The TRIX trading strategy for MT4 is a profitable trend riding strategy to determine the price momentum depending on the market bias and wait for indicators to give a signal to execute a trade. As it is an indicator-based trading method, we will always look for the confirmation provided by the indicators.

We will explore four types of trading methods using the TRIX index, TRIX TCI, THV4 TRIX indicators. However, you can utilize this trading technique as both a swing and intraday trading system.

What Is the TRIX (triple exponential average)?

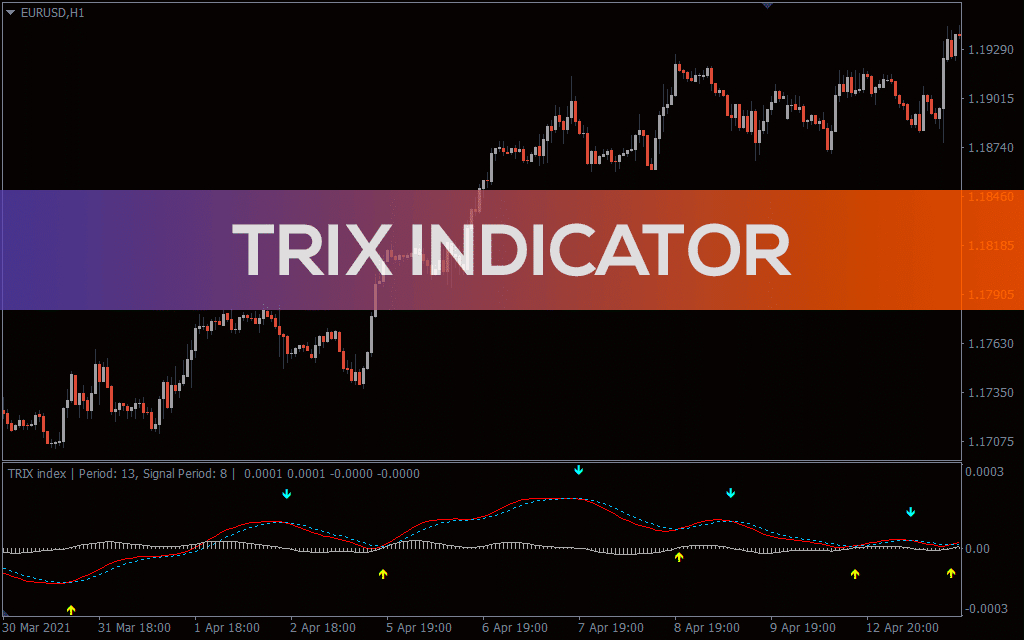

Jack Hutson developed the TRIX indicator in the 1980s. He is also an editor for the “Technical Analysis of Stocks and Commodities” magazine. The TRIX is a momentum indicator. It is mainly used by technical traders, illustrating the percentage switch into a triple exponential moving average (EMA).

However, it is intended to sift through value developments viewed as irrelevant or insignificant, while it is applied to triple smoothing of moving averages. Moreover, some technical traders use TRIX indicators as MACD because they are similar.

TRIX calculation

- Smooth price with 14-period EMA.

- Smooth the EMA from step 1 with a 14-period EMA.

- Smooth the EMA from step 2 with a 14-period EMA.

- Divide the value (triple smoothed) of today from the one of yesterday. The result is the TRIX.

TRIX trading strategy for MT4

As a trend following strategy, first, we have to identify the primary trend on the higher time frame to get higher accuracy. As an analyst, we can predict the market by 70% to 80%. However, the FX market is full of unpredictability. That’s why the only way to hold down in the market is to develop a high accuracy trading system by using multiple indicators.

However, the TRIX indicator can be traded in many ways. Usually, you should utilize the proper money management like the MACD indicators, which are visually the same.

The TRIX trading system for MT4 is appropriate on all time frames from five minutes to daily. However, the 1 hour and 4 hours give high outcomes as they extract the short-term impacts of the fundamental events.

However, you can trade on any currency pairs you wish, such as GBP/USD, GBP/CAD, GBP/NZD, EUR/JPY, GBP/JPY, USD/JPY, EUR/USD, EUR/CAD, EUR/NZD, etc.

Let’s have a look at trading indicators for the TRIX trading system for MT4:

- TRIX Index

- TRIX TCI

- THV4 TRIX

Trading method 1: signal line cross

This trading method utilizes the signal line to produce buy and sell signals. The trading condition is similar to the one used at MACD, stochastic, and other consecutive trading indicators.

