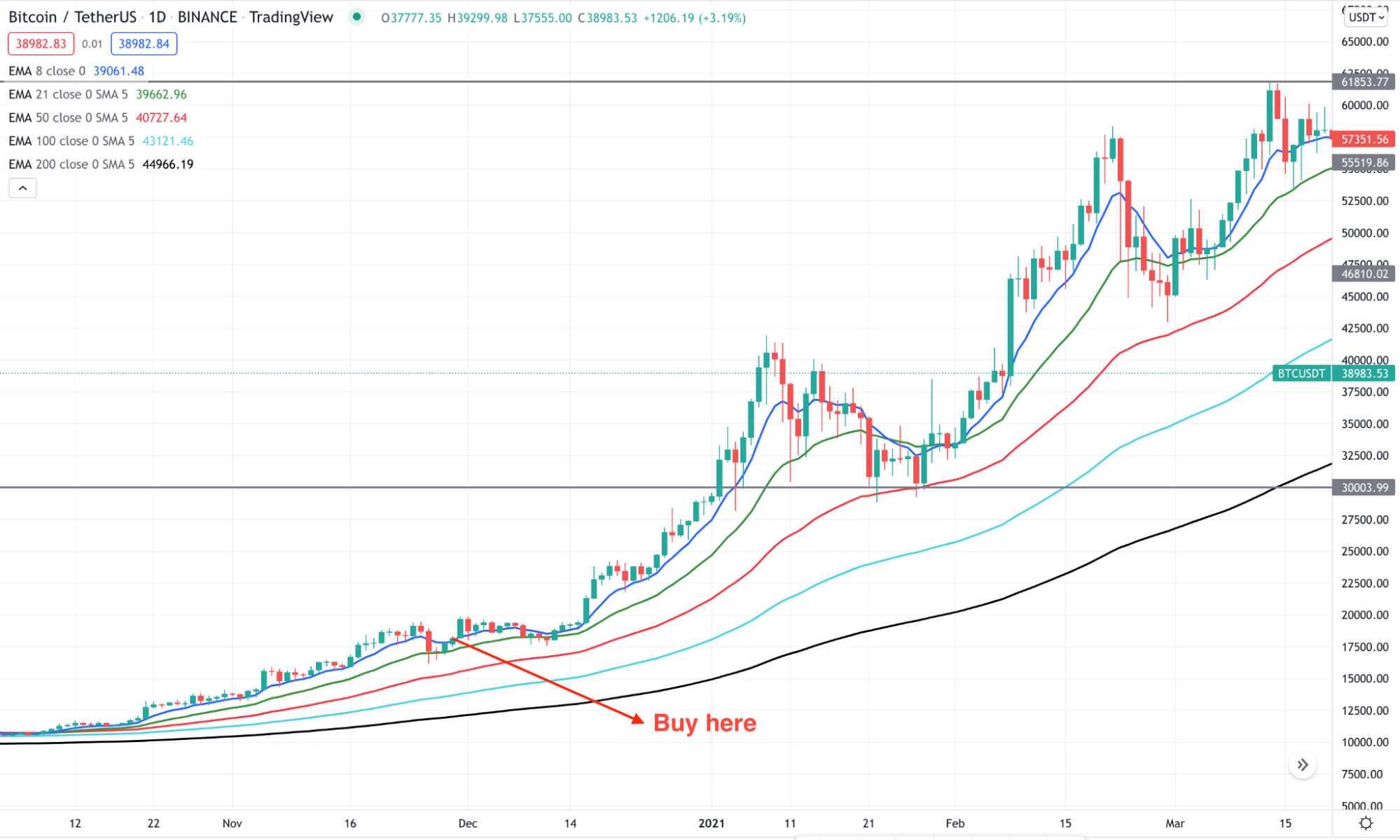

Long-term trading strategy

Crypto Wave Rider indicator strategy suits fine on long-term trading. In contrast, we recommend using at least an H4 or daily chart to determine entry/exit points to generate long-term trade ideas. We use the same concept of MA crossover in this trading method; the difference is at least four crossovers occur in this case. More crossovers mean more accuracy on the trades. Although, it usually takes more time than traditional crossover methods as it involves four or more crossovers.