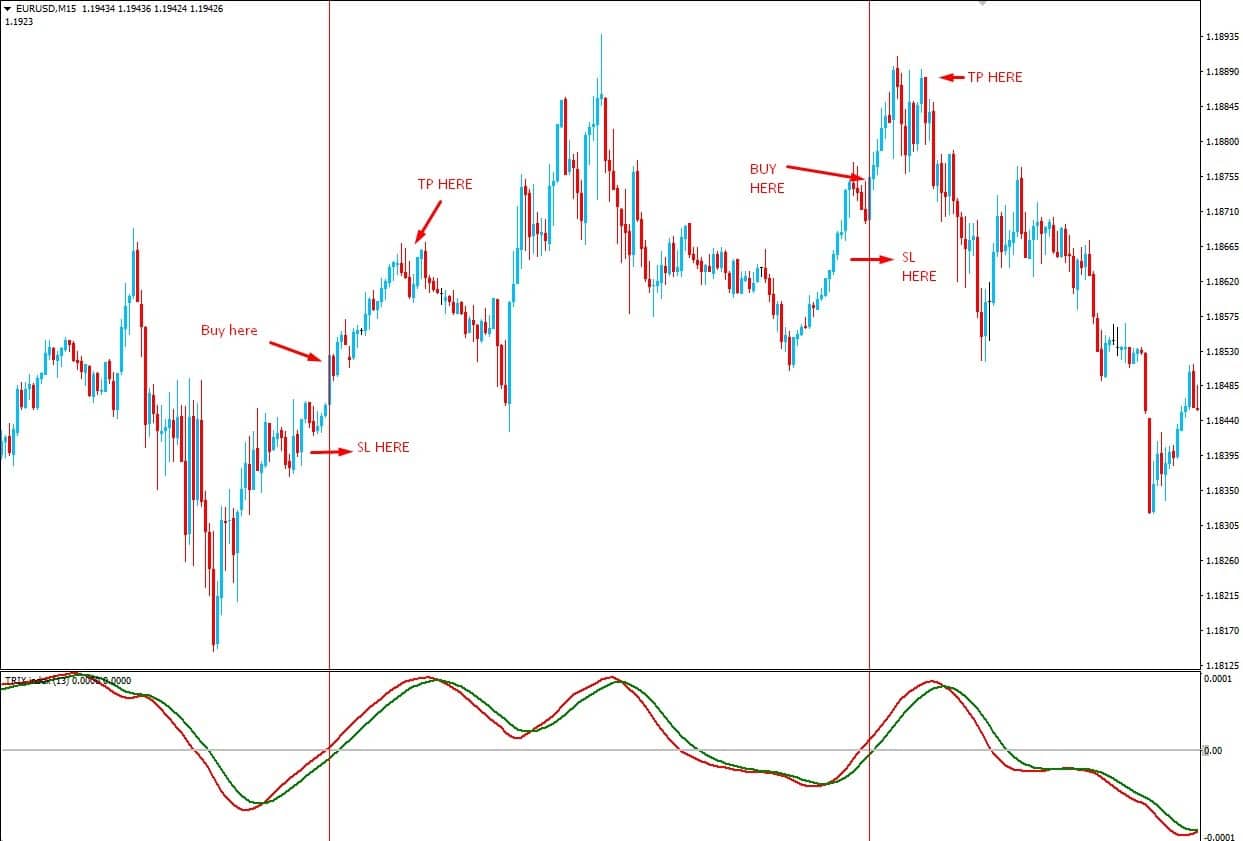

Bullish trading conditions

- Buy when TRIX crosses its signal line from below.

Entry

After confirming the bullish crossover, you should wait for the candle to close and execute the buy trade as soon as the candles close. Do not enter before closing the candle because it may impact your capital if the trade goes against you.

Stop loss

As it is a trend following strategy, the current bias is prospective to sustain as long as the price is trading above the recent swing low. So, put your stop loss underneath the recent swing low with a 10 to 15 pips buffer.

Take profit

The ideal take profit level is based on a 1:1.5 or 1:2 risk: reward ratio. Therefore, if your stop-loss is 20 pips, you should set the take profit at 40 pips. Otherwise, you can take the profit when the TRIX index has a bearish crossover above zero-line.

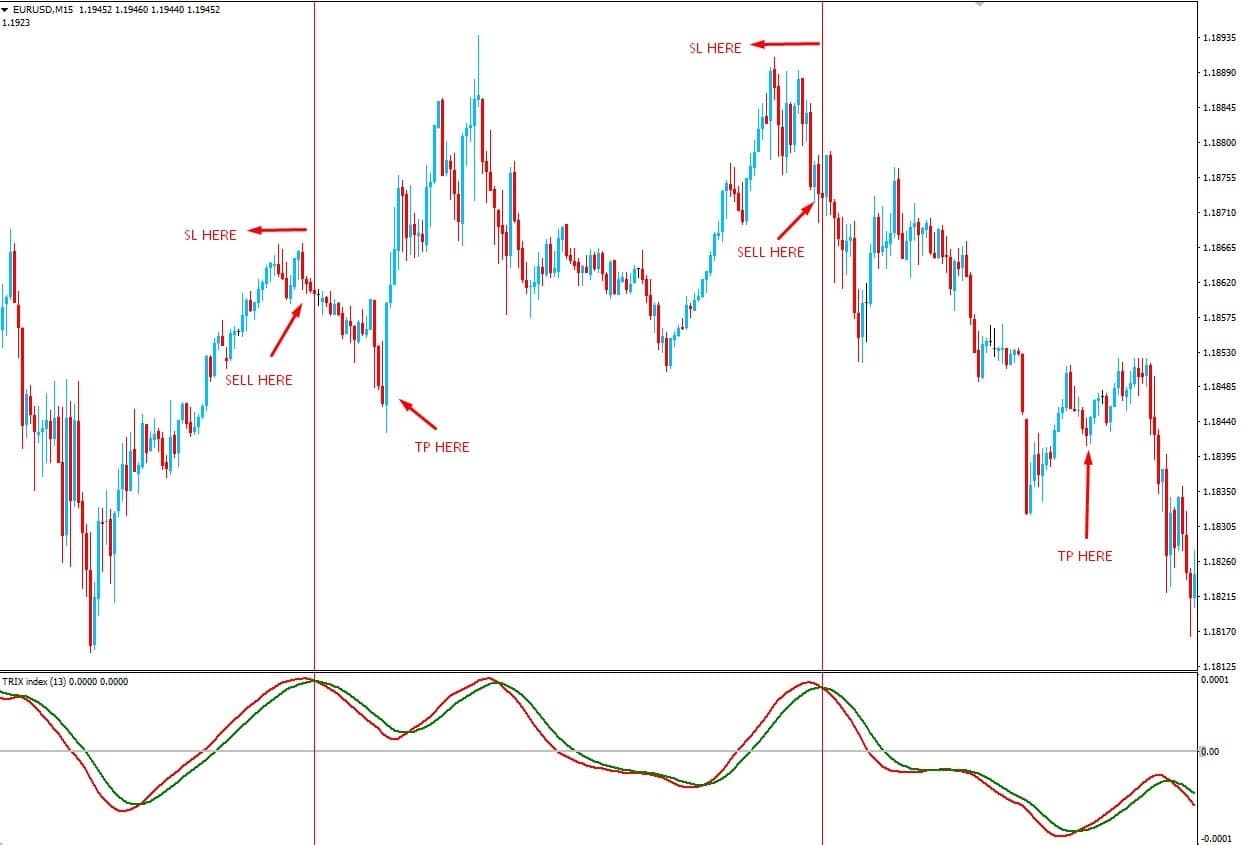

Bearish trading conditions

- Sell when TRIX crosses its signal line from above.

Entry

After confirming the bearish crossover, you should wait for the candle to close and execute the sell trade as soon as the candles close. Do not enter before closing the candle because it may impact your capital if the trade goes against you.

Stop loss

As it is a trend following strategy, the current bias is prospective to sustain as long as the price trades below the recent swing high. So, put your stop loss above the recent swing high with a 10 to 15 pips buffer.

Take profit

The ideal take profit level is based on a 1:1.5 or 1:2 risk: reward ratio. Therefore, if your stop-loss is 20 pips, you should set the take profit at 40 pips. Otherwise, you can take the profit when the TRIX index has a bullish crossover below zero-line.

Trading method 2. zero-line cross

Because the TRIX indicator revolves around its zero-line, it can be used as a pivot to gauge trend bias. This approach is similar to CCI and RSI trading signals.

Bullish trading conditions

- Buy when TRIX crosses zero-line from below.

Entry

After confirming the zero-line cross from below, you should wait for the candle to close and execute the buy trade as soon as the candles close. Do not enter before closing the candle because it may impact your capital if the trade goes against you.

Stop loss

Put your stop loss underneath the recent swing low with a 10 to 15 pips buffer.

Take profit

Take the profit when the TRIX index had a bearish crossover above zero-line.