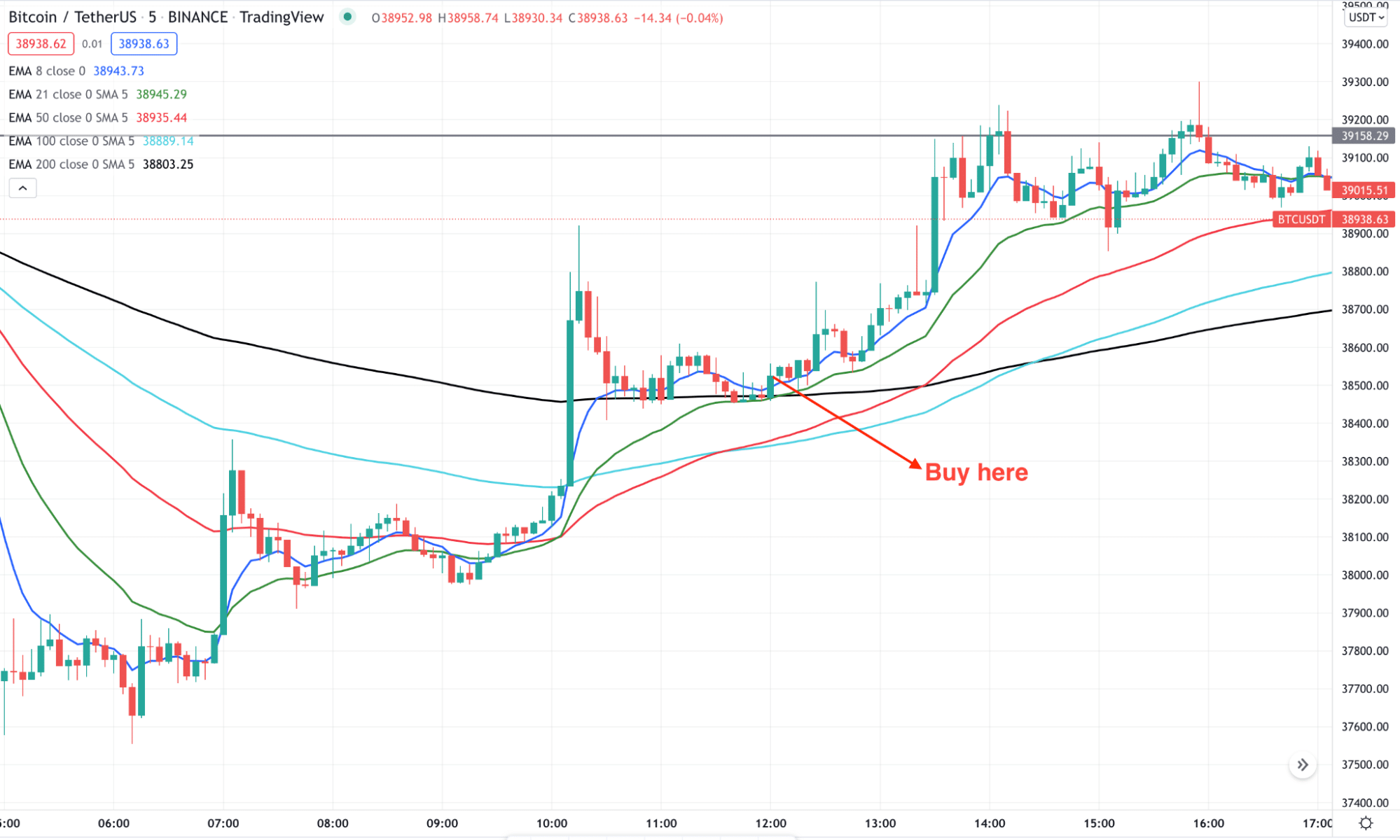

Bullish trade scenario

This trading method suggest buying trades when:

- EMA 8 crosses the EMA 21 on the upside.

- EMA 8 and EMA 21 cross the EMA 50 on the upside.

- EMA 8, EMA 21, and EMA 50 cross the EMA 100 on the upside.

- EMA 8, EMA 21, EMA 50, and EMA 100 crosses EMA 200 on the upside.

Entry

These conditions above match your target asset chart declaring sufficient bullish pressure on the asset price. Place a buy order after the current bullish candle closes.

Stop loss

The initial stop loss will be below the current bullish momentum.

Take profit

Close the buy order when:

- The EMA 8 declines below the EMA 21.

- EMA 8 and EMA 21 cross below the EMA 50.

- EMA 8, EMA 21, and EMA 50 drops below the EMA 100.