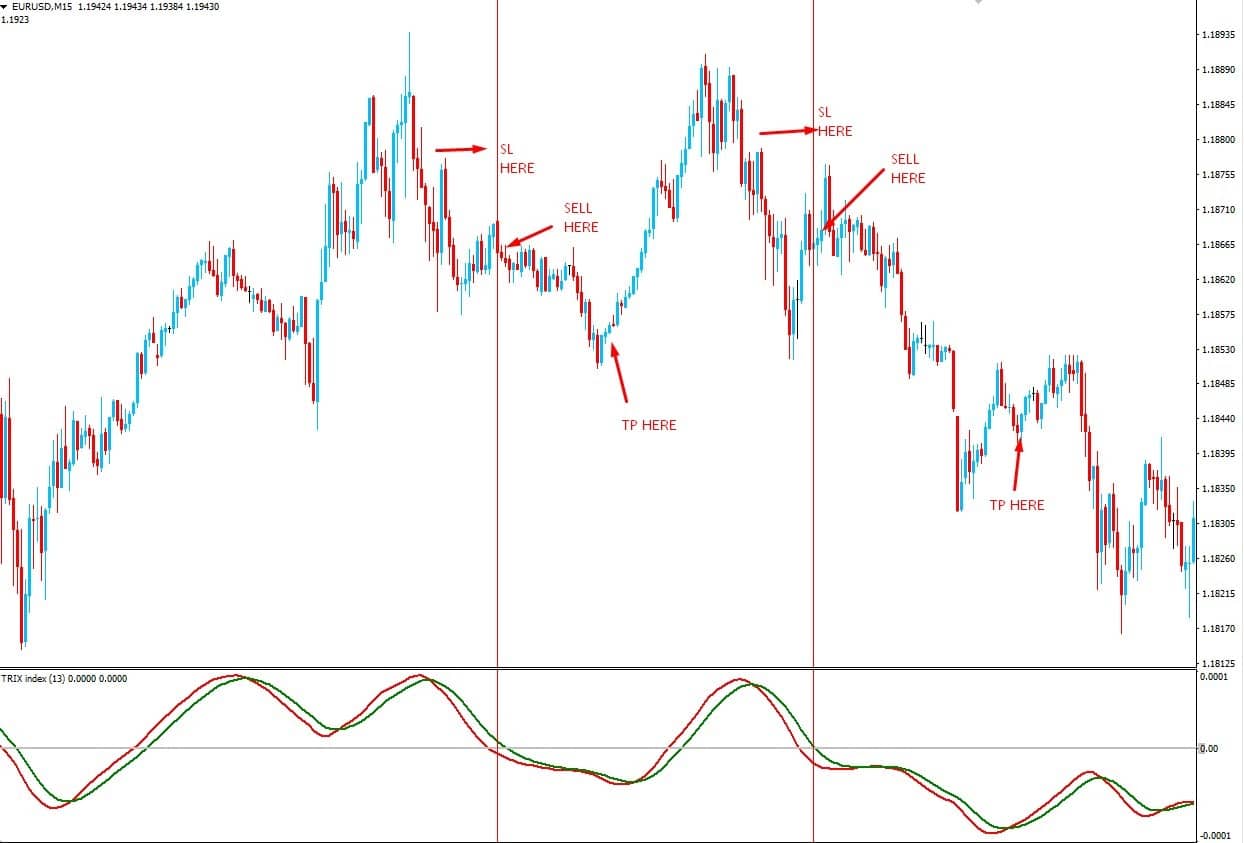

Bearish trading conditions

- Sell when TRIX crosses zero-line from above.

Entry

After confirming the zero-line cross from below, you should wait for the candle to close and execute the sell trade as soon as the candles close.

Stop loss

Put your stop loss above the recent swing high with a 10 to 15 pips buffer.

Take profit

Take the profit based on the 1:5 to 1:2 ratio. Otherwise, you can take the profit when the TRIX index has a bullish crossover below zero-line.

Trading method 3: divergence

This trading strategy is based on divergence and market context. When TRIX is creating lower highs and price making higher highs, it can be a signal of an irregular trend reversal (sell signal). On the other hand, when TRIX is making higher lows and price is making lower lows. It can be a signal of a bullish reversal.

Bullish trading condition

Entry

After confirming the bullish divergence, you should wait for the candle to close and execute the buy trade as soon as the candles close.

Stop loss

Put your stop loss below the lower low with a 10-15 pips buffer.

Take profit

Take the profit based on the 1:5 to 1:2 ratio. Otherwise, you can target the next potential resistance level.

Bearish trading condition

Entry

After confirming the bearish divergence, you should wait for the candle to close and execute the sell trade as soon as the candles close.

Stop loss

Put your stop loss above the higher high with a 10-15 pips buffer.

Take profit

Take the profit based on the 1:5 to 1:2 ratio. Otherwise, you can target the next potential support level.

Final thoughts

These TRIX trading strategies are the most profitable trading method because it depends on highly accurate indicators. Therefore, you can achieve great trading results at the end of the month. However, in FX trading, there is nothing 100% guaranteed profit in each trade.

Therefore, to achieve a better outcome from this trading strategy, you should utilize the proper money management.