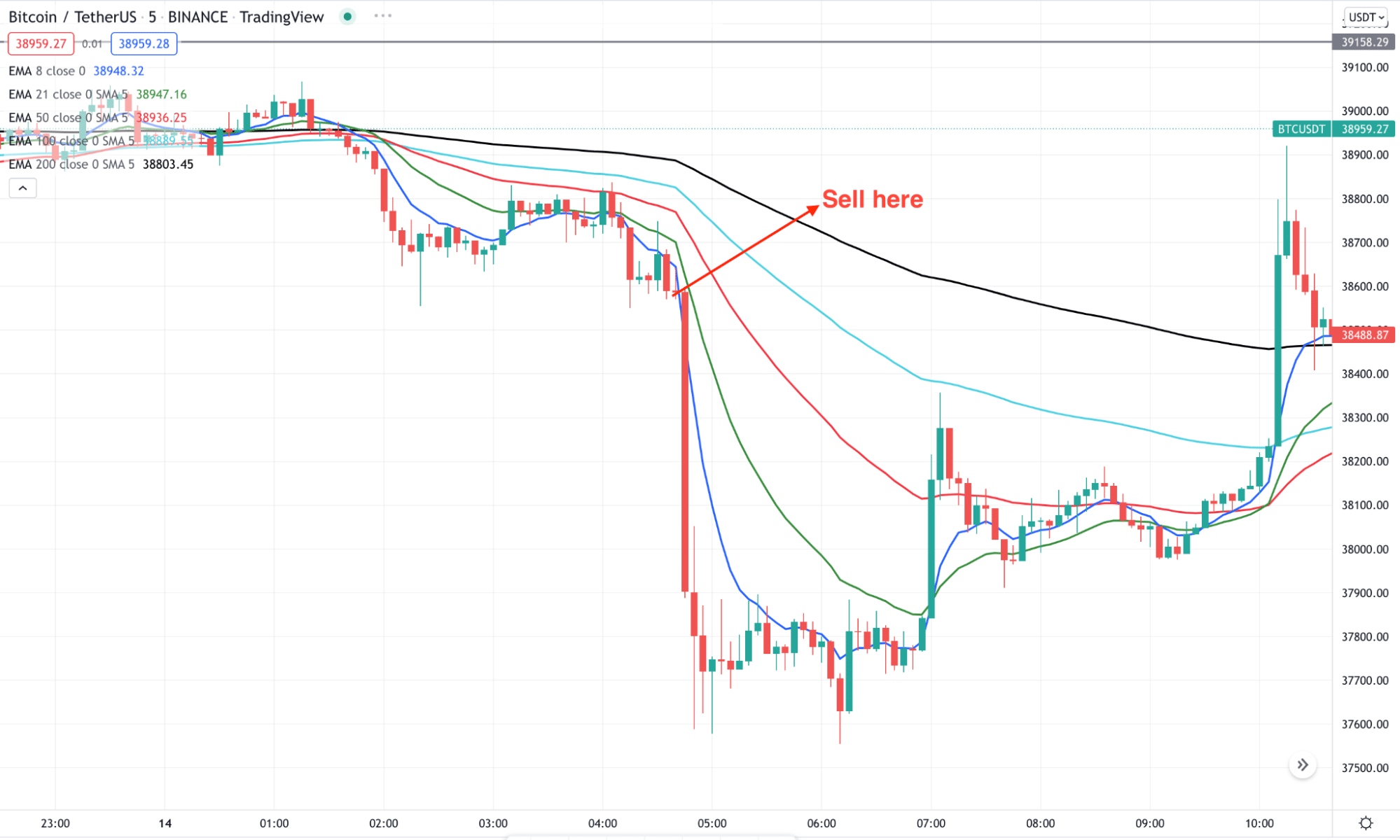

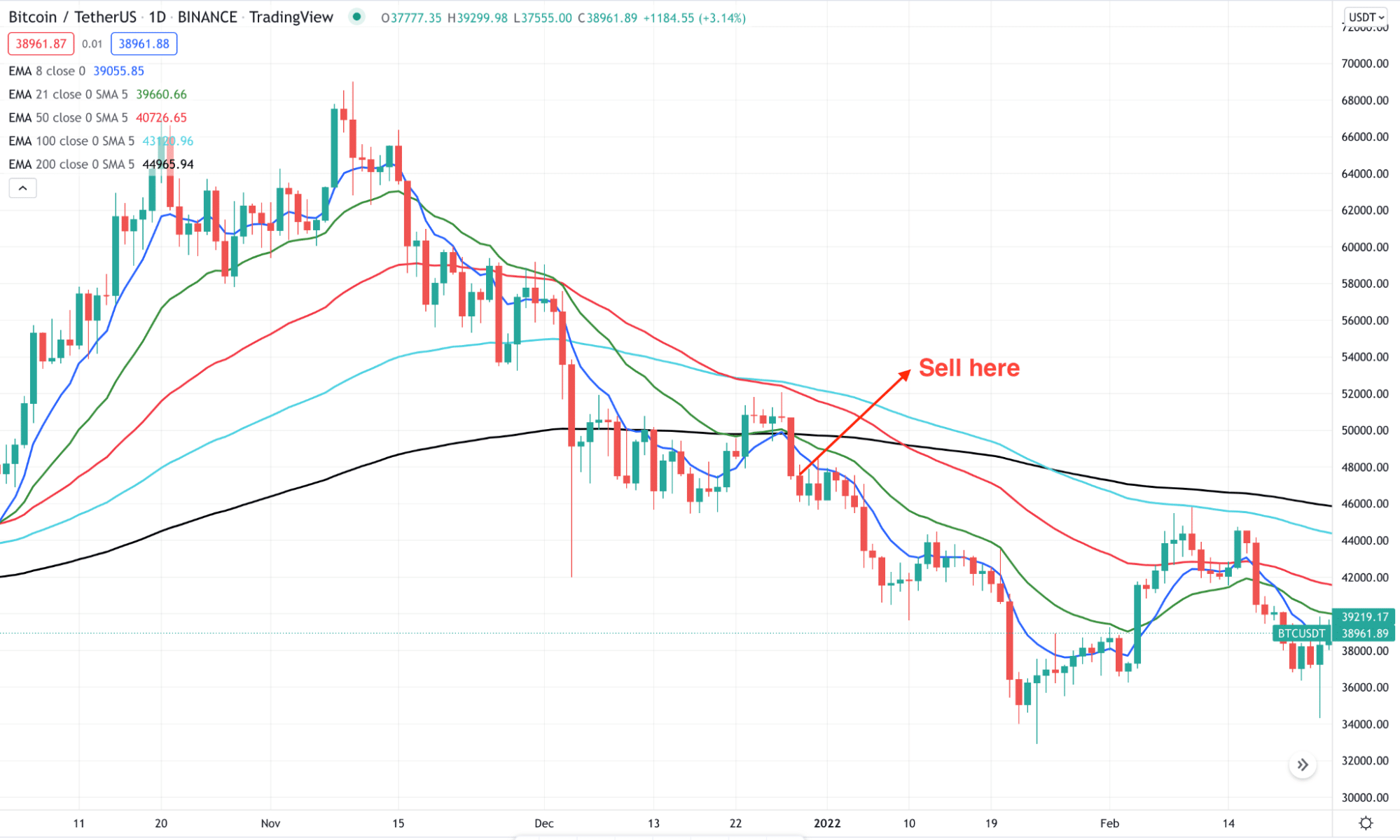

Bearish trade scenario

This trading method suggest selling trades when:

- EMA 8 crosses the EMA 21 on the downside.

- EMA 8 and EMA 21 cross the EMA 50 on the downside.

- EMA 8, EMA 21, and EMA 50 cross the EMA 100 on the downside.

- EMA 8, EMA 21, EMA 50, and EMA 100 crosses EMA 200 on the downside.

Entry

These conditions above match your target asset chart declaring sufficient bullish pressure on the asset price. Place a buy order after the current bullish candle closes.

Stop loss

The initial stop loss will be above the current bearish momentum.

Take profit

Close the sell order when:

- The EMA 8 crosses the EMA 21 on the upside.

- EMA 8 and EMA 21 cross the EMA 50 on the upside.

- EMA 8, EMA 21, and EMA 50 cross the EMA 100 on the upside.

Pros and cons

Cryptocurrencies are a new addition to the financial world, but all primary features match other financial assets. So no wonder that wave rider indicator strategy suits fine on any crypto asset. However, there are some limitations alongside all positive features of this trading method.

| Pros | Cons |

| The indicator strategy is a straightforward method that allows riding the trends. | This method can fail due to fundamental reasons. |

| The strategy suits many crypto assets. | This method generates false signals during consolidation phases of price movements. |

| This method suits many time frame charts. | Crypto assets are volatile, so when it comes to closing the trades by following the exact rules of this method, you might lose a significant portion of profits. |

Final thought

The Crypto Wave Rider indicator strategy is unbeatable as it allows traders to ride the trends alongside determining trend shifting levels. We suggest practicing to master this method before applying it in live trading and following fair trade and money management rules